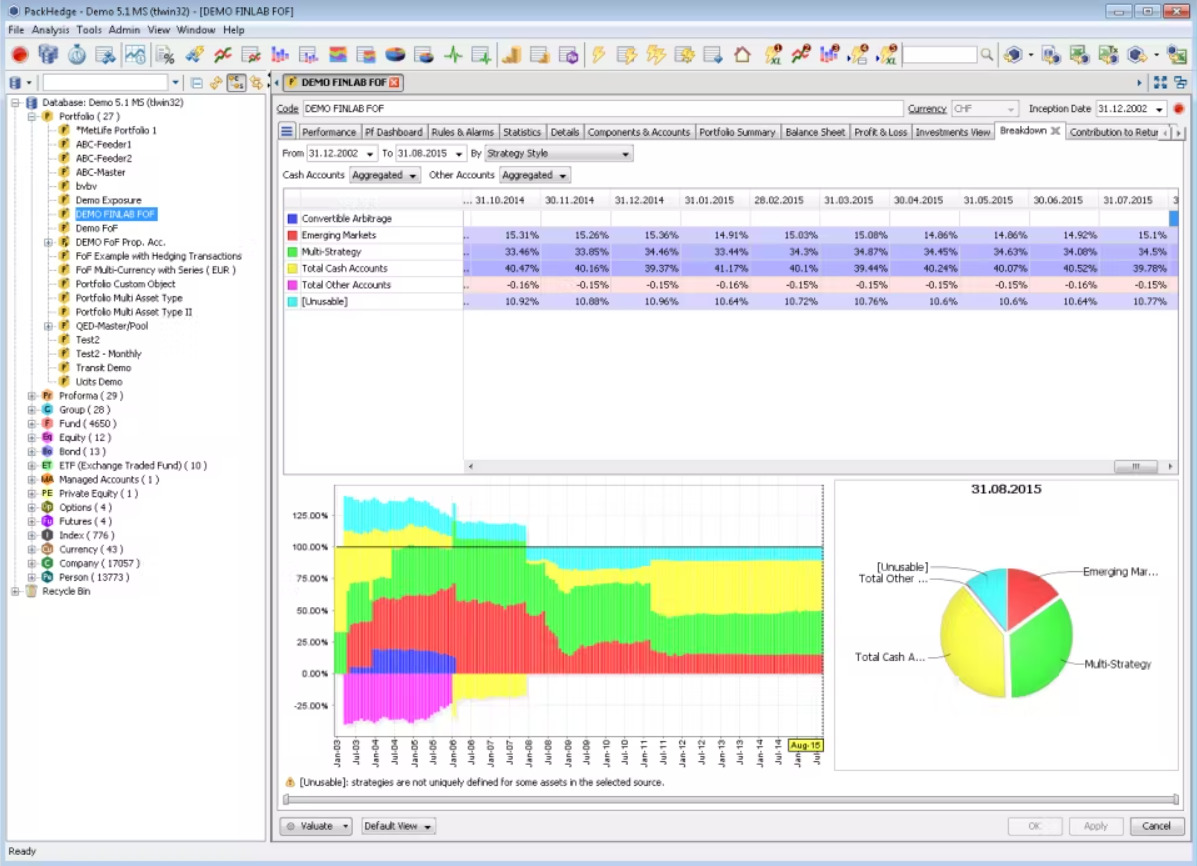

Fund managers can use the platform to analyze their funds using a weighted rating based on statistical data derived from hedge fund index members.

Allocators can collect qualitative and quantitative data in one place with the help of AlternativeSoft's due diligence module. Users can easily run quantitative screenings and searches, monitor fund exposures, conduct in-depth analyses, and control risk and portfolio exposures at the portfolio level. Automated data imports into a central repository with thorough due diligence capabilities will save you time.

There are a bunch of decent tools out there that offer the same array of services as AlternativeSoft. And it can sure get confusing to choose the best from the lot. Luckily, we've got you covered with our curated lists of alternative tools to suit your unique work needs, complete with features and pricing.