Most teams discover AI conversation failures during a holiday surge, not from their dashboards. Working across different tech companies, I have learned that observability lives in the gritty details, like correlating WebRTC jitter and MOS dips with rising AHT, spotting LLM intent misclassifications that trigger loops, and tracking edge device CPU spikes that derail audio. The contact center stack keeps shifting and spend is following it, with the global Call Center AI market projected to be valued at approximately 1.8 billion dollars in 2026 while overall contact center platforms continue to expand their AI foundations and omnichannel capabilities. Analysts also forecast that conversational AI will automate an increasing share of interactions by 2026 and that deployments will significantly reduce agent labor costs, underscoring why AI observability has moved from nice to have to run-the-business critical.

Operata

End‑to‑end CX observability built for cloud contact centers, correlating technical, operational, and experience data. Adds AI copilots for insight discovery and agent guidance.

Best for: CX, IT, and operations teams on Amazon Connect, Genesys Cloud CX, or NICE CXone that need deep voice and agent‑edge telemetry.

Key Features:

- Continuous monitoring of networks, WebRTC, carrier, CCaaS, and agent environments

- Assurance, including heartbeat and performance testing with real calls

-

AI‑driven Featured Insights plus AX Copilot and a CX data copilot for natural‑language queries

Why we like it:

Strong at correlating voice quality, network, and agent device metrics with CX outcomes to cut mean time to resolution.Notable Limitations:

- High annual minimums can be a hurdle for small teams

- Limited volume of independent end‑user reviews relative to older QA suites

-

Primary CCaaS focus on Connect, Genesys Cloud CX, and NICE CXone

Pricing:

AWS Marketplace lists annual plans at 36,000 dollars per 12 months with overage charges between 0.004 and 0.006 dollars per monitored minute, plus a Migration Velocity package at 25,000 dollars per month and 0.01 dollars per extra agent minute (AWS Marketplace listing, high‑volume plans, Migration Velocity). Operata also offers a free 14‑day proof of value via AWS Marketplace (listing).

Observe.AI

Real‑time AI for contact centers with agent assist, supervisor alerts, Auto QA, and summarization, plus a contact‑center‑tuned LLM.

Best for: Enterprises that want real‑time guidance and QA at scale across voice and digital, with rapid time‑to‑value.

Key Features:

- Real‑Time AI for in‑call guidance and Supervisor Assist

- Auto QA across 100 percent of interactions and post‑call summaries

- Omnichannel conversation intelligence backed by a domain‑specific LLM

Why we like it: Strong feature depth for frontline coaching and QA, with analyst recognition and active product cadence.

Notable Limitations:

- Some reviewers cite moment detection or false positives, and lengthy implementations in certain cases

- Language coverage gaps reported by users in specific locales

- Account management quality varies by customer, per reviews

Pricing: Pricing not publicly available. Contact Observe.AI for a custom quote. The product is listed on AWS Marketplace for Real‑Time AI and Post‑Interaction AI, but pricing is private (Real‑Time AI listing, Post‑Interaction AI listing).

Convin

AI‑powered monitoring and QA with 100 percent conversation analysis, real‑time coaching, alerts, and LMS.

Best for: Contact centers standardizing QA and coaching workflows with real‑time nudges and an integrated learning stack.

Key Features:

- Automated QA on all calls, chats, and emails with custom scorecards

- Real‑time Agent Assist and Supervisor visibility

- Built‑in LMS for training, assessments, and coaching follow‑ups

Why we like it: A practical post‑interaction plus real‑time combo with strong coaching workflows and broad reviewer coverage.

Notable Limitations:

- Reviewers cite slow loading at times and accuracy variability in certain analyses

- Some want deeper customization and more flexible reporting formats

- Regional deployment patterns mean most reviews skew to APAC, which may not mirror every market

Pricing: Pricing not publicly available. G2 indicates vendor does not publish pricing and shows only buyer‑reported insights (G2 pricing overview).

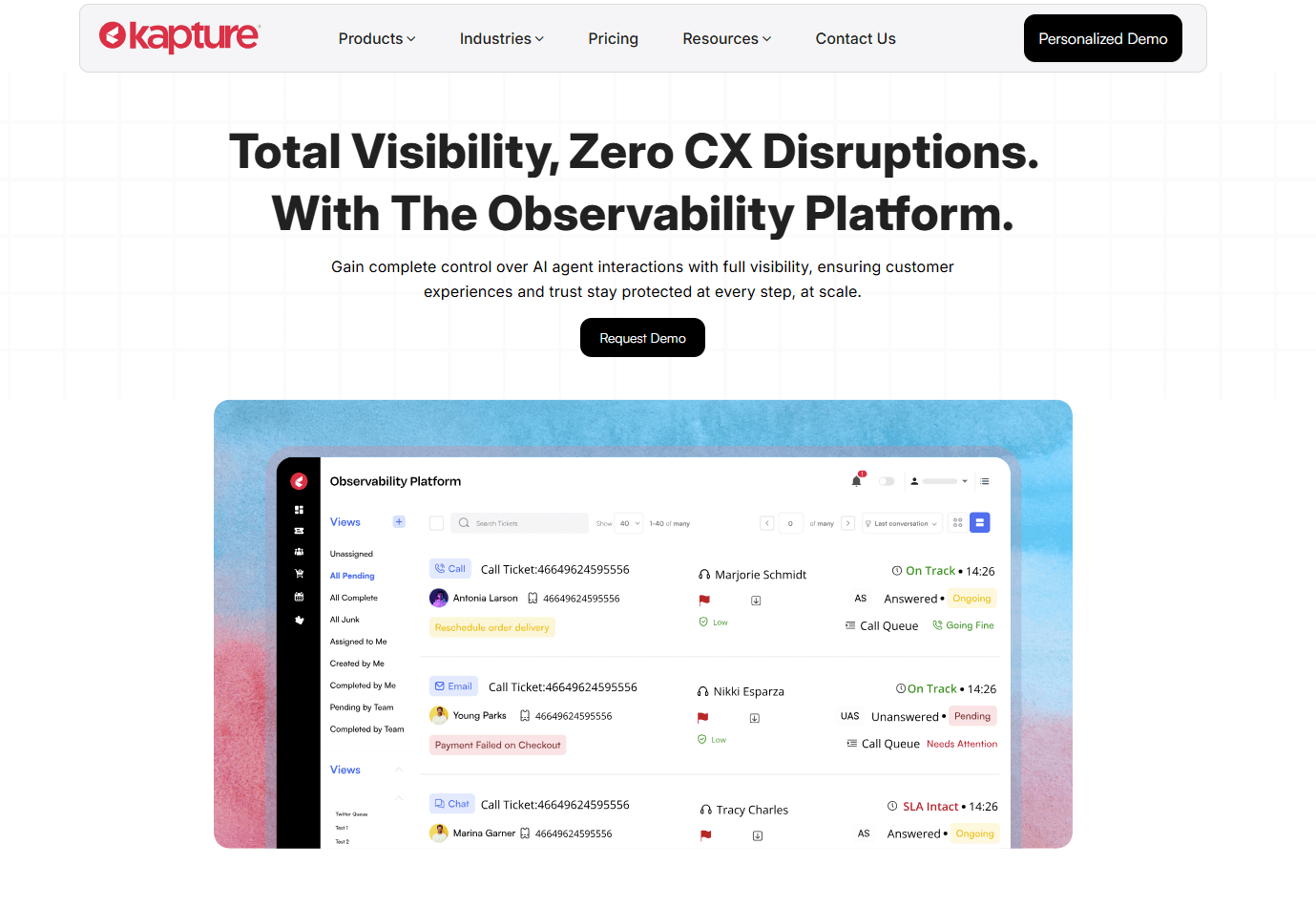

Kapture CX Observability Platform

Visibility into AI agent interactions with real‑time anomaly detection, intent monitoring, proactive alerts, and human takeover.

Best for: Teams deploying AI agents at scale that need a control center for live sessions, alerts, and fast handoff to humans.

Key Features:

- Live AI agent session monitoring and health tracking

- Real‑time detection of failed intents, long silences, stuck flows

- One‑click agent takeover and escalation with context carryover

Why we like it: Purpose‑built lens on AI agent reliability and customer protection, which many CC stacks lack today.

Notable Limitations:

- Reviewers note occasional sluggishness under heavy load

- Some integrations require vendor help to configure

- Mobile feature gaps versus desktop reported in reviews

Pricing: Pricing not publicly available. Contact Kapture for a custom quote. Independent media coverage highlights enterprise deployments and growth but does not list public pricing.

Contact center AI observability Tools Comparison: Quick Overview

| Tool | Best For | Pricing Model | Free Option | Highlights |

|---|---|---|---|---|

| Operata | Multi‑CCaaS voice observability and agent‑edge telemetry | Annual contracts with usage overages | AWS Marketplace free 14‑day proof of value | Monitoring, Assurance testing, AI Featured Insights and copilots |

| Observe.AI | Real‑time assist plus Auto QA at enterprise scale | Custom quote | None public | Real‑time agent guidance, Supervisor Assist, summarization |

| Convin | Automated QA plus coaching and LMS | Custom quote | Not listed | 100 percent conversation analysis, real‑time coaching, omnichannel QA |

| Kapture CX Observability Platform | Live oversight of AI agents and safe human takeover | Custom quote | Not listed | Real‑time anomaly detection, intent monitoring, takeover workflow |

Sources: Operata pricing and trial on AWS Marketplace; Observe.AI marketplace listings show private pricing (Real‑Time AI); Convin and Kapture pricing not published on reputable third‑party sites.

Contact center AI observability Platform Comparison: Key Features at a Glance

| Tool | Feature 1 | Feature 2 | Feature 3 |

|---|---|---|---|

| Operata | End‑to‑end monitoring across CCaaS, network, agent device | Assurance heartbeat and performance load testing | AI insights plus AX and CX copilots |

| Observe.AI | Real‑Time AI for in‑call guidance | Auto QA across interactions | Post‑call summaries and analytics |

| Convin | Automated QA with custom scorecards | Real‑time Agent and Supervisor Assist | Integrated LMS for training and assessments |

| Kapture CX Observability Platform | Live AI agent session visibility | Anomaly and intent detection | One‑click human takeover with context carryover |

Evidence: Operata’s AI and Assurance were announced via Business Wire and detailed on AWS Marketplace; Observe.AI Real‑Time AI launch is covered by Business Wire; Convin’s capabilities and reviewer‑summarized features are listed on G2; Kapture’s feature set is described in vendor documentation and reflected in media coverage.

Contact center AI observability Deployment Options

| Tool | Cloud API | On-Premise | Air-Gapped | Integration Complexity |

|---|---|---|---|---|

| Operata | Yes, SaaS via AWS Marketplace | No public evidence | No public evidence | Low to medium, browser extension and APIs per AWS listing |

| Observe.AI | Yes, AWS‑hosted SaaS | No public evidence | No public evidence | Medium, some reviewers cite multi‑month rollouts |

| Convin | Yes, SaaS | No public evidence | No public evidence | Medium, G2 shows typical one‑month implementation |

| Kapture CX Observability Platform | Yes, SaaS with APIs | No public evidence | No public evidence | Medium, multi‑channel integrations reported in media |

Evidence: Operata’s SaaS delivery, plans, and low‑code collector on AWS Marketplace; Observe.AI operates on AWS per its security overview and is listed on AWS Marketplace; Convin implementation time and deployment indicated by G2; Kapture’s omnichannel integrations reported by (ETCIO SEA). Where no public evidence exists for on‑premise or air‑gapped modes, I list that explicitly rather than guess.

Contact center AI observability Strategic Decision Framework

| Critical Question | Why It Matters | What to Evaluate | Red Flags |

|---|---|---|---|

| Do we need deep voice and agent‑edge telemetry or primarily QA and coaching? | Determines whether observability or QA suite is your system of record | Ability to correlate MOS, jitter, device, carrier with CX metrics vs. QA coverage and coaching depth | Tools that only sample calls or lack edge telemetry |

| How will we audit and intervene on AI agents in real time? | AI agents add failure modes that require oversight | Live session visibility, anomaly detection, intent confidence, human takeover | No real‑time view of agent sessions, no takeover path |

| Can we validate changes with synthetic or live testing? | Reduces outage risk and speeds releases | Heartbeat and performance testing with real calls at scale | No assurance testing or only basic ping checks |

| What is time to implement and who owns it? | Impacts cost and adoption | Reviewer‑reported timelines, marketplace references, SI support | Open‑ended rollout plans and unclear ownership |

| Is pricing aligned with our traffic pattern? | Prevents overpaying for idle capacity | Contract minimums, overage rates, unit definitions | Opaque units, high minimums for small teams |

Supporting context: Gartner expects conversational AI to handle 14 percent of customer service interactions by 2027, which raises the stakes for monitoring and human handoff design. Industry guidance also stresses clean handoff design from bot to agent (TechTarget) and observability of agentic systems (IBM explainer).

Contact center AI observability Solutions Comparison: Pricing & Capabilities Overview

| Organization Size | Recommended Setup | Monthly Cost | Annual Investment |

|---|---|---|---|

| 100–300 seats | Convin for Auto QA and coaching, plus Kapture for AI agent oversight if deploying bots | Custom quote | Custom quote |

| 300–1000 seats | Observe.AI for real‑time + Auto QA, optional Kapture for bot oversight | Custom quote | Custom quote |

| 1000+ seats or voice‑heavy WFH | Operata for end‑to‑end CX observability and assurance plus QA stack of choice | From 3,000 dollars per month equivalent per AWS 12‑month plans | From 36,000 dollars per year per AWS Marketplace plan |

Note: Where vendors do not publish pricing, I explicitly state “Custom quote.” I do not infer numbers from blogs or sales decks.

Problems & Solutions Section

-

Problem: Mystery audio issues in WFH environments spike AHT and abandonment.

- Operata: Continuous monitoring of WebRTC, network, and agent endpoints, with Assurance heartbeat and performance tests to catch degradations before releases. See the high‑volume plan details and Assurance notes on

AWS Marketplace. - Why it saves money: Fewer blind escalations and faster root cause reduce support tickets and lost calls.

- Operata: Continuous monitoring of WebRTC, network, and agent endpoints, with Assurance heartbeat and performance tests to catch degradations before releases. See the high‑volume plan details and Assurance notes on

-

Problem: Manual QA misses risky calls and slows coaching.

- Observe.AI: Real‑Time AI guides agents mid‑call, Supervisor Assist surfaces escalations, Auto QA scores 100 percent of interactions, all covered in its product launch news on Business Wire.

- Convin: Automated QA across calls, chats, emails with real‑time coaching and LMS follow‑through, with buyer‑verified pros and cons on G2

- Why it saves money: Cuts auditor hours and speeds targeted coaching that lifts FCR.

-

Problem: AI agents drift, fail intents, or stall, hurting CSAT.

- Kapture CX Observability Platform: Real‑time AI agent session monitoring, anomaly detection, intent tracking, and one‑click human takeover per vendor documentation. Media coverage shows enterprise use across channels with API integrations.

- Why it saves money: Prevents bot loops from driving repeat contacts and churn, while preserving context during handoff, a best practice echoed by TechTarget.

-

Problem: Deciding the right category investment as AI share grows.

- Market signal: Contact center and CC conversational AI spend hit 18.6 billion dollars in 2023 and is forecast to grow 24 percent in 2024.

- Solution path: Start with observability where voice is critical or work from QA outward where coaching gaps are largest, then layer AI agent observability as automation expands. IBM’s overview outlines what to log and alert for agent systems.

Conclusion

By 2026, contact centers that anchor decisions in measurable telemetry and observability will outperform peers that rely solely on sampled QA and siloed metrics. Real-time insights into voice quality, network performance, AI intent accuracy, and agent experience are no longer optional. Buyers should match their stack to specific failure modes and prioritize tools that provide both deep telemetry and actionable alerts. Organizations that invest in observability, real-time assistance, and AI agent oversight will better manage automation complexity, reduce operating costs, and improve customer outcomes in an era where AI and human agents increasingly work in tandem. Market growth continues, but value will accrue to teams that can both detect and act on early signals of failure.