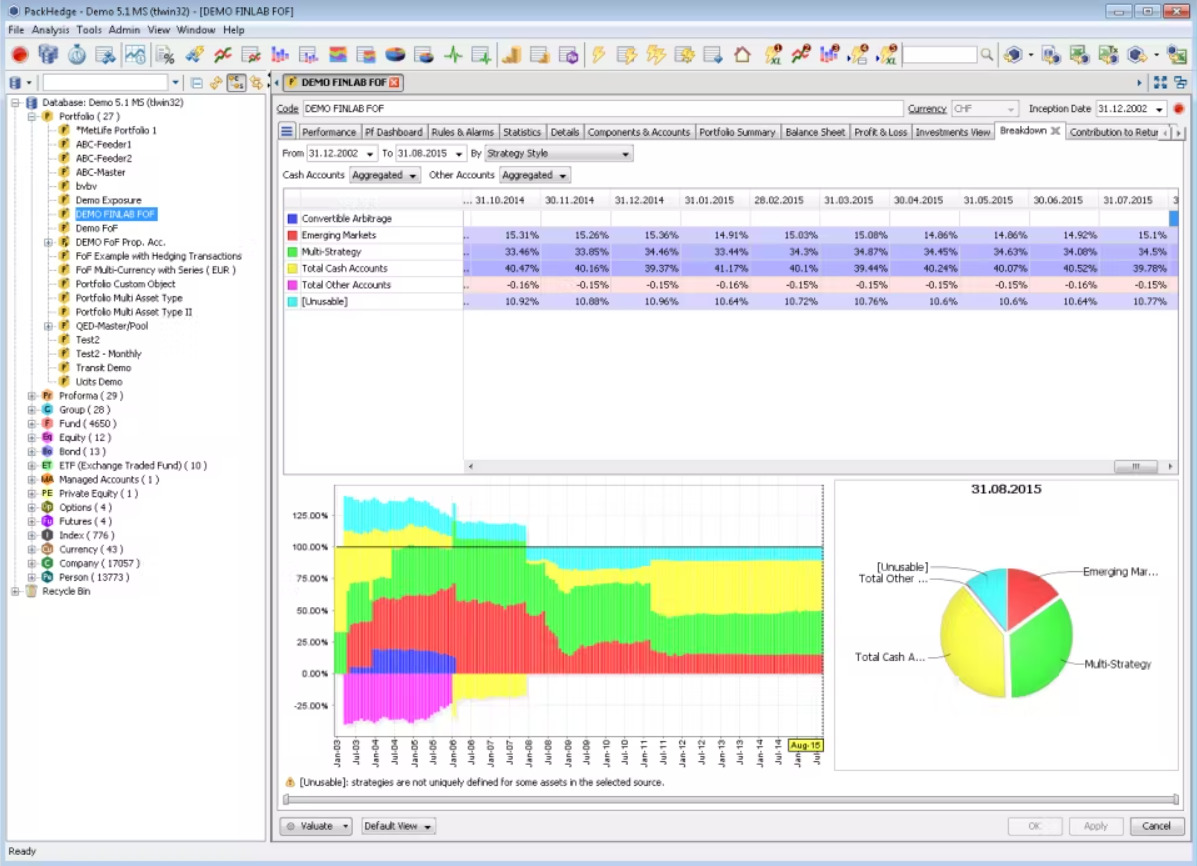

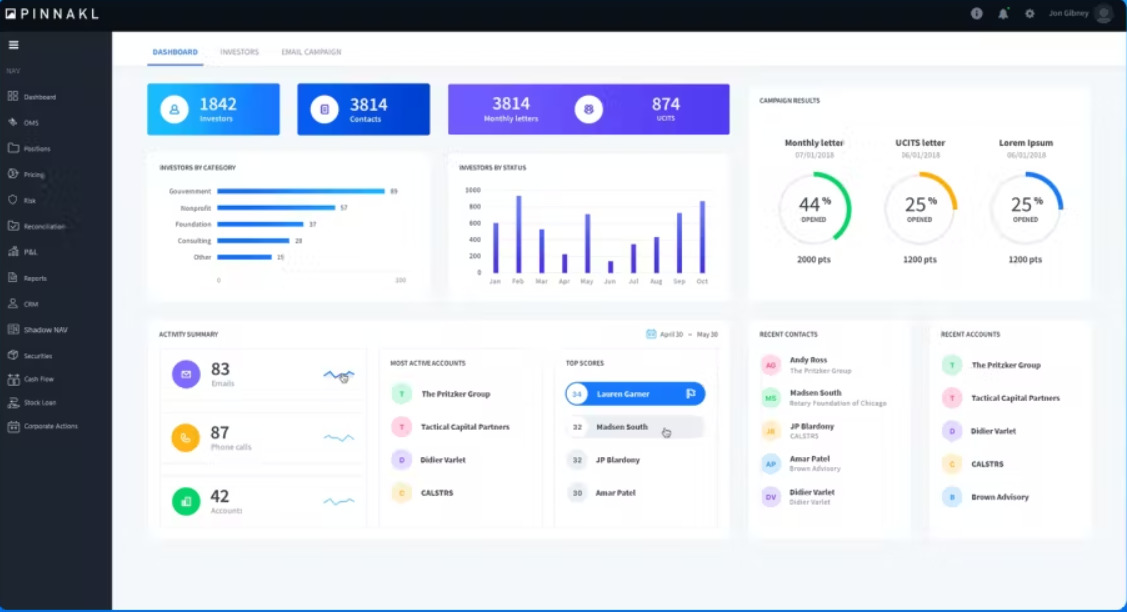

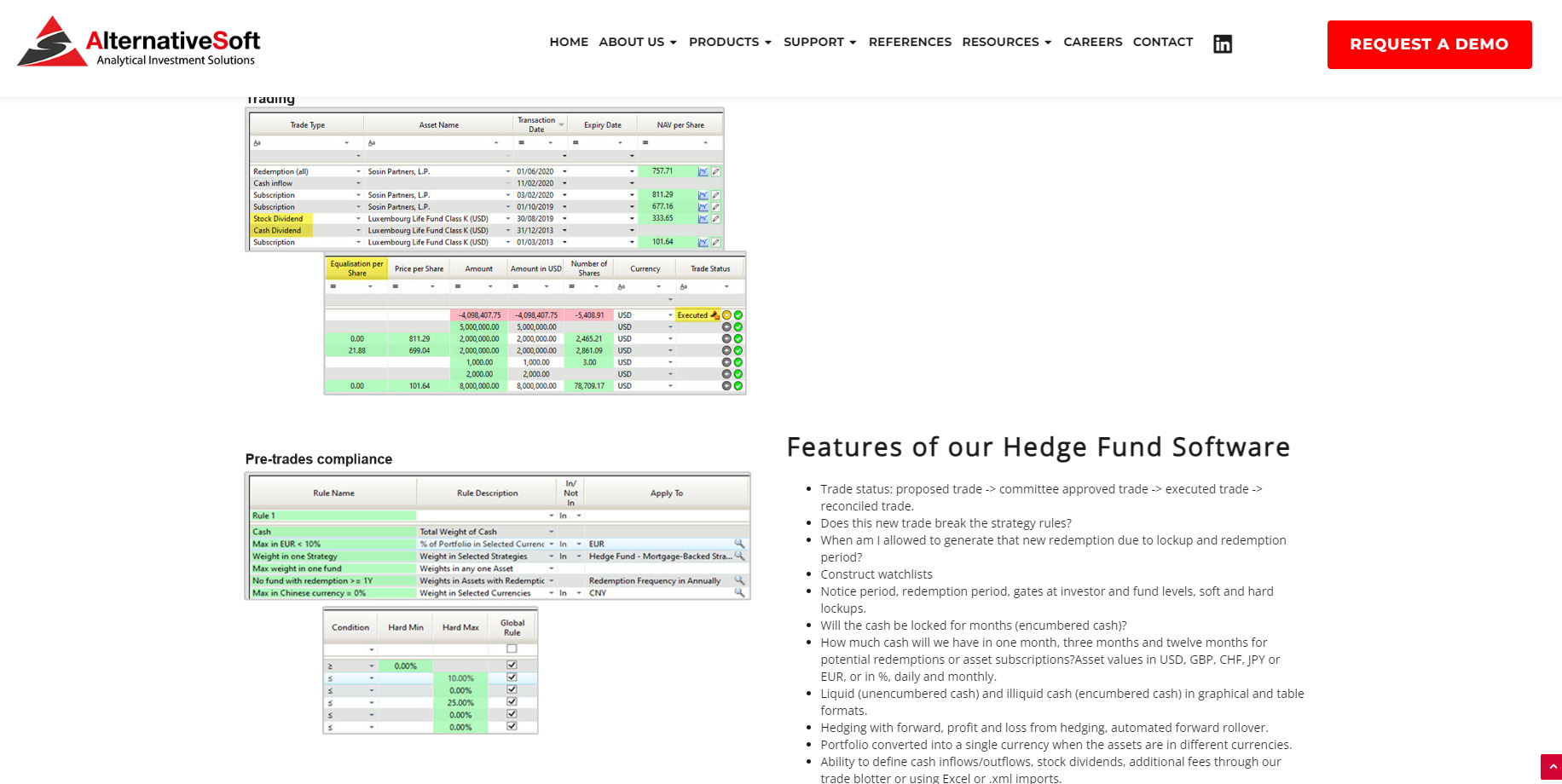

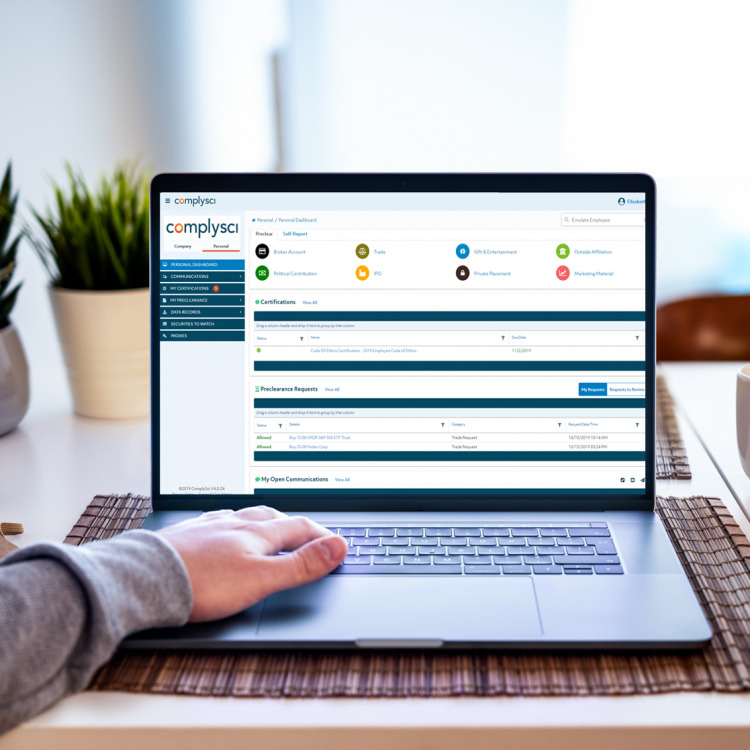

HedgeTek is a Hedge Fund Software that assists fund managers in providing continuous functional improvements that improve workflow and save costs.

Investment firms can utilize HedgeTek's dual book and tax allocation technology to create investor statements and tax reports that are unique to their business. Leading fund administrators, managers of hedge funds, and major accounting firms collaborated on the development and ongoing improvement of HedgeTek.

There are a bunch of decent tools out there that offer the same array of services as HedgeTek. And it can sure get confusing to choose the best from the lot. Luckily, we've got you covered with our curated lists of alternative tools to suit your unique work needs, complete with features and pricing.