Most teams discover their third-party AI risk gaps during contract redlines or a live incident, not from the vendor's glossy questionnaire. Working across different tech companies, we have seen TPAIR programs rise or fall on three basics: maintaining an AI model and vendor inventory, parsing vendor evidence like SOC 2 and model cards with LLMs, and continuously mapping controls to regulations such as the EU AI Act and NIST AI RMF. With breach costs hitting record highs, the dollars at stake are real, not theoretical, as shown in IBM's 2024 report. Our take below focuses on platforms that reduce review cycles and make evidence audit-ready.

Global security and risk management spend was projected at 215 billion dollars in 2024, a trend driven by cloud, AI adoption, and regulation, per Gartner's forecast. You will learn where each tool is strongest, what the reviews say, how they align to NIST AI RMF and ISO 42001, and how to pick for your size and risk profile. The EU AI Act timeline makes this urgent, with phased obligations running through 2026, as summarized by the European Parliament's Think Tank and reinforced by the Commission's no-delay stance reported by Reuters.

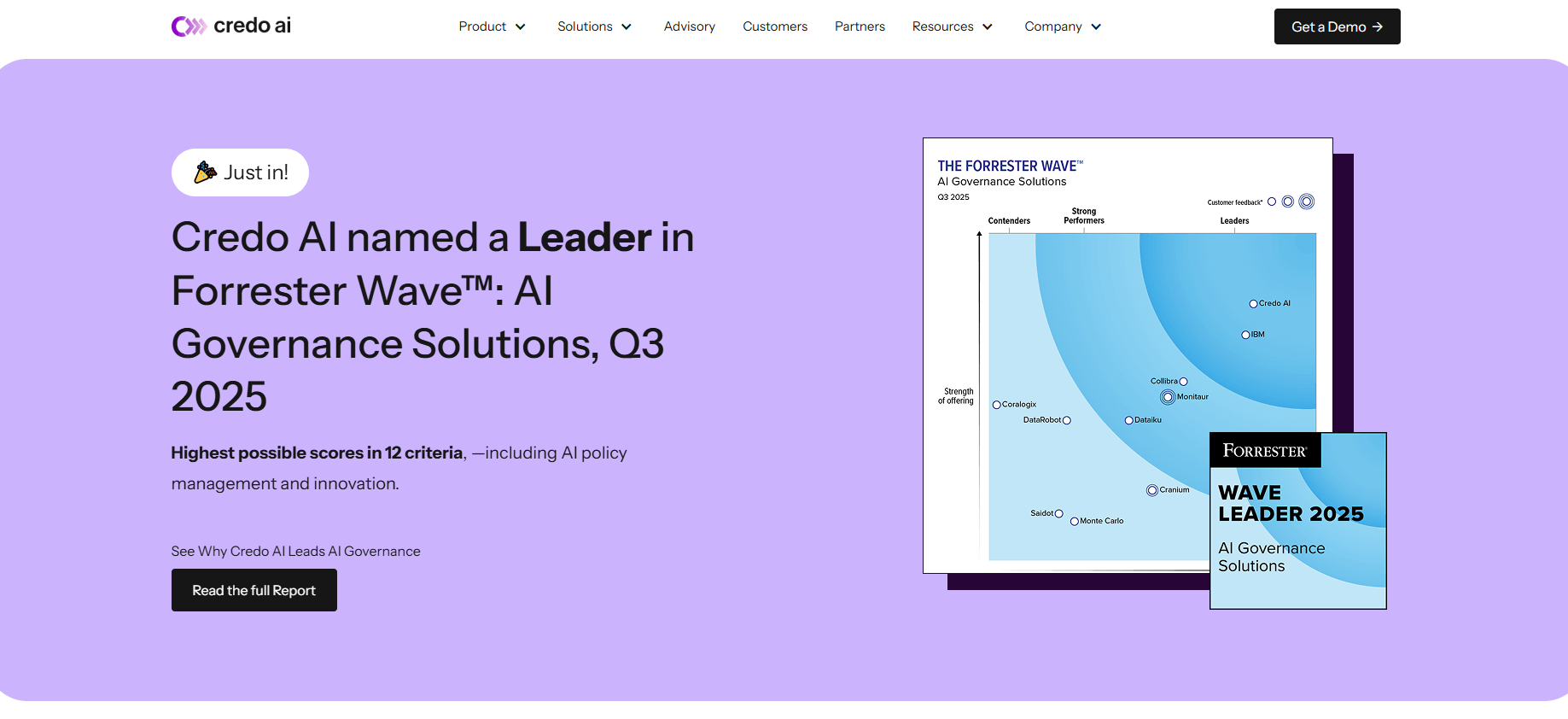

Credo AI

Enterprise AI governance platform focused on risk, compliance, and third-party AI vendor assurance. Built to align programs to frameworks like the EU AI Act, NIST AI RMF, and ISO 42001 across the AI lifecycle.

According to vendor documentation, Credo AI provides policy mapping, unified AI inventory, risk workflows, and reporting to help legal, risk, and engineering collaborate.

Best for: Enterprises with formal AI oversight that need policy-to-evidence traceability and board-level reporting across internal and third-party AI.

Key Features:

- AI use case and model inventory with risk scoring tied to policies and controls

- Regulatory alignment accelerators for EU AI Act, NIST AI RMF, and ISO 42001

- Third-party AI vendor evaluations and evidence collection

- Cross-functional workflows for risk, legal, and engineering

- Exportable audit trails and dashboards

Why we like it: Credo AI has independent analyst recognition and a strong focus on enterprise governance maturity, which shortens time to compliant evidence for AI systems and vendors.

Notable Limitations:

- Enterprise-grade depth demands process changes and program ownership to realize value

- Pricing and packaging are not public, so buyers should request detailed scoping and implementation plans

- Fewer public customer reviews than broad GRC suites

Pricing: Pricing not publicly available. Contact vendor for a custom quote. Analyst validation exists, such as recognition in Forrester's AI Governance evaluation.

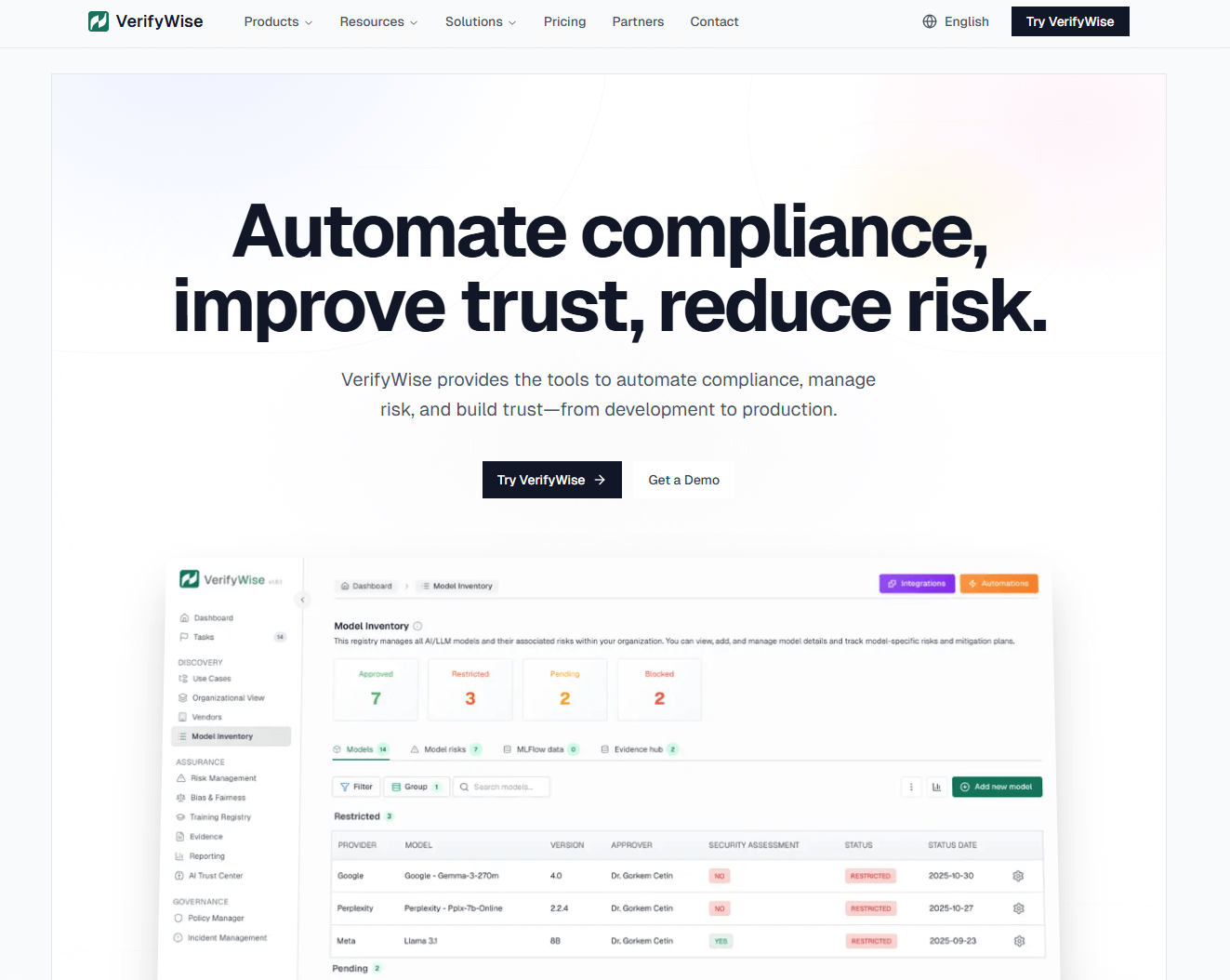

VerifyWise

AI governance platform focused on automating compliance, model inventory, vendor tracking, and risk management aligned to NIST AI RMF and ISO 42001.

Per vendor documentation, VerifyWise supports SaaS and self-hosted deployments with templates for EU AI Act, ISO 42001, and NIST AI RMF, plus approval workflows and audit logs.

Best for: Teams that want a lightweight AI governance system with self-hosted option to track AI use cases, vendors, and policies early in their program.

Key Features:

- AI systems registry with structured intake and risk scoring

- Model inventory, policy management, and audit logging

- Templates aligned to EU AI Act, ISO 42001, and NIST AI RMF

- Vendor tracking with statuses and evidence snapshots

Why we like it: Straightforward intake plus self-hosting can reduce legal friction for regulated or data-sensitive environments that need control over where governance data lives.

Notable Limitations:

- Limited third-party reviews to validate large-scale enterprise deployments

- Young company with a small public footprint on review sites

- Feature depth for complex vendor ecosystems may require vetting in a pilot

Pricing: Pricing not publicly available. Contact vendor for a custom quote. The product is listed on directories like Crunchbase and has a placeholder profile on G2 with no reviews yet.

Relyance AI

Third-party AI risk and privacy platform emphasizing continuous vendor monitoring and automated evidence gathering to improve audit defensibility.

Per vendor documentation, Relyance AI focuses on real-time telemetry, contract-to-control mapping, and AI-specific risk scoring for external vendors and data flows.

Best for: Privacy, security, and AI risk teams that need continuous third-party posture checks tied to contracts and regulatory obligations.

Key Features:

- Live vendor validation without relying only on periodic questionnaires

- Automated evidence ingestion and continuous compliance mapping

- AI-specific risk scoring for datasets, model dependencies, and decisions

- Immutable proof trails for audits and regulatory reporting

Why we like it: Strong emphasis on continuous monitoring and contract mapping fits organizations that must keep vendor AI behavior aligned with GDPR, CCPA, and emerging AI rules.

Notable Limitations:

- Public customer reviews remain limited compared to larger GRC platforms, as seen on G2

- Buyer references and proof points are important because many features are cutting-edge

- Pricing not public, which can slow procurement

Pricing: Pricing not publicly available. Contact vendor for a custom quote. Company momentum and product focus are covered by TechCrunch's funding report.

Hyperproof

Third-party risk management within a broader GRC platform, with AI-assisted vendor document analysis and automated workflows for questionnaires, risk registers, and reassessments.

Per product materials, Hyperproof's RiskAI analyzes vendor artifacts like SOC reports and policies to highlight gaps, standardize scoring, and route remediation.

Best for: GRC teams that want TPRM embedded alongside audits, controls, and frameworks like SOC 2 and ISO within one system.

Key Features:

- Vendor catalog, tiering, questionnaires, and residual risk reporting

- AI-assisted analysis of vendor evidence to speed assessments

- Risk register and automated reassessments with workflows

- Integrations for collaboration and continuous evidence collection

Why we like it: If your audit, controls, and TPRM live together, you avoid duplicate work and keep auditors, procurement, and security on one playbook.

Notable Limitations:

- Reviewers cite a desire for more customizable dashboards and reporting, and a learning curve for some features, per G2 reviews

- Some teams report integration or sync delays in reviews

- Pricing not public and modules like Vendor Register may be add-ons

Pricing: Pricing not publicly available. Contact vendor for a custom quote. See third-party feedback on G2.

UpGuard Vendor Risk

Cyber TPRM platform with automated scanning, AI document analysis, and transparent vendor risk profiles to accelerate assessments and remediation.

Per product materials and press coverage, UpGuard introduced AI-powered profiles, instant risk assessments, and AI Autofill to compress review timelines.

Best for: Security and vendor risk teams that need fast external posture checks, AI-assisted document review, and scalable questionnaires.

Key Features:

- Automated external scanning and vendor security ratings

- AI document analysis to extract controls from artifacts like SOC 2

- Instant risk assessments and vendor portfolio risk views

- Questionnaires and remediation workflows at scale

Why we like it: Strong at turning scattered vendor evidence and open-source signals into a single, defensible snapshot that procurement and security can act on quickly.

Notable Limitations:

- Reviews note limited visibility into internal assets and that it is not a SIEM or EDR replacement, per G2 feedback

- Deep customization of assessments can require careful template design

- Best paired with internal telemetry tools for a full picture

Pricing: Pricing not publicly available. Contact vendor for a custom quote. Recent AI feature launches and roadmap have public coverage via press releases and company announcements summarized on review sites like G2.

Third-Party AI Risk Management (TPAIR) Tools Comparison: Quick Overview

| Tool | Best For | Pricing Model | Highlights |

|---|---|---|---|

| Credo AI | Large enterprises needing AI policy mapping to evidence across vendors and internal systems | Custom quote | Analyst-recognized governance focus, deep EU AI Act and NIST AI RMF alignment per vendor documentation and Forrester coverage |

| VerifyWise | Early to mid-maturity programs wanting SaaS or self-hosted AI governance with vendor tracking | Custom quote | Self-hosted option and ISO 42001, NIST AI RMF templates per vendor documentation and listing on Crunchbase |

| Relyance AI | Continuous third-party AI monitoring tied to contracts and data flows | Custom quote | Live vendor validation and AI-specific risk scoring per vendor materials and TechCrunch |

| Hyperproof | GRC teams centralizing TPRM with controls, audits, and frameworks | Custom quote | AI-assisted doc analysis and questionnaires inside broader GRC, with user feedback on G2 |

| UpGuard Vendor Risk | Security teams needing rapid vendor posture, AI doc analysis, and portfolio views | Custom quote | AI Autofill and instant assessments reported in releases and user feedback on G2 |

Third-Party AI Risk Management (TPAIR) Platform Comparison: Key Features at a Glance

| Tool | AI Evidence Analysis | Continuous Vendor Monitoring | Audit Trails |

|---|---|---|---|

| Credo AI | Yes, policy-linked evaluations per vendor documentation | Yes, via risk workflows | Yes |

| VerifyWise | Yes, model and vendor evidence per vendor documentation | Basic tracking, growing feature set | Yes |

| Relyance AI | Yes, automated evidence ingestion | Yes, live posture sync per vendor documentation | Yes |

| Hyperproof | Yes, AI-assisted artifact review per product materials | External incident monitoring and reassessment | Yes |

| UpGuard Vendor Risk | Yes, AI doc analysis and instant assessments | Yes, automated scanning | Yes |

Third-Party AI Risk Management (TPAIR) Deployment Options

| Tool | Cloud API | On-Premise | Integration Complexity |

|---|---|---|---|

| Credo AI | Yes | Not publicly stated | Enterprise integrations, requires coordination across security, legal, data teams |

| VerifyWise | Yes | Self-hosted per vendor documentation | Light to moderate based on scope and hosting model |

| Relyance AI | Yes | Not publicly stated | Moderate, due to continuous monitoring and data flow mapping |

| Hyperproof | Yes | Not publicly stated | Moderate, depends on GRC scope and vendor modules |

| UpGuard Vendor Risk | Yes | Not publicly stated | Low to moderate, faster time to value for external posture and questionnaires |

Third-Party AI Risk Management (TPAIR) Strategic Decision Framework

| Critical Question | Why It Matters | What to Evaluate |

|---|---|---|

| Do we maintain an AI vendor and model inventory tied to controls? | Inventory is the backbone for audits and remediation | Native AI inventory, vendor registry, linkage to policies |

| Can we parse vendor evidence with AI and cite sources? | SOC 2 and model cards are long and inconsistent | LLM-based extraction with source citations and reviewer override |

| How do we align to NIST AI RMF and ISO 42001? | These frameworks are becoming the lingua franca of AI governance | Prebuilt templates, control mapping, and reports |

| Is monitoring continuous or point-in-time? | Annual questionnaires miss fast-moving vendor posture | External scanning, breach feeds, and trigger-based reassessment |

Third-Party AI Risk Management (TPAIR) Solutions Comparison: Pricing & Capabilities Overview

| Organization Size | Recommended Setup | Monthly Cost | Annual Investment |

|---|---|---|---|

| Startup, <250 employees | VerifyWise self-hosted or SaaS pilot, limited vendor scope | Not publicly available | Not publicly available |

| Mid-market, 250-2,000 | Hyperproof TPRM module plus questionnaires and evidence automation | Not publicly available | Not publicly available |

| Enterprise, 2,000+ | Credo AI for policy-to-evidence and vendor assurance, with UpGuard for external telemetry | Not publicly available | Not publicly available |

| Data-sensitive verticals | Relyance AI for continuous monitoring tied to contracts and flows | Not publicly available | Not publicly available |

Problems & Solutions

-

Problem: EU AI Act obligations require article-level documentation, vendor assurances, and controls over high-risk and GPAI workflows beginning February 2025 with more in 2026.

Solution paths:- Credo AI and Hyperproof offer framework mapping and exportable evidence to speed alignment to governance frameworks. The urgency is real as outlined by the European Parliament's timeline and the Commission's refusal to delay, reported by Reuters.

- NIST's AI RMF provides a structure to govern, map, measure, and manage AI risks, which these platforms align to, per NIST's AI RMF 1.0.

-

Problem: Questionnaire sprawl slows onboarding and misses live posture drift.

Solution paths:- UpGuard and Hyperproof apply AI to vendor documents to cut review time and standardize scoring, supported by third-party user feedback on G2 for UpGuard and G2 for Hyperproof.

- Relyance AI emphasizes continuous vendor monitoring instead of only periodic surveys, a design aligned with modern supply-chain risk thinking in privacy and AI.

-

Problem: Shadow AI and vendor incidents amplify breach costs and audit exposure.

Solution paths:- Use platforms that centralize AI inventories, vendor attestations, and monitoring. IBM reports the average breach cost rose to 4.88 million dollars in 2024, and cites benefits when AI and automation are applied to security operations, per IBM's Cost of a Data Breach 2024.

- Pair continuous monitoring with policy enforcement and audit logs. UpGuard's public research spotlighted widespread unapproved AI usage among employees, reinforcing the need for governance guardrails, as shared via PR Newswire coverage.

The Bottom Line on TPAIR in 2025

If you need enterprise policy-to-evidence rigor, start with Credo AI. If you want TPRM inside your GRC backbone, Hyperproof is the safer bet. UpGuard is compelling when you must turn external posture signals and vendor documents into quick, defensible assessments. Relyance AI is worth piloting if you want continuous monitoring tied to contracts and data flows. VerifyWise is a pragmatic entry point when you want an AI governance system with self-hosting on day one. The pressure is rising, with breach costs at 4.88 million dollars on average per incident per IBM and EU AI Act obligations moving forward on the schedule tracked by the European Parliament's Think Tank. Build your TPAIR program around inventory, AI-assisted evidence parsing, and continuous monitoring, then prove it with audit-ready trails mapped to NIST AI RMF and ISO 42001, which ISO describes as the first AI management system standard in its official materials.