You think medication pass is under control until a double round day, agency staff on the floor, and a narcotics count collide. Across different care organizations, eMAR success in 2026 still hinges on a few practical realities: two way pharmacy interfaces that eliminate retyping, PRN follow up documentation that is actually completed, and offline charting that syncs reliably when Wi Fi drops. These details matter because medication administration remains one of the highest risk workflows in care delivery. Medication errors continue to cost the global health system tens of billions of dollars each year, and barcode supported eMAR models are consistently associated with meaningful reductions in administration and transcription errors. This guide is designed to help providers choose tools that hold up during real med passes, not just during calm demos.

eVero eMAR

Medication administration module for I/DD and HCBS providers that sits inside eVero's EHR, with pharmacy data, scheduling, and inventory tied to individual profiles. Launched in 2025 to bring end‑to‑end medication workflows to agencies already on eVero.

Best for: U.S. I/DD agencies that want medication management embedded in their existing eVero stack.

Key Features:

- Pharmacy integrations and real‑time prescription/refill details, plus images and warnings from a national drug database, per vendor launch materials.

- Scheduling, inventory tracking, and missed/late dose reporting tied to eVero's EHR profiles.

- Role‑based access with AMAP certification checks on who can administer meds.

Why we like it: For providers already using eVero for EVV, billing, and clinical records, adding eMAR reduces app sprawl and double entry.

Notable Limitations:

- New module as of January 2025, limited third‑party reviews at this stage, per news coverage of the launch (EIN Presswire summary).

- Focused on I/DD, may be less aligned to skilled nursing medication complexities out of the box.

Pricing: Pricing not publicly available. Contact vendor for a custom quote.

OnCare eMAR

Home care eMAR inside an all‑in‑one agency platform for scheduling, care notes, and finance. Designed for domiciliary and community care teams that need real‑time medication tracking and audit trails.

Best for: Small to mid‑size home care agencies moving off paper MARs to a mobile workflow.

Key Features:

- Real‑time alerts, visual medication history, and audit trails for missed or refused doses per product pages.

- Works alongside scheduling and visit reporting to surface med tasks in day‑to‑day operations.

- Mobile app for in‑field documentation with offline support noted on site content.

Why we like it: Agencies can digitize meds, visits, and payroll in one place, reducing context switching for coordinators.

Notable Limitations:

- Limited independent review volume relative to bigger U.S. brands, though recent user feedback on third‑party sites is positive (Trustpilot sample).

- Integration details beyond the core suite are not widely documented on third‑party sources.

Pricing: Pricing not publicly available on review aggregators. Contact vendor for a custom quote.

eMAR Plus

Medication administration app developed in the UK and Ireland that digitizes charts, stock, timestamps, and barcode workflows, with care home and pharmacy collaboration at its core.

Best for: UK and Ireland care homes that want close pharmacy collaboration and stock controls.

Key Features:

- Real‑time eMAR charting with PRN management and automated alerts, per product overview.

- Pharmacy connectivity including pouch scanning and stock/ordering coordination highlighted by partner content.

- Audit trails with timestamps and staff identity for inspections.

Why we like it: The emphasis on stock, ordering, and barcode workflows aligns with practical med‑round pain points in residential care.

Notable Limitations:

- Primarily UK/Ireland footprint and ecosystem.

- Limited third‑party analyst and review coverage compared with larger, older vendors.

Pricing: Pricing not publicly available. Contact vendor for a custom quote.

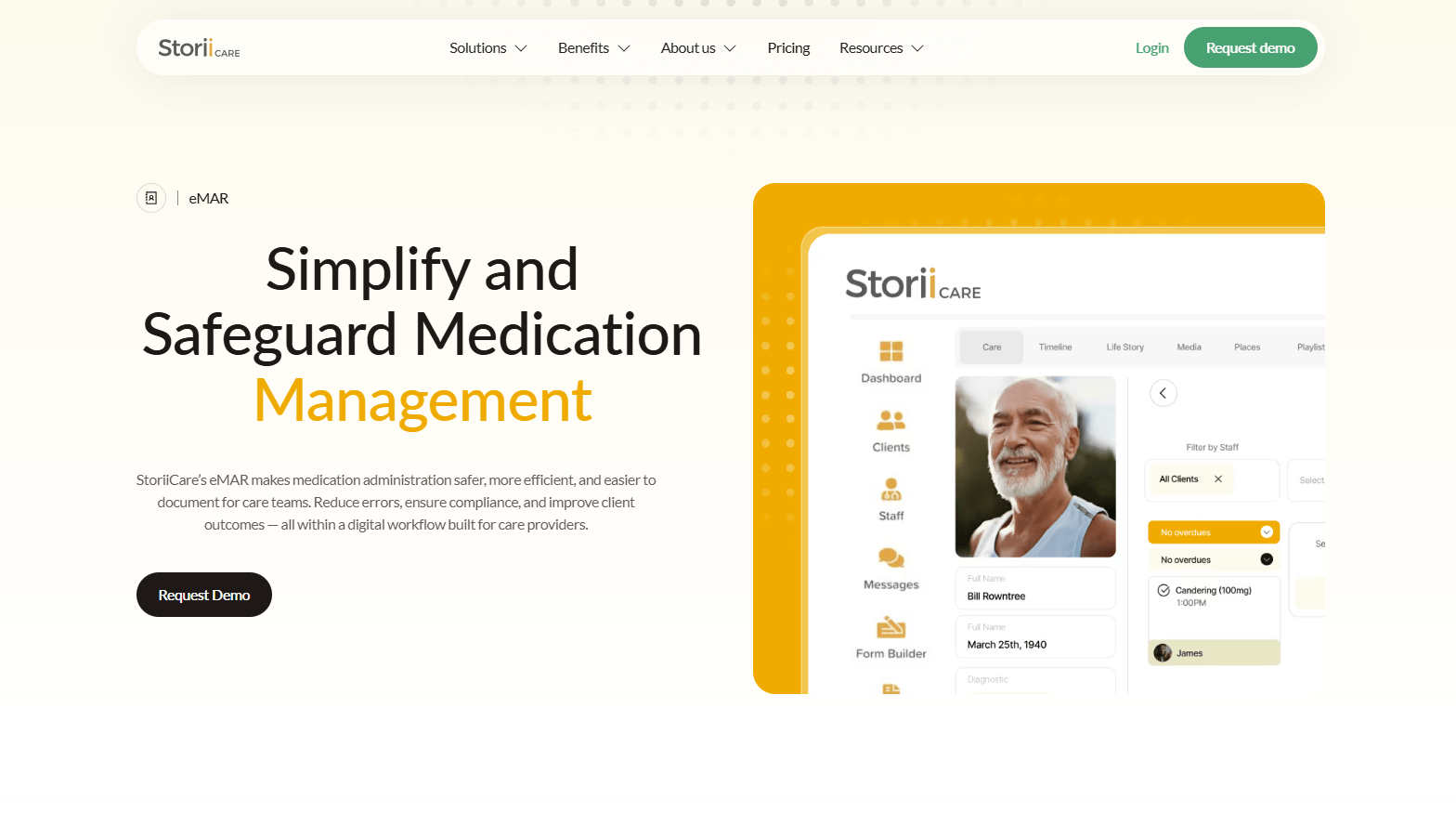

StoriiCare eMAR

eMAR integrated into a broader care management platform popular with adult day and community‑based providers. The eMAR module is rolling out with scheduling, alerts, inventory, and audit trails.

Best for: Adult day, residential, and community‑based providers already using StoriiCare for care planning and documentation.

Key Features:

- Scheduling, missed dose alerts, and inventory controls inside the care platform, per product pages.

- eMAR availability marked as in Beta as of February 20, 2025 in support documentation (StoriiCare Help Center note).

- Positive usability ratings from third‑party reviews across the platform (Capterra reviews overview).

Why we like it: A single login for day records, care plans, and meds is attractive for small teams with limited admin capacity.

Notable Limitations:

- eMAR marked as Beta in early 2025, so production scale features and integrations may still be evolving.

- Some users report limited nursing‑specific functions and form builder friction on reviews.

Pricing: No public per‑seat pricing on reviews, Capterra lists "custom quote" plans (Capterra pricing page).

Eldermark NEXT EMAR

Senior living EHR with medication workflows tied into assessments and service plans. Known for assisted living, memory care, and related settings.

Best for: Senior living operators standardizing clinical workflows and medication management across multiple communities.

Key Features:

- Integrated medication management with assessments and care planning per user reviews.

- Enterprise support and reporting frequently noted by administrators.

- Active vendor roadmap with modernization to web modules referenced by users.

Why we like it: Operators can unify billing, clinical, and meds without juggling multiple vendors, which simplifies training and support.

Notable Limitations:

- Users cite legacy server‑based components and "cumbersome" areas when not on the latest web modules (Capterra reviews).

- Occasional comments on hidden or hard‑to‑find reports in user feedback.

Pricing: Pricing not publicly available on trusted aggregators. Contact vendor for a custom quote.

Residex eMAR

Electronic medication administration system within a senior living EHR that emphasizes delegation, real‑time documentation, and audit trails. The company has seen recent investment and expansion.

Best for: Assisted living and senior care providers seeking clinical eMAR plus EHR in one platform.

Key Features:

- Real‑time charting of due meds only, PRN controls with early‑dose alerts, and verification options for high‑alert meds per product materials.

- Delegation support and end‑to‑end auditability from receipt to administration and destruction.

- Recent capital backing and expansion in workforce tech through acquisition, indicating active development (Accel‑KKR investment release, GeekWire on Kevala acquisition).

Why we like it: Strong emphasis on medication oversight and PRN workflows addresses common deficiency areas in surveys.

Notable Limitations:

- Sparse independent review volume, which makes third‑party validation limited (Capterra UK page snapshot).

- U.S.‑centric workflows may require evaluation for non‑U.S. regulatory models.

Pricing: Pricing not publicly available. Contact vendor for a custom quote.

Yardi eMAR

Senior living eMAR within Yardi's suite, designed to connect providers with a large pharmacy network and support online and offline charting during outages.

Best for: Senior living operators already standardized on Yardi financials or EHR who want connected pharmacy workflows.

Key Features:

- Pharmacy Network integrations documented in press and milestones, including Canadian deployments (PR Newswire pharmacy integration).

- Enterprise platform approach with integrated EHR and operations due to ALMSA acquisition history (Senior Housing News coverage).

- Per vendor documentation, supports offline charting, digital med passes, and refill requests within the network.

Why we like it: Pharmacy connectivity at scale plus enterprise controls suit multi‑site providers that want one stack.

Notable Limitations:

- Mixed user feedback on performance and support cadence in third‑party reviews, including older comments about slow med passes (Capterra review set).

- Implementation and change‑management effort can be significant for smaller teams.

Pricing: Pricing not publicly available. Contact vendor for a custom quote.

eMAR Tools Comparison: Quick Overview

| Tool | Best For | Pricing Model | Highlights |

|---|---|---|---|

| eVero eMAR | U.S. I/DD agencies on eVero | Custom quote | New module with pharmacy links inside eVero EHR |

| OnCare eMAR | Home care agencies | Custom quote | Real‑time alerts and audit trails, positive small‑sample user sentiment |

| eMAR Plus | UK/IE care homes | Custom quote | Barcode workflows, pharmacy collaboration focus |

| StoriiCare eMAR | Adult day and community care | Custom quote | eMAR in Beta as of Feb 2025 |

| Eldermark NEXT EMAR | Senior living multi‑site | Custom quote | Medication plus assessments and care plans |

| Residex eMAR | Assisted living and senior care | Custom quote | PRN controls, audit trails, recent growth news |

| Yardi eMAR | Enterprise senior living | Custom quote | Pharmacy Network, enterprise suite pedigree |

eMAR Platform Comparison: Key Features at a Glance

| Tool | Pharmacy Integration | PRN Follow‑up Workflow | Inventory/Stock |

|---|---|---|---|

| eVero eMAR | Yes, per launch materials | Yes | Yes |

| OnCare eMAR | Not publicly detailed with third‑party sources | Yes | Visual history and audit trails indicated on site |

| eMAR Plus | Yes, pharmacy collaboration focus | Yes | Yes |

| StoriiCare eMAR | Not publicly detailed beyond vendor pages | Yes | Yes |

| Eldermark NEXT EMAR | Integrated with clinical workflows (per reviews) | Yes | Yes |

| Residex eMAR | Yes | Yes, early‑dose alerts | Yes |

| Yardi eMAR | Yes, Yardi Pharmacy Network | Yes | Yes |

eMAR Strategic Decision Framework

| Critical Question | Why It Matters | What to Evaluate | Red Flags |

|---|---|---|---|

| Do we need two‑way pharmacy integration or is one‑way enough? | Two‑way reduces calls, delays, and miscommunication | Supported pharmacy systems, refill flows, delivery status views | Manual faxing, CSV imports as the "integration" |

| How will PRN follow‑ups be enforced? | Surveys cite missed PRN efficacy documentation | Timers, required follow‑ups, exception dashboards | PRN charting without system‑enforced follow‑up |

| Can we chart offline reliably? | Wi‑Fi dead zones disrupt med passes | Mobile offline modes, conflict resolution, audit logs | "Works offline" without clear sync and conflict handling |

| What is our audit and investigation workflow? | You need fast answers for surveyors and families | Drill‑downs by person, med, staff, time ranges | CSV exports only, slow or missing audit filters |

eMAR Solutions Comparison: Pricing & Capabilities Overview

| Organization Size | Recommended Setup | Monthly Cost | Annual Investment |

|---|---|---|---|

| Single‑site care home (UK) | eMAR Plus with pharmacy connectivity | Varies by quote | Varies by quote |

| Multi‑site senior living (U.S.) | Yardi eMAR or Eldermark NEXT with corporate reporting | Varies by quote | Varies by quote |

| I/DD agency (U.S.) | eVero eMAR added to existing eVero EHR | Varies by quote | Varies by quote |

| Home care agency | OnCare eMAR within agency suite, or StoriiCare if already adopted | Varies by quote | Varies by quote |

Problems & Solutions

-

Problem: Pharmacy communication gaps lead to late meds and phone tag.

Solutions:- Yardi eMAR connects providers and pharmacies through its Pharmacy Network, with documented third‑party coverage of integrations in production.

- eVero eMAR launch materials emphasize real‑time pharmacy data inside the EHR profile, limiting rekeying and delays.

-

Problem: Missed PRN follow‑ups and incomplete documentation.

Solutions:- Residex describes PRN early‑dose alerts and required documentation to close the loop, aligning with survey readiness needs (feature themes summarized on product pages; limited third‑party reviews exist).

- Eldermark user reviews highlight integrated clinical data for medication management tied to assessments and plans, improving follow‑through in workflows.

-

Problem: Wi‑Fi dead zones stall med rounds.

Solutions:- Yardi references online and offline charting modes in product communications and release notes, useful for uninterrupted med passes across large communities, with enterprise cadence evident in long‑running pharmacy integrations.

- Home care contexts can also benefit from mobile‑first documentation, with third‑party feedback suggesting OnCare's app is easy to use in the field.

-

Problem: Paper MARs and manual checks drive errors and survey risk.

Solutions:- WHO frames the global error burden at $42B per year and endorses system‑level fixes.

- Barcode‑supported eMAR models are associated with substantial reductions in administration and transcription errors in AHRQ‑funded research.

Bottom line: Pick eMAR for your real workflow, not a demo

Most teams discover the limits of their eMAR during a chaotic weekend or overnight med pass, not during implementation training. In 2026, the difference between a system that helps and one that hurts usually comes down to pharmacy connectivity, enforced PRN follow up, audit visibility, and dependable offline use. Enterprise platforms can bring scale and standardization, but they require careful rollout and change management. Smaller or specialized providers often benefit more from tools that fit their exact setting, whether that is I/DD, home care, adult day, or residential care. Whatever platform you choose, technology alone will not reduce risk. The real gains come when eMAR workflows are paired with clear medication policies, consistent training, and accountability on the floor. Choose the system that supports how your staff actually work, because that is where safety is won or lost.