With digital payments and online shopping still accelerating in 2026, fraud has become more frequent, more automated, and harder to spot. Retail and ecommerce brands remain prime targets because they process high volumes of card not present transactions, manage large promotional budgets, and need fast checkout experiences that criminals can exploit. As a result, fraud detection tools are now a core part of modern revenue protection, helping businesses reduce chargebacks, stop account takeover attempts, and prevent losses from stolen credentials, bots, and synthetic identities.

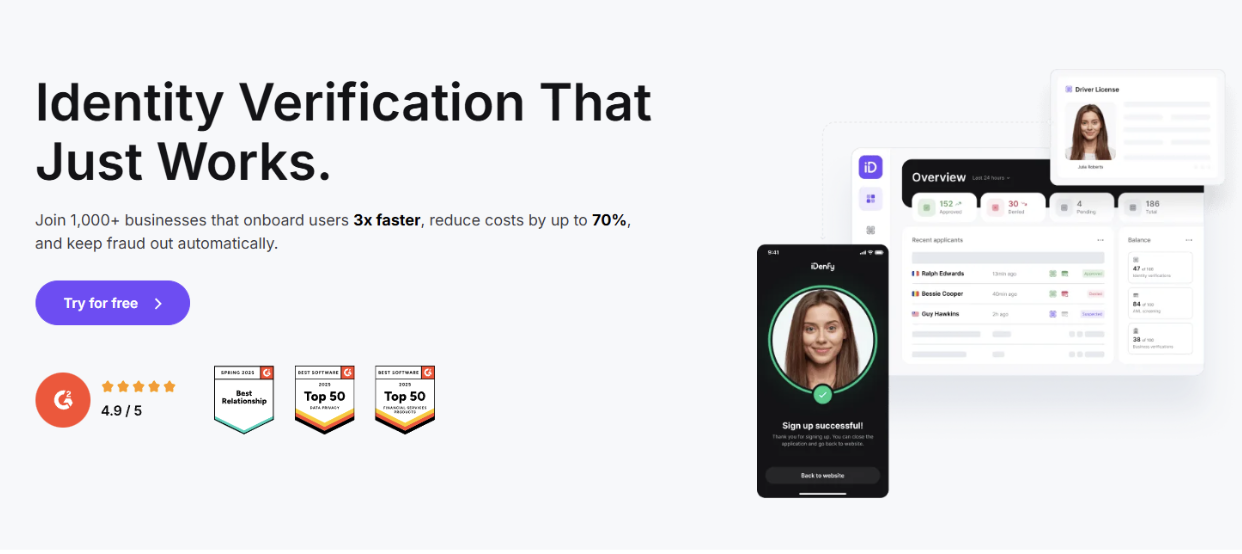

1. iDenfy

iDenfy is a standout solution for all things fraud and identity verification. It verifies customer IDs with AI-powered biometric recognition. The iDenfy team also reviews every audit manually.

Whether it’s forged documents, blocklisted documents, stolen documents, or expired documents, iDenfy secures businesses with its three-layer identity verification process.

iDenfy asks you to pay only per successful ID verification. On average, enterprises save about 70% of user onboarding costs. Not to mention the increase in overall customer quality by eliminating fraudulent accounts.

Key Features:

-

Adverse media screening

-

AML sanctions screening

-

Email verification and Pre-KYC Screening

-

Age verification

-

Criminal background check and screening

-

Perpetual KYB

Cost:

You can request a quote through their website.

2. ClearSale

ClearSale is an eCommerce fraud protection service that uses artificial intelligence, complex statistical methodologies, and a staff of expert fraud analysts to give the best results for its customers. The entire solution enables businesses to resolve chargebacks and false rejects, ensuring that income is maximized and that customers have a better experience.

A sophisticated statistical system that checks client orders for frequent fraud trends is owned by the corporation. In addition, the algorithm may be adjusted with fraud rules tailored to a given firm and has been connected with a machine learning network to react to new fraudulent strategies.

Key Features:

-

Minimized chargebacks and false positives

-

Chargeback security according to KPI performance

-

Regulation and data compliant

-

Custom reports

-

User-friendly dashboard

Cost:

You can request a quote through their website.

3. Advarisk

AdvaSmart by AdvaRisk is an AI-powered fraud detection tool that uses a thorough research and tracking platform to identify proactive rating bad events for early fraud identification. The program includes an intelligent decision engine with 1000+ information sources and intelligent analytics.

The program uses data analytics to uncover unknown tendencies connected with defaulters by combining 600+ data sources. It also gives commercial firms exposure to the company's real-time financial data for fraud identification and repayment in their business loan portfolios.

Key Features:

-

Threat susceptibility examination

-

Recovery-rate enhancement

-

Virtually monitoring of accounts and assets for any unusual activity.

-

Reduce the chances of engaging in a fraudulent transaction

Cost:

You can request a quote through their website.

4. Signify

Signifyd is another tool that comes to mind when it comes to eCommerce fraud protection. Signifyd is a commerce protection technology that uses artificial intelligence and machine learning in the backend to provide businesses with relevant commerce data.

The platform's decision core detects irregularities such as account takeover, unauthorized resellers, and promotion misuse instantly.

Merchants and merchants may tailor their responses to their own company needs. It also gives merchants a particular viewpoint of all activity data, allowing them to make more educated choices.

Key Features:

-

Account protection

-

Payments optimization

-

Fraud protection

-

Abuse prevention

-

Future-proof authentication

Cost:

You can request a quote through their website.

5. Sift

Sift is a complete online confidence and security package that enables clients to protect their interactions while also leveraging real-time algorithms for growth optimization.

For banking, travel, and eCommerce firms, this solution brings it all together, from chargeback minimization, payment fraud prevention, and spamming prevention to user acquisition defense and built-in authentication.

For real-time scoring, the software package uses machine learning and bespoke models. It also includes dynamic panel statistics to track important fraud parameters.

Key Features:

-

An unmatched global data connectivity

-

Profound Investigation console with a user-friendly interface

-

Access to device fingerprinting API

-

A technical account team devoted to you

Cost:

You can request a quote through their website.

6. FCase

FCase is another fraud detection tool that has built a name for itself in the field, which uses advanced analytics to assist BFSI organizations with their fraud inquiries. FCase Fraud Orchestration creates a standardized fraud platform for businesses to assess frauds, financial conduct, and customer case management systems.

The system gives a unified perspective of fraud investigations, assisting businesses in preventing future fraudulent activity. It includes a cross-functional synchronization that assists in the development of a fraud plan to limit such actions, false positives, and consumer irritation.

Key Features:

-

Effortless passwordless authentication

-

Determining which transactions are legitimate

-

Reduced fraud

-

Improved customer experience

Cost:

You can request a quote through their website.

7. Ondato

Ondato is a comprehensive platform that provides end-to-end solutions for identity verification and regulatory compliance. The platform is designed to streamline and automate KYC (Know Your Customer) and AML (Anti-Money Laundering) processes for businesses, enhancing security and compliance while reducing manual workloads. One of Ondato's standout features is its AML compliance software that ensures businesses meet regulatory requirements efficiently and effectively. Ondato offers fraud detection tools that integrate seamlessly with various business systems, providing real-time monitoring and detailed reporting to detect and prevent fraudulent activities.

Key Features:

-

Automated KYC: Simplifies the customer onboarding process with automated identity verification.

-

AML Compliance Software: Provides robust tools to monitor transactions and detect suspicious activities.

-

Multi-Platform Integration: Seamlessly integrates with various business systems, enhancing flexibility and usability.

Cost:

Ondato offers three main pricing plans:

- Starter Plan: €50 per month, suitable for small businesses and startups.

- Growth Plan: €200 per month, ideal for growing businesses with increasing compliance needs.

- Enterprise Plan: Custom pricing for large enterprises with extensive requirements, including tailored solutions and dedicated support.

8. Caseware

Caseware is a comprehensive solution that makes AML compliance and fraud protection simple and affordable. For banks, MSBs, fintech businesses, and insurance organizations, the program uses risk intelligence data and machine learning algorithms to reduce financial crime risks.

Instead of costly inquiries and cost solutions, the program focuses on assisting consumers with fraud prevention. Alessa's unique capabilities allow it to continually monitor internal operations in order to discover faults and avert time, money, and reputational damage.

Key Features:

-

Continuous monitoring

-

Fraud management operations

-

Advanced analytics including

-

On-demand screening

Cost:

You can request a quote through their website.

9. Appsflyer

Appsflyer helps you get a thorough look at your account's fraudulent activity, expected savings, post-attribution fraud rate, and media partner metrics. Advanced fraud assaults necessitate novel defenses.

This tool can scan hundreds of mobile sensors at the same time to identify genuine consumers, so you can tell the difference between humans and robots and keep your ad money focused on actual conversions.

To detect fraud, dig deeper and evaluate partner behavior trends for aberrant behavior patterns. Get complete access to all of Protect360's fraud raw data so you can slice, dissect, and analyze it to make better decisions.

Key Features:

-

Protect360 dashboard

-

Anomaly insights

-

Raw data resorts

-

Media partner transparency

-

Post-attribution fraud detection

Cost:

You can request a quote through their website.

10. Seon

Seon’s SDK and modules are easy to integrate into any process or technology stack. With our Zapier connection, you can even take efficiency and management to the next degree. With no initial expenses, you may add an extra protection layer or a complete preventative system.

With its straightforward pay-per-API-call price, you can easily manage ROI and growth processes. Decrease all fraud levels instantly. Machine Learning and customized rules are used to enable device identification, data augmentation, and prognostic grading.

End-to-end platform with a comprehensive Admin Dashboard, complete team management, and exceptional UX.

Key Features:

-

Granular control

-

Device fingerprinting and proxy detection

-

Block and allow lists

-

Insightful connections

Cost:

The cost for this fraud detection tool starts from $0.06 per check.

11. Kount

Kount offers a comprehensive spectrum of fraud detection and prevention solutions and services to secure the end-to-end consumer experience. Protect against account takeover threats and dangerous bot activity while providing excellent customer service. Prevent digital payment fraud by using AI, machine learning, and global network data to make proper identity trust judgments.

Stop disputes before they turn into chargebacks with a single dashboard that interfaces with major card brands' post-authorization technologies. Custom consultation with Kount's expertise can help you improve your fraud policies and company processes. Thousands of new data points may be accessed to optimize marketing efforts, upsells, and cross-sells.

Key Features:

-

Automated decisions

-

Reduced friction

-

Reduced chargebacks

-

Maximized conversations

Cost:

You can request a quote through their website.

12. CertifID

CertifID For each transaction, Certifid verifies identities and credentials. CertifID works with the industry's most renowned title creation software for a quick and easy solution that saves you time and money.

Protect your client's data and double-check their credentials. CertifID provides you with the functionality you want as well as the security you deserve, all in one place.

Eliminate callback procedures to reclaim critical time. Provide peace of mind to your employees, customers, and partners. Verify banking information and insure each transaction to save time and reduce risk for all parties involved.

Key Features:

-

Assured

-

Secured

-

Integrated

-

Accelerated

Cost:

You can request a quote through their website.

13. Stripe Radar

Stripe Radar uses machine learning to detect and prevent fraud in any sort of organization, and it learns on data from millions of firms across the world. It's already incorporated into Stripe, so there's no need to do anything else to get started.

Old methods of fraud prevention were never meant for modern online enterprises, and they might result in reduced acceptance rates and revenue loss. Radar can assist you in distinguishing between fraudsters and consumers and applying Dynamic 3D Secure to high-risk transactions.

Every day, our machine learning infrastructure allows us to retrain models, including ones specific to your company. Radar's algorithms are fast to react to changing fraud tendencies as well as your specific organization.

Key Features:

-

Use ML that actually works

-

Stop blocking legitimate customers

-

Get protection that adapts to you

-

Frictionless authentication

Cost:

You can request a quote through their website.

14. Pipl

Pipl unrivaled identification information is connected with your systems. Top fraud analysts and investigators utilize this simple search engine for speedy identification verification and investigations. For real-time identity verification and contact enrichment applications.

Pipl's unique advanced analytics, gather cross-reference and integrate relevant data from a variety of public and private sources in order to provide highly accurate identification assessments in real-time.

The data in Pipl's worldwide index of online identity information comes from an almost infinite number of sources, such as the web, the deep web, official records, and corporate databases. Individual IDs and incomplete records are automatically re-searched by Pipl's recursive algorithm numerous times before being included in the digital footprint.

Key Features:

-

Cross-Referenced

-

Proprietary clustering algorithms collect

-

Connect-related data

-

Real-time identity verification

Cost:

You can request a quote through their website.

15. DataDome

DataDome proprietary SDK is small, unobtrusive, and can be installed in under three minutes on all main mobile devices. Because of its reliability, safeguarding mobile apps is a no-brainer for all of our clients.

DataDome may be used on any cloud. It takes only a few minutes to set up, thanks to a simple line of code that is tailored to your design. Our bot detection software protects complex systems in a unified manner. It works with every major web technology, supporting multi-cloud and multi-CDN configurations.

Key Features:

-

Data retention

-

24*7 technical support

-

Real-time dashboard

-

AI-powered protection

-

Advanced analytics

Cost:

The pricing for this fraud detection tool starts from $2,990 per month.

16. TruValidate

TruValidate provides a reliable and extensive perspective of each customer by connecting proprietary data, personal data, device identifiers, and online activities. Our powerful analytics and worldwide fraud reporting network assist organizations in detecting abnormalities, assessing risk, and reliably identifying excellent customers.

This helps you to focus on protecting your company while still providing effective, tailored, and friction-free services. Protect each step of the customer journey with tailored solutions that are suited for the transaction's risk level. Reduce operational costs by proactively identifying risky transfers and deceptive systems in real-time.

Key Features:

-

Risk-Based Authentication

-

Fraud analytics

-

Identity Proofing

-

Real-time insights

Cost:

You can request a quote through their website.

17. Nethone

Nethone helps internet companies develop by providing an anti-fraud payment solution. Every single one of your users has 5,000+ properties extracted by Nethone. It illuminates more than simply declarative information.

It detects the minimum possible information about the device, connection, and behavior in order to exhaust the entire context. For a travel firm approaching a new market, it results in a lower chargeback rate. In a digital banking mobile app, this capability allows for more precise fraud detection.

Key Features:

-

Thoroughly tested machine learning

-

Blocked account takeovers

-

Manual review rate

-

Higher fraud detection precision

Cost:

You can request a quote through their website.

18. Ocrolus

Ocrolus is a trailblazer when it comes to combining robots and people for data verification. To acquire exact data every time, combine machine learning with human confirmation. Reduce the requirement for document pre-sorting to save time.

You may rapidly alert borrowers of poorly supplied or missing information by retrieving structured, indexed output for all document kinds. Obtain access to the most cutting-edge technology for detecting undesirable actors.

With continually learning algorithms, you may improve over time. Receive fraud and document manipulation alerts. Integrate data points from a variety of different sources.

Key Features:

-

Accelerate processing speed

-

Integrate new data

-

Increase accuracy

-

Bolster compliance

Cost:

You can request a quote through their website.

19. Fraud.net

Fraud.net is an AI-based fraud detection and prevention product suite that streamlines fraud management by defending against several forms of fraud with a single solution.

This fraud detection tool makes it easier for your company to protect itself from risks and avoid fraud. Stop people from gaining unauthorized access to client accounts by using password cramming and relentless force tactics.

Instabilities and fraudulent schemes in multi-party transactions should be identified.

Prevent opportunists from exploiting software flaws and malevolent actors from infiltrating whole member registries.

Key Features:

-

Insider threat identification

-

Chargeback protection

-

Varied fraud management solutions

-

Uses artificial intelligence

Cost:

You can request a quote through their website.

20. Abrigo

Abrigo identifies and warns you of a variety of fraud types that you may customize, as well as offering a central case management system for rapidly and effectively resolving alarms. With BAM+ Fraud, you can easily uncover, recognize, and prevent fraud at your organization.

Fraudsters keep up with technological advancements. Abrigo produces fraud scenarios that are used to track the areas of fraud that have the most direct impact on the organization and its people.

As a consequence, banks and credit unions may modify the product to match their unique requirements while saving money and decreasing false positives. Fraudsters evolve and change all the time, and your organization requires a strategy to remain ahead of the competition.

Key Features:

-

Enhanced reporting

-

Collaboration and efficiency

-

Control and flexibility

-

Single and Multi-Channel Detection

Cost:

You can request a quote through their website.

21. Xceed

Xceed’s out-of-the-box AML and fraudulent frameworks and network connections, mid-market enterprises like credit unions, FinTechs, and regional banks will see reduced downtime and risk.

Your consumers may enjoy the benefits of digital acceleration and speedier payments, but they are also more exposed to fraud. Xceed recognizes early phases of an assault using the most powerful AI, allowing you to intervene before any money is moved.

Xceed's self-learning behavioral analytics detect anomalous activity throughout all channels, allowing you to dynamically adjust to new risks without interrupting your consumers.

Key Features:

-

Real-time behavior-based analytics and machine learning

-

Higher detection accuracy

-

Lower false positives

-

Maximize operational efficiency

Cost:

You can request a quote through their website.

22. Ekata

Ekata’s pro Insight includes six methods to search, rich statistics and administration tools, easy workflow connectors, and a simple and complete view for agents. Ekata is developed for the review process on fraudulent investigation teams.

The Identity Risk Score, important modeling and analysis signals that influence the score, check stages, and in-depth information for each particular information feature is all shown on our online interface.

With the tool's account opening solution, you can protect against incentive and promo misuse, inventory risk, and trade authenticity by analyzing risk early in the customer experience. Sort consumers by risk level using simply an IP address, email, or phone number.

Key Features:

-

Pro Insight

-

Reduced false positives

-

Transaction risk API

-

Automated process

Cost:

You can request a quote through their website.

23. Opticks

Opticks In real-time, Opticks detects and prevents the most sophisticated ad fraud. Instantly determine whether traffic will generate money and prevent ad fraud before it occurs. Provide detailed acquisition statistics to your growth teams.

Opticks makes it simple to detect and track complex online ad fraud, allowing you to reliably increase your income. Our patented system identifies the most complex fraud schemes, and its machine learning nature puts us one step ahead of the criminals. Using machine learning and behavioral analytics, our analyzer analyses the data recorded in real-time.

The risk score determines whether or not a user is harmful. Opticks systems collect telemetry at the connection, program, and user levels, resulting in a full collection of useful information about the session.

Key Features:

-

Unmatched fraud detection

-

Clear data visualization

-

Modern and flexible software

-

Customizable fraud protection

Cost:

You can request a quote through their website.

24. Outseer

Outseer identifies and eliminates fraud throughout every online connection with a consumer. Its machine learning and data science technology provide a pleasant user experience while also combating fraud. In real-time, consider the risk of user behaviors and payments emanating from online platforms.

Use the built-in step-up verification methods or create your own. To improve your risk management decisions, integrate insight from the Outseer Global Data Network with proprietary and third information. Outseer Fraud Manager gives you the foresight you need to spot fraudulent consumer transactions before they occur.

Key Features:

-

Seamless fraud prevention across channels

-

Your choice of step-ups

-

A complete ecosystem approach

-

Highest fraud detection rates in the industry

Cost:

You can request a quote through their website.

Things to Consider While Selecting Fraud Detection Tools

Real-time Detection and Prevention

To begin, an optimal system must be able to detect and respond in real-time to a wide range of fraud situations, both industry-wide and unique to your business. Chargeback fraud, account acquisition fraud, internet fraud, credit card fraud, payment fraud, and other types of fraud are all used by criminals.

Analyzing Features

It's also critical that the technology be able to adapt to new and perhaps unforeseen fraud practices.

It should have a flexible set of tools for gathering and analyzing data, drawing accurate inferences about the online footprint, taking action depending on fraud risk findings, and lastly generating complete reports.

It must be able to connect to your current environment, and at some time, your fraud department should be unable to envision life without it.

Advanced Monitoring System

Present and emerging multi-factor identification alternatives should be able to interface with the fraud monitoring system. It should continually assess the danger of a certain occurrence and arrange the identification flow depending on that assessment. It should constantly select the most appropriate authentication mechanism for a particular circumstance based on the amount of risk.

Conclusion

Fraud detection tools help organizations keep legitimate transactions moving while stopping high risk activity before it turns into chargebacks, refunds, and customer churn. In 2026, the most effective programs combine real time monitoring, strong identity signals, behavioral analytics, and flexible decisioning so they can adapt quickly as tactics evolve. The right solution reduces both direct fraud losses and the hidden costs of false declines, manual reviews, and dispute management, protecting revenue without adding unnecessary friction for real customers.

FAQs

What are fraud detection tools?

Fraud detection and prevention tools are technologies that enable businesses to monitor and avoid high-risk, false, or fraudulent internet activities. These systems can track a variety of indicators in real-time, including monetary operations, access points and activity, purchases, and more.

The IT and regulatory departments of enterprises and online banking institutions employ fraud detection systems to monitor suspected fraudulent acts taken by their users. Companies use these solutions to secure critical information about the company and its customers.

What should you consider while using fraud detection tools?

- Automation of Work Processes

Automation plays a significant part in accelerating a company's workflow. Implementing digital payment fraud tests, identifying and banning suspicious behaviors or technologies, and canceling fraudulent purchases may all help businesses stay safer.

- Real-time Analysis

Real-time insights and data on suspicious actions may be accessed on a single platform to expedite the fraud screening process. This interface improves the visibility of possible frauds that may affect a company and allows for monitoring of such activity without having to switch screens.

What is fraud detection?

The term fraud detection refers to a combination of methods and analysis that allow firms to detect and prevent unlawful financial activity. This can involve things like credit card fraud, identity theft, internet theft, and false claims, among other things.

Fraud prevention can be integrated into a company's website, rules, personnel training, and additional security measures.

How do fraud verification tools work?

Many fraudsters test trends and look for gaps to exploit. To unlock the password on a credit card, a hacker may create a computer program that examines hundreds of pins every second at irregular intervals.

Because fraud is frequently perpetrated in patterns, fraud detection software uses artificial intelligence to search for these trends and delivers an alarm when one is found. Based on the intensity of the alarm, it may result in an instant halt to all operations or transmit the alarm to a professional assessor for further study.

How do fraud detection tools help organizations?

Organizations can use fraud detection and prevention solutions to monitor and eliminate high-risk, phony, or fraudulent electronic transfers. These systems can track a variety of indicators in real-time, including payment information, operating systems and activity, sales, and more.

Companies that are most vulnerable to monetary fraud should have at least some fraud detection procedures. Banks, other payment service providers, insurance firms, and enterprises that perform major internet transactions are examples of these.

While any business faces the danger of being cheated, businesses with big transaction amounts, high transaction volumes, or cashless business systems are more vulnerable to fraud.