You think you know your referral pipeline until a Friday 5 pm discharge avalanche hits and your team has 20 minutes to parse a 300‑page packet. Working across different tech companies, I have seen post‑acute teams win or lose referrals based on three nuts‑and‑bolts capabilities: HL7 ADT feeds that drive real‑time alerts, payer checks like 270/271 to avoid denied days, and FHIR R4 document ingestion that extracts risks and PDPM drivers. Hospital utilization and payer mix make this even tougher, since U.S. health spending climbed to $4.9T in 2023, according to a December 2024 government summary reported by Reuters, and Medicare Advantage now represents a rising share of inpatient days, per a recent KFF analysis.

Four consistently delivered the fastest time to decision, the cleanest payer workflows, and credible interoperability: ExaCare AI, Clinware, Aidin, and Netsmart CareFabric. I screened for active customer traction or recognized interoperability milestones, used third‑party news and reviews to validate claims, then narrowed to these four tools. In the next ten minutes you will learn where each tool fits, what it actually does, where it struggles, and how to avoid hidden costs like stalled interfaces, denied days, and training time.

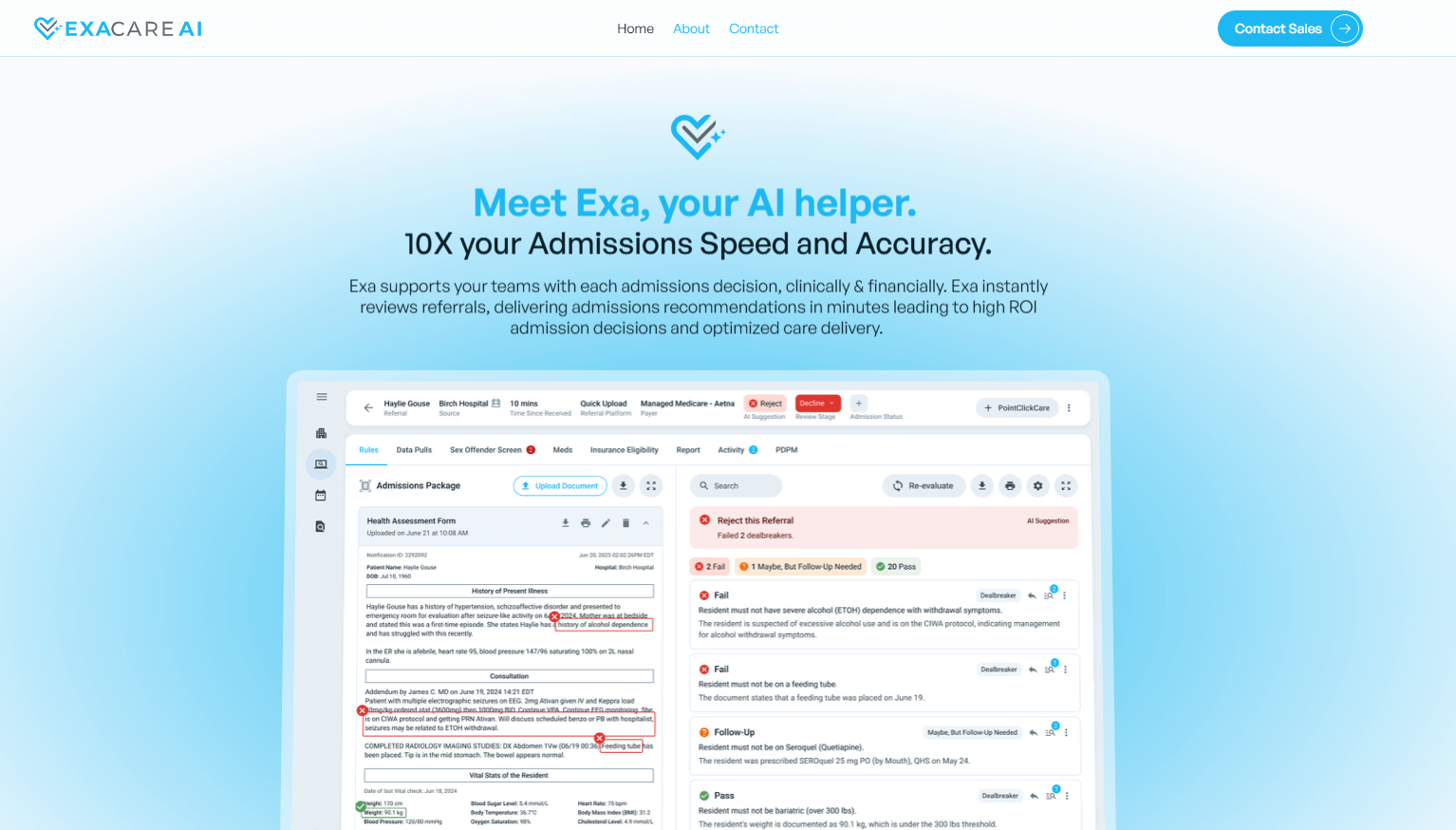

ExaCare AI

AI‑powered referral intake and admissions decisioning that reads full hospital packets, flags clinical and financial risks, and standardizes admit criteria. Recent funding signals category momentum and expanded R&D.

Best for: SNFs and post‑acute operators that want faster yes/no decisions with auditable criteria and payer‑risk visibility across a multi‑facility footprint.

Key Features:

- AI referral packet review that extracts meds, DME needs, behavioral risks, and payer details, then recommends disposition, per vendor documentation.

- Configurable admission criteria and rules with team tagging and comments, per vendor documentation.

- Upfront PDPM and reimbursement risk indicators to protect margin, per vendor documentation.

Why we like it: The product focuses on the most expensive bottleneck in post‑acute admissions, the first 10 minutes after a referral arrives, and turns packet noise into a structured, auditable call. The Series A led by Insight Partners in October 2025 suggests both runway and customer scale that matter in healthcare IT, as covered by PR Newswire and the funder's brief on the round from Insight Partners.

Notable Limitations:

- Limited independent, third‑party end‑user reviews as of November 2025, so buyers should request reference calls and proof‑of‑value pilots.

- Early claims about "AI agents" are primarily described in funding news rather than peer reviews.

- Pricing transparency is minimal in public sources.

Pricing: Pricing not publicly available. Contact ExaCare AI for a custom quote.

Clinware

New AI platform aimed at automating post‑acute referrals, admissions workflows, and reimbursement optimization for SNFs and related settings. Public launch and seed funding were announced in October 2025.

Best for: Operators piloting modern admissions and reimbursement automation who are open to a newer vendor and want close product collaboration.

Key Features:

- AI‑powered referral processing and prioritization with predictive insights, per launch materials.

- Documentation automation with compliance checks, plus coding and claim optimization, per launch materials.

- Real‑time analytics and secure API integrations to existing systems, per launch materials.

Why we like it: The product narrative aligns with current operational pain, namely fragmented intake and manual packet review. The October 2025 launch and $4.25M raise indicate active investment, which is covered in Newswire's release and trade pickup by Skilled Nursing News.

Notable Limitations:

- Very limited third‑party user reviews as of November 2025, so buyer diligence should include workflow demos and data validation, per the October 2025 launch coverage.

- New product maturity risks, including evolving roadmaps and integrations, are typical for recent launches.

- Pricing and reference lists are not widely published.

Pricing: Pricing not publicly available. Contact Clinware for a custom quote.

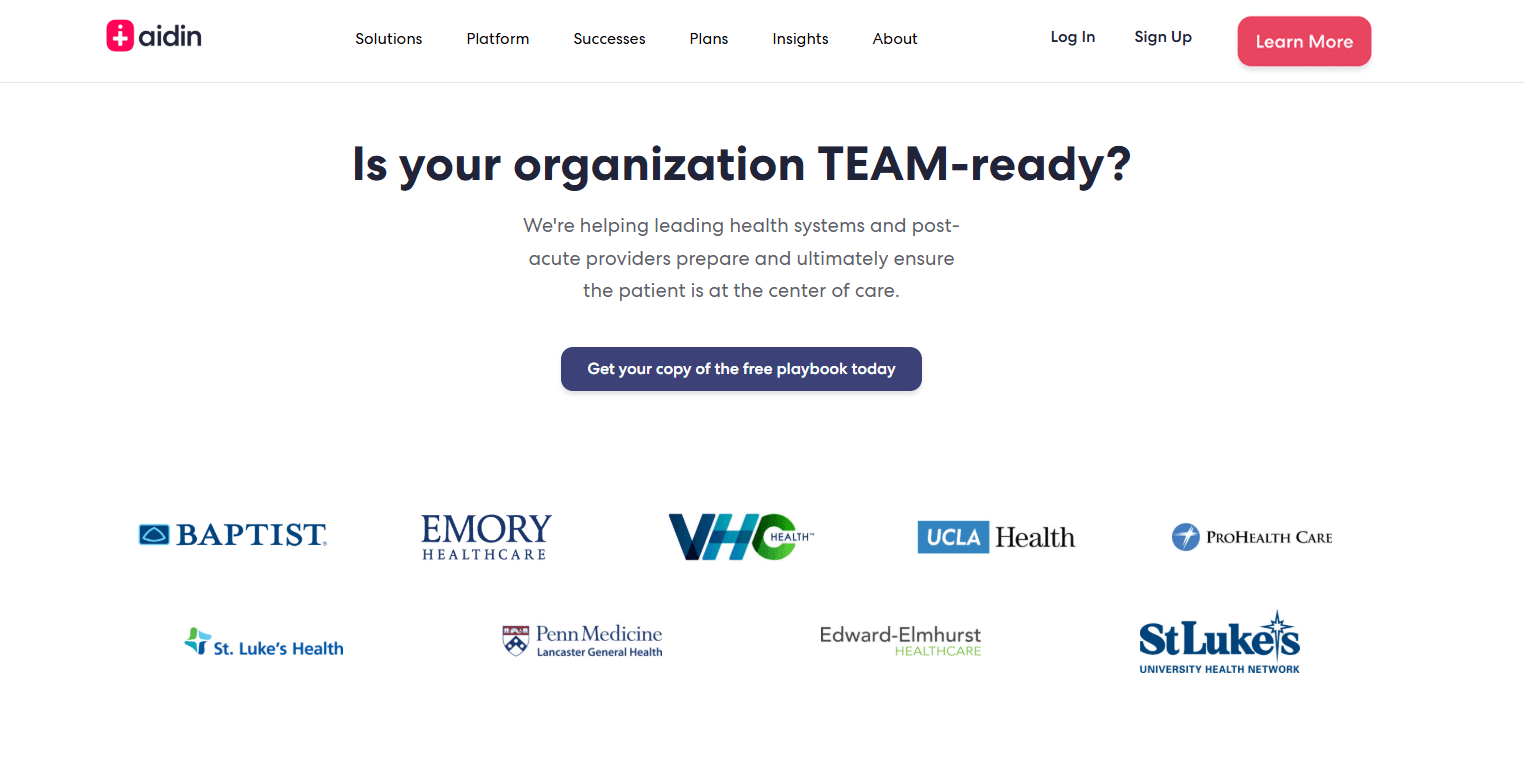

Aidin

Referral management and care transitions platform that standardizes discharge workflows, supports patient choice with performance data, and coordinates with post‑acute partners. Multiple health systems cite LOS improvements in public case studies.

Best for: Health systems and IDNs needing standardized discharge planning, authorization tracking, and a broader, quality‑aware network of PAC partners.

Key Features:

- Digital marketplace and patient choice workflows with provider performance signals, per customer case studies and vendor materials.

- Referral, authorization, and care transition tracking across inpatient and outpatient teams, per customer stories.

- Documented rollouts at major systems, with LOS improvements reported by St. Luke's and Ohio State in trade coverage.

Why we like it: Aidin has repeatable outcomes reported by provider organizations. For example, St. Luke's cited a 0.3‑day average LOS reduction and $7.9M in savings after adopting Aidin, per a 2024 case write‑up covered by PRWeb. Earlier coverage noted LOS reductions and financial impact at Ohio State Wexner Medical Center, reported by Skilled Nursing News. Emory Healthcare's 2025 collaboration suggests continued enterprise adoption, per PRWeb and trade recap at HLTH Community.

Notable Limitations:

- Limited third‑party review aggregator coverage, so buyers should weigh trade press and system case studies over crowd reviews.

- Enterprise rollouts imply non‑trivial change management and partner onboarding time; this is an inference from systemwide deployments like Emory's, which require standardization across 10 hospitals.

- Pricing transparency is minimal in public sources.

Pricing: Pricing not publicly available. Contact Aidin for a custom quote.

Netsmart CareFabric

Enterprise post‑acute EHR platform that connects home health, hospice, senior living, and SNF workflows, with reinforced interoperability through TEFCA QHIN designation in 2025.

Best for: Multi‑service post‑acute organizations that want a single clinical, interoperability, and RCM backbone with national network exchange.

Key Features:

- Post‑acute EHR modules across home health, hospice, senior living, and SNF, per industry materials.

- TEFCA connectivity as a designated QHIN, validated by the Recognized Coordinating Entity.

- Interoperability initiatives showcased at HIMSS and other venues, plus revenue cycle enhancements, per industry news.

Why we like it: The QHIN designation gives CareFabric native access to TEFCA exchange, which matters for closed‑loop referrals and cross‑network histories. Netsmart's status as a designated QHIN was announced by the RCE, The Sequoia Project, in August 2025, as documented by The Sequoia Project's press release. That positioning is useful for PAC teams that struggle to chase documents across systems.

Notable Limitations:

- User reviews cite reporting gaps and training burden for myUnity, per recent feedback on G2.

- Implementation and interface timelines can be lengthy in enterprise EHRs, echoed in user comments compiled by G2.

- Pricing is enterprise‑grade and not published.

Pricing: Pricing not publicly available. Contact Netsmart for a custom quote.

Post Acute Care Tools Comparison: Quick Overview

| Tool | Best For | Pricing Model | Highlights |

|---|---|---|---|

| ExaCare AI | SNF admissions teams needing rapid, auditable decisions | Custom quote | AI packet review, PDPM risk flags, configurable admit rules |

| Clinware | Early adopters piloting AI admissions and reimbursement | Custom quote | New 2025 launch with predictive intake and coding optimization |

| Aidin | Health systems standardizing discharge and PAC referrals | Custom quote | Documented LOS gains in trade press and case studies |

| Netsmart CareFabric | Multi‑service PAC operators seeking unified EHR + TEFCA | Custom quote | QHIN designation for national exchange, enterprise modules |

Post Acute Care Platform Comparison: Key Features at a Glance

| Tool | Feature 1 | Feature 2 | Feature 3 |

|---|---|---|---|

| ExaCare AI | AI referral extraction | Admit criteria rules engine | PDPM, payer risk signals |

| Clinware | AI referral prioritization | Documentation automation | Coding and claim optimization |

| Aidin | Patient choice workflows | Referral and auth tracking | Network performance signals |

| Netsmart CareFabric | Post‑acute EHR suite | TEFCA QHIN connectivity | Interop and RCM add‑ons |

Post Acute Care Deployment Options

| Tool | Cloud API | On‑Premise | Air‑Gapped | Integration Complexity |

|---|---|---|---|---|

| ExaCare AI | Vendor states API integrations | Not publicly documented | Not publicly documented | Varies by EHR and HIE interface scope |

| Clinware | Vendor states secure APIs | Not publicly documented | Not publicly documented | Varies by EHR, request demo for interfaces |

| Aidin | Vendor states EHR integrations | Not publicly documented | Not publicly documented | Enterprise rollout typically involves IT and case management |

| Netsmart CareFabric | Enterprise interoperability stack | Available in enterprise deployments | Not typical | Enterprise EHR project, multi‑phase interfaces |

Post Acute Care Strategic Decision Framework

| Critical Question | Why It Matters | What to Evaluate | Red Flags |

|---|---|---|---|

| Can the tool shorten LOS without adding payer denials? | Delays raise costs and tie up beds as health spending climbs. | Time to decision, auth turnaround, denial rates by payer. | No evidence of LOS impact, no payer workflows. |

| How well does it handle Medicare Advantage prior auth? | MA drives a growing share of inpatient days and millions of prior authorization decisions. | 270/271 checks, payer rules, auth status tracking, appeal support. | Manual payer checks, no audit trail. |

| Does interoperability extend beyond point‑to‑point interfaces? | TEFCA connectivity improves cross‑network data exchange. | QHIN participation, FHIR support, CCD ingestion, document reconciliation. | Proprietary-only exchange, slow interface timelines. |

| Is there third‑party proof of outcomes? | Independent validation reduces piloting risk. | Trade coverage, case studies, review sites. | Only vendor claims, no external references. |

Post Acute Care Solutions Comparison: Pricing & Capabilities Overview

| Organization Size | Recommended Setup | Monthly Cost | Annual Investment |

|---|---|---|---|

| Single‑facility SNF | Admissions AI + referral tracking pilot (ExaCare AI or Clinware) | Not publicly disclosed | Not publicly disclosed |

| Regional operator (10–40 sites) | Admissions AI, payer workflows, network referrals (ExaCare AI or Aidin) | Not publicly disclosed | Not publicly disclosed |

| Health system with PAC network | Enterprise discharge, auth, interop with QHIN connectivity (Aidin + Netsmart) | Not publicly disclosed | Not publicly disclosed |

Problems & Solutions

-

Problem: Medicare Advantage prior authorization volume delays safe discharges, with nearly 50 million determinations in 2023 and 3.2 million denials, per KFF.

How tools help:- ExaCare AI and Clinware focus on structured packet extraction and payer risk cues so admission teams can submit cleaner, faster auths with evidence, which reduces ping‑pong.

- Aidin standardizes authorization workflows across teams, which supports earlier auth submission and fewer handoff errors, as seen in multi‑hospital rollouts like Emory's collaboration covered by PRWeb.

- Netsmart's TEFCA connectivity offers broader clinical histories at the point of decision, improving documentation completeness for auth requests.

-

Problem: Extended hospital LOS drives cost and capacity strain as national health spending rises.

How tools help:- Aidin has public case outcomes showing LOS reduction at St. Luke's and earlier improvements at Ohio State Wexner.

- ExaCare AI and Clinware aim to convert referrals to decisions in minutes, cutting avoidable hours in the discharge queue.

- Netsmart, with QHIN status, can support closed‑loop referral and document exchange that reduces back‑and‑forth delays.

-

Problem: Documentation and coding errors create overpayments or denials in post‑acute settings, exposing operators to audits and clawbacks, as highlighted by an OIG report on physician place‑of‑service miscoding in SNF contexts (HHS OIG).

How tools help:- ExaCare AI and Clinware emphasize upfront identification of reimbursement risks and documentation gaps so teams fix errors before claims.

- Netsmart's enterprise RCM stack and interoperability help reconcile encounters and coding across care settings, which reduces mismatches that surface in audits.

- Aidin's standardized workflows decrease manual re‑keying during transitions, lowering risk of missing documents that commonly drive denials and resubmissions.

The Bottom Line

By 2026, referral pressure is no longer episodic. It is continuous. The teams that win are not reacting faster. They are operating with real-time intake, payer-aware decisioning, and interoperable data flows that remove manual triage entirely. Fast, auditable admissions are now table stakes as Medicare Advantage penetration, prior authorization volume, and utilization scrutiny continue to rise.

If your goal is near-term LOS reduction with hospital partners, Aidin remains the strongest option, supported by repeatable outcomes at large health systems. If your primary bottleneck is referral packet triage, margin protection, and admission speed, ExaCare AI or Clinware can materially compress time to decision. If you need a unified clinical backbone with national exchange and long-term interoperability, Netsmart’s QHIN designation positions it well for 2026 workflows.

The lesson is consistent across operators. Do not buy features. Buy time. Pilot with live referrals, track decision latency, denial rates, and LOS impact by payer, and walk away from any deployment that does not produce measurable improvement within one quarter.