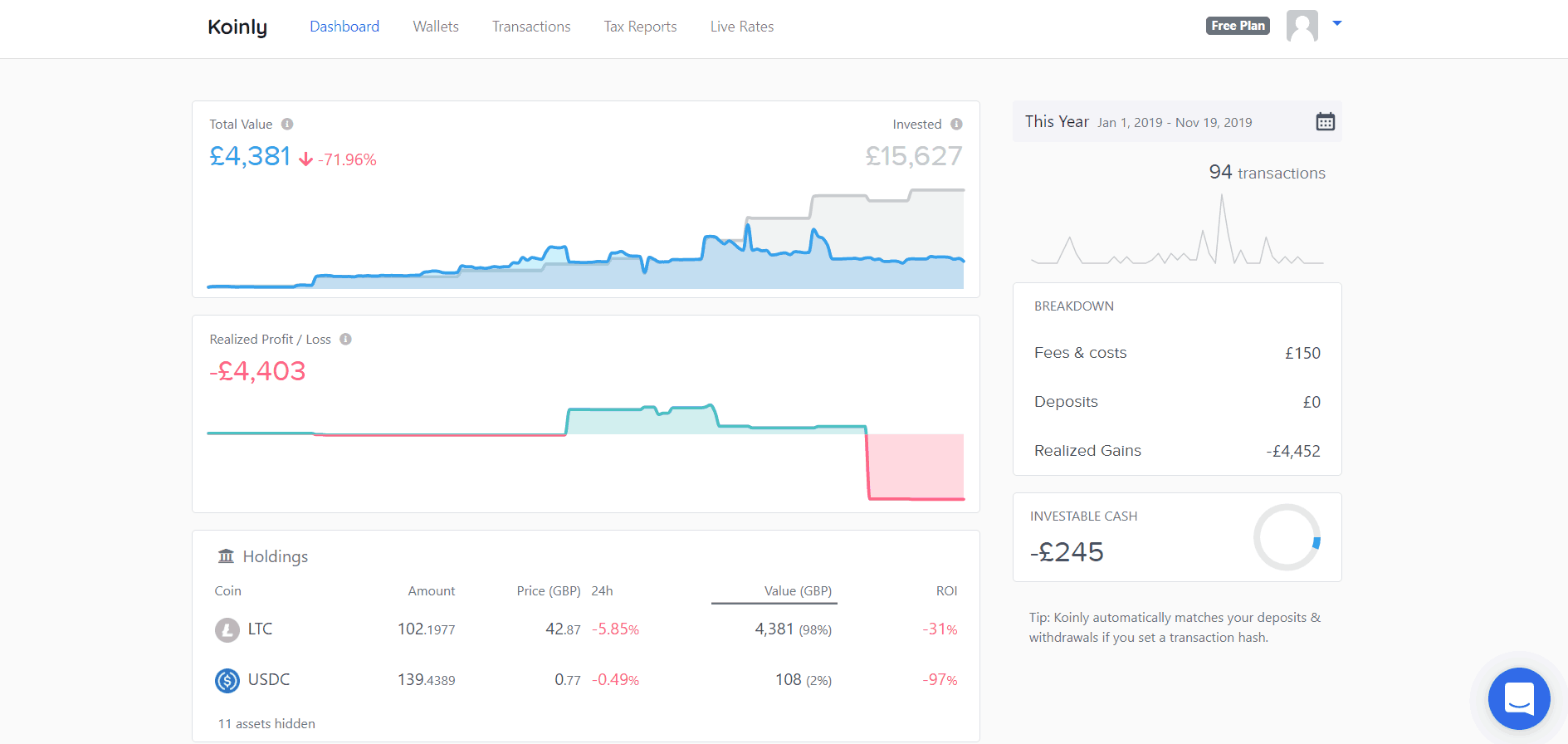

Consumers and corporations use Coinpanda to keep track of their bitcoin portfolios, investment performance, and taxes in real-time.

It generates a single report that contains all of your bitcoin transactions and taxable gains. Gains and losses from margin and futures trading are also included. For each coin, get a full analysis of your overall proceeds and acquisition expenses. Its tax reports detail all of your earnings from mining, staking, airdrops, yield farming, and other sources.

But did you know that there are some great alternatives to Coinpanda that you can consider? So, let’s take a look at some of the best Coinpanda alternatives. By the end of this article, we’re sure that you’ll have in-depth information about the various options, their features, and the pricing structure.