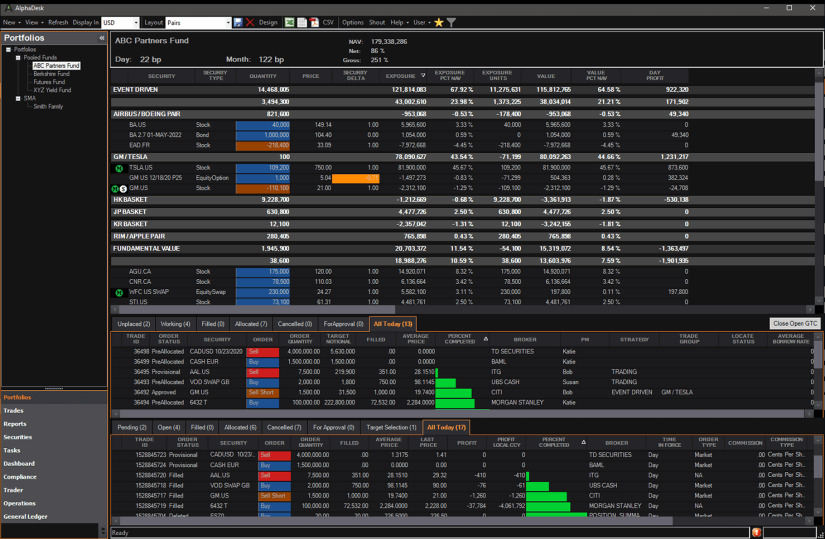

By using FIS Hedge Fund Portfolio Manager (formerly known as VPM), hedge funds can manage their portfolios and their positions in real time while maintaining accurate financial records.

The data integrity of your hedge fund's holdings and financial transactions is protected by FIS Hedge Fund Portfolio Manager's comprehensive audit trail. Better decision-making is possible with readily available, actionable data and automated reporting, both of which can be incorporated into more adaptable reporting frameworks.

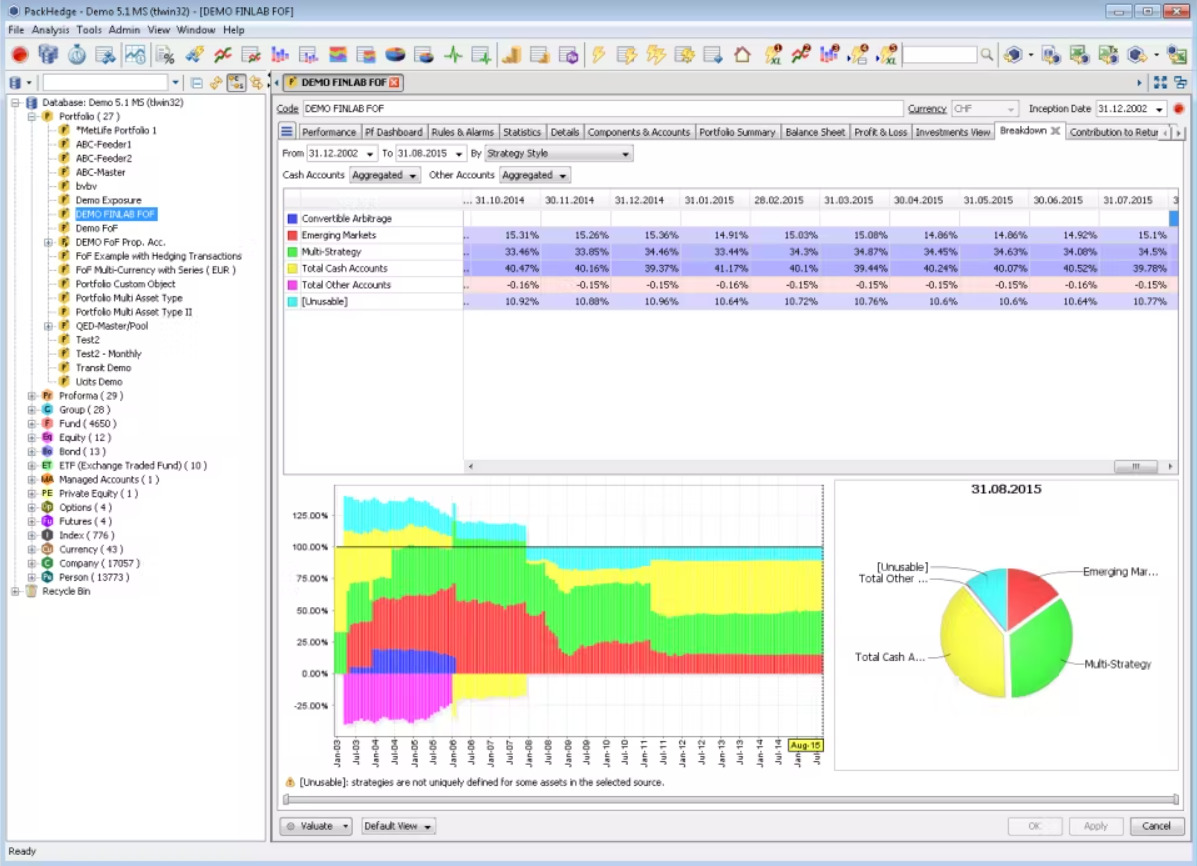

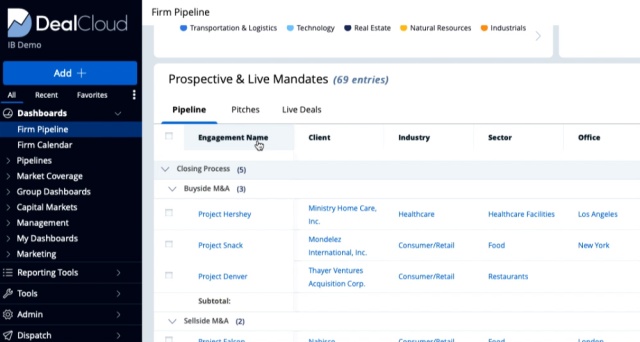

There are a bunch of decent tools out there that offer the same array of services as FIS Hedge Fund Portfolio Manager. And it can sure get confusing to choose the best from the lot. Luckily, we've got you covered with our curated lists of alternative tools to suit your unique work needs, complete with features and pricing.