The American startup ecosystem is without a doubt the best in the world, with a range of hubs like Silicon Valley, New York, Dallas, and more smashing the world averages for total investment and ecosystem worth. The main factor behind this is not only the talent and entrepreneurial spirit in America, but it is also the strength of the Venture Capital (VC) funds that operate in the USA, helping startups to reach the next level there are a number of world-leading top VCs in the USA.

1. Greycroft

Year Founded: 2006

HQ: New York, USA

Size: 51-100

Founders: Alan Patricof, Dana Settle, Ian Sigalow

Greycroft is an American VC firm that was founded in 2006 and is currently based in New York, USA. The company specializes in providing investments into technology startups, with the main bulk of these startups being in the internet and mobile markets. Their investment portfolio is vast and they are behind a number of widely successful startups.

In total Greycroft has run twelve funds and made 657 investments since being founded in 2006. From these investments, the company has successfully exited from a total of 100 businesses. This highlights why they are one of the top VCs in the USA.

2. Andreessen Horowitz

Year Founded: 2009

HQ: Menlo Park, USA

Size: 101-250

Founders: Ben Horowitz, Marc Andreessen

Andreessen Horowitz is an American VC firm that was founded in 2009 and is currently based in Menlo Park, California. The fund specializes in investing in a wide variety of startups across all stages of their fundraising journey. The preferred investments for this company are in the social media and technology markets, with a wide variety of these businesses in their portfolio.

The team at Andreessen Horowitz has a total of 19 funds and has made a total of 1,018 investments since it was founded in 2009. From these investments, the USA VC firm has successfully exited from 169 of these investments.

3. Index Ventures

Year Founded: 1996

HQ: San Francisco, USA

Size: 101-250

Founders: David Rimer, Giuseppe Zocco, Neil Rimer

Index Ventures is one of the inclusions on this list that has been around for a while, with the USA VC firm being founded in 1996 and having a headquarters in San Francisco, California. They predominantly focus on technology companies and have worked with well-known brands like Dropbox, Slack, Deliveroo and more.

This Venture Capital firm has made a total of 953 investments in its lifetime, with many of these being resounding successes. These investments have been spread across 19 funds and from these investments, Index has managed to exit from 210 of these.

4. Lightspeed Venture Partners

Year Founded: 2000

HQ: Menlo Park, USA

Size: 101-250

Founders: Barry Eggers, Christopher Schaepe, Peter Nieh, Ravi Mhatre

Lightspeed Venture Partners is a USA VC firm that was founded at the turn of the new millennium and is currently based in Menlo Park, USA. The investment firm specializes in a number of markets, including consumer, enterprise, technology and cleantech. This variety of specialization has led to the firm getting a large number of high-profile companies under its umbrella.

Lightspeed Venture Partners has managed a total of 22 investment funds and from these funds, the USA VC firm has made a total of 981 investments. From these investments, Lightspeed has successfully managed to exit from 189 of these companies.

5. Accel

Year Founded: 1983

HQ: Palo Alto, USA

Size: 251-500

Founders: Arthur Patterson, Jim Swartz, Prashanth Prakash

Accel is one of the oldest USA VCs on this list, with the company being founded in 1983 and currently operating out of a headquarters in Palo Alto, California. They specialize in early and growth stage startups that need more funding to get their business to the next level. They have backed global companies like Atlassian, Dropbox, Etsy, Facebook and more.

Accel has managed a large amount of funds since opening its doors in 1983, with 33 funds being managed. Naturally this has led the VC firm to make a large number of investments, with a total of 1640 investments being made by Accel. From these investments, the company has managed to successfully exit from 328 of them.

6. Founders Fund

Year Founded: 2005

HQ: San Francisco, USA

Size: 11-50

Founders: Ken Howery, Luke Nosek

Founders Fund is an American Venture Capital firm that was established in 2005 and is currently based in San Francisco, California. The company aims to invest in businesses that are building cutting-edge technology to help improve people’s lives. Some examples of the companies they have worked with include PayPal, Facebook, SpaceX and more.

Founders Fund has managed a total of 10 funds since it was founded in 2005, which has allowed the company to make a total of 675 investments. From these investments, the company has successfully exited from 118 of these investments.

7. Khosla Ventures

Year Founded: 2004

HQ: Menlo Park, USA

Size: 51-100

Founders: Vinod Khosla

Khosla Ventures is an American VC firm that was founded in 2004 and is currently based in Menlo Park, California. The company primarily focuses on investment into environmentally friendly technology companies that are trying to make a difference. They also invest in companies that operate in the computing, mobile and internet industries.

Khosla Ventures has managed a total of 10 funds since being founded in 2004 and this has led to the VC firm making a total of 931 investments into up-and-coming businesses. From these investments, the company has managed to successfully exit from 124 of these companies.

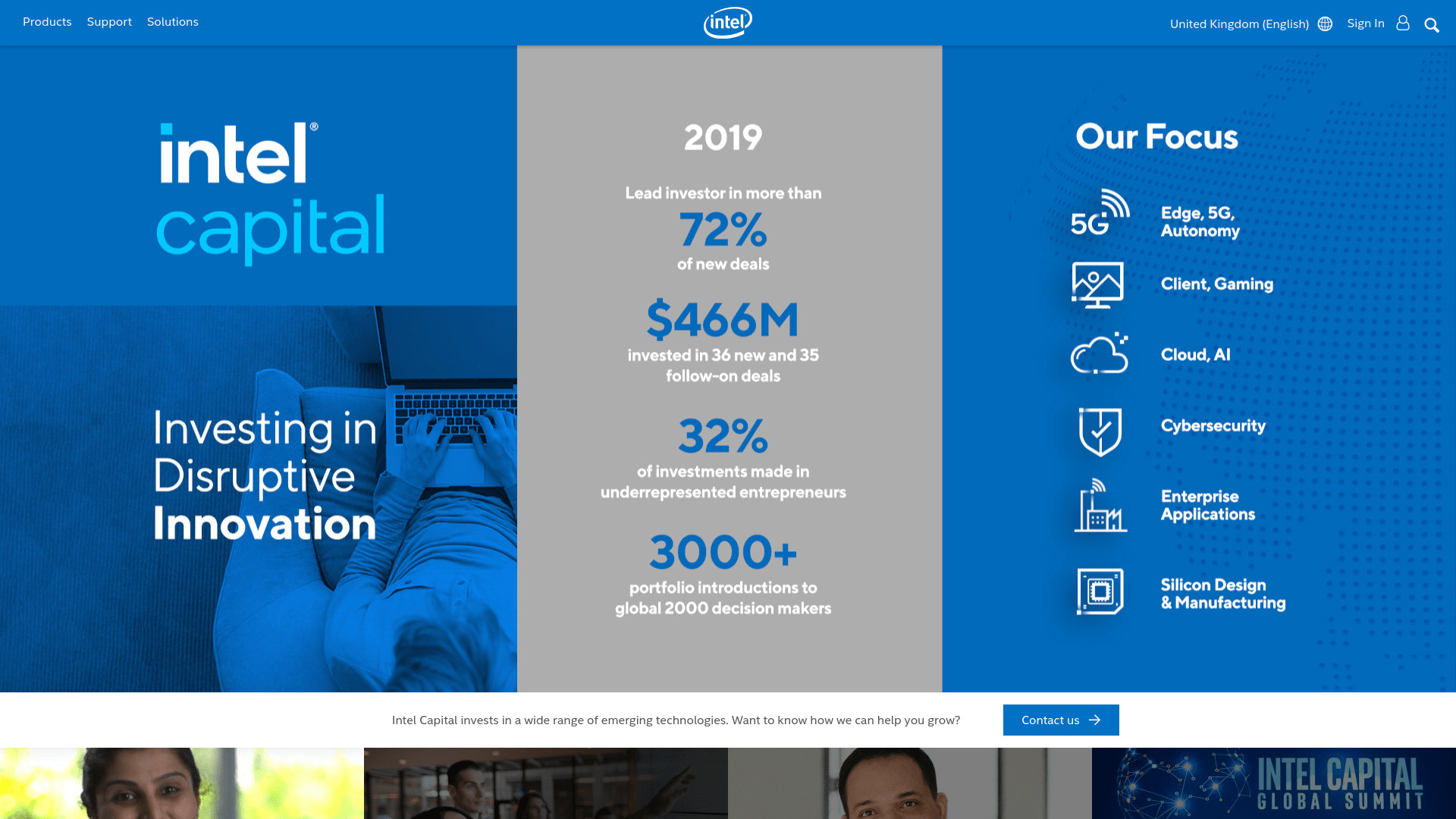

8. Intel Capital

Year Founded: 1991

HQ: Santa Clara, USA

Size: 51-100

Founders: Anthony Lin

Intel Capital is the investment arm of the well-known Intel Corporation and was founded in 1991, with a headquarters in Santa Clara, California. Intel Capital mainly focuses on investment into businesses that operate in the cloud, AI, network infrastructure and cyber security sectors among others.

Since being founded in 1991, the VC firm has managed to make a total of 1469 investments into growing businesses. Also in that time, the company has managed to exit on a total of 444 of these investments.

9. Kleiner Perkins

Year Founded: 1972

HQ: Menlo Park, USA

Size: 101-250

Founders: Brook Byers, Eugene Kleiner, Frank Caufield, Tom Perkins

Kleiner Perkins is a USA VC firm that was founded in 1972 and is currently based in Menlo Park, California. They mainly invest in businesses that are in the early, incubation or growth stages. The industries that they primarily target are the digital, healthcare and life sciences industries, helping people to become healthier.

The company has managed a total of 19 funds since it was founded in 1972 and in that time, Kleiner Perkins has made a total of 1281 investments. From these investments, the VC firm has successfully managed to exit on a total of 297 of these investments.

10. Benchmark

Year Founded: 1995

HQ: San Francisco, California

Size: 11-50

Founders: Bob Kagle, Kevin Harvey

Benchmark is an American Venture Capital Firm that was founded in 1995 and is currently based in San Francisco, California. They primarily focus on early-stage businesses that operate in the mobile, marketplace, social, infrastructure and enterprise software arenas. They help new businesses to get funding to back their ideas.

Since being founded, Benchmark has managed a total of 6 investment funds. From these funds, the company has managed to make 625 investments into growing businesses. From these investments, the company has managed to make successful exits on 168 of these investments.

11. First Round Capital

Year Founded: 2004

HQ: San Francisco, USA

Size: 251-500

Founders: Howard Morgan, Josh Kopelman

First Round Capital is a USA VC firm that was founded in 2004 and currently has its headquarters in San Francisco, California. This Venture Capital firm mainly focuses on providing seed investment to companies in the earliest stages of their journey. They have previously invested in companies like Uber, Square and Warby Parker.

Since being founded in 2004, First Round has managed a total of 7 investment funds. From these funds, the company has made a total of 803 investments into growing businesses. From these investments, the company has successfully exited from a total of 178.

12. GGV Capital

Year Founded: 2000

HQ: Menlo Park, USA

Size: 51-100

Founders: Hany Nada, Jenny Lee, Joel Kellman, Scott Bonham, Thomas Ng

GGV Capital is a USA VC firm that was founded in 2000 and is currently based in Menlo Park, USA. The company provides funding across all startup stages and predominantly focuses on consumer, digital, enterprise tech and a variety of other different markets. They have more than $6.2 Billion in assets under their management.

Since being founded in 2000, GGV Capital has made a total of 736 investments into companies to help them grow. From these investments, the VC firm has successfully exited from a total of 113 of these.

13. Redpoint

Year Founded: 1999

HQ: Menlo Park, USA

Size: 11-50

Founders: Brad Jones, Geoff Yang, John Walecka, Timothy Haley, Tom Dyal

Redpoint is a Venture Capital firm in the USA that was founded in 1999 and is currently based in Menlo Park, California. They mainly focus on seed, early and growth stage startups by giving them the funding they need to reach the next level. The company currently manages more than $4 Billion in assets.

Redpoint has managed a total of 13 funds since it was founded in 1999 and from these funds, it has managed to make 660 investments into growing businesses. From these investments, the company has managed to successfully exit from a total of 150 of these investments.

14. DCM Ventures

Year Founded: 1996

HQ: Menlo Park, USA

Size: 11-50

Founders: David Chao, Dixon Doll

DCM Ventures is an American VC firm that was founded in 1996 and is currently based in Menlo Park, USA. The company predominantly focuses on early-stage startups that operate in the mobile, internet, consumer, communications and professional service sectors.

The company has managed a total of 13 funds since it was founded in 1996 and from those funds it has managed to make a total of 591 investments into growing startups. From these funding ventures, DCM Ventures has managed to successfully exit from a total of 122 investments.

15. Spark Capital

Year Founded: 2005

HQ: San Francisco, USA

Size: 11-50

Founders: Bijan Sabet, Paul Conway, Santo Politi, Todd Dagres

Spark Capital is a USA VC firm that was founded in 2005 and is currently based in San Francisco, California. Their preferred businesses to invest into are consumer, commerce, Fintech, software, media and others.

Spark Capital has managed a total of 10 funds since being founded in 2005 and from these funds it has made 448 investments into startups and growing businesses. From these investments, Spark Capital has managed to successfully exit from 79 of these.

16. Union Square Ventures

Year Founded: 2003

HQ: New York, USA

Size: 11-50

Founders: Brad Burnham, Fred Wilson

Union Square Ventures is an American Venture Capital firm that was founded in 2003 and is currently based in New York, USA. The company focuses on startups across a variety of different funding stages and exclusively invests in businesses that operate in the internet market and the mobile sector.

Since it was founded in 2003, Union Square Ventures has managed a total of 11 investment funds and has made a total of 345 investments from these investment funds. From these investments, USV has successfully exited from a total of 50 of them.

17. QED Investors

Year Founded: 2005

HQ: Alexandria, USA

Size: 11-50

Founders: Caribou Honig, Frank Rotman, Nigel Morris

QED Investors is an American Venture Capital firm that was founded in 2005 and is currently based in Alexandria, Virginia. The company primarily invests in companies and startups that are undergoing high and rapid growth in the Fintech sector.

The team at QED Investors have managed a total of 4 funds since being founded in 2005 and from these investment funds they have made a total of 195 investments. From these investments, the company has successfully managed to exit from a total of 29.

18. Boldstart Ventures

Year Founded: 2010

HQ: New York, USA

Size: 1-10

Founders: Ed Sim

Boldstart Ventures is one of the newest inclusions on this list, since it was founded in 2010. The American VC firm currently has its headquarters in New York. They help SaaS developers by working with founders before their products have even been made and lead pre-product rounds to further assist the companies in turning their software ideas into great startups.

Since the company was founded in 2010, it has managed ten investment funds. From these investment funds, the company has made 135 investments into tech startups. Boldstart Ventures has successfully managed to exit from a total of 19 of these investments so far.

19. 500 Startups

Year Founded: 2010

HQ: San Francisco, USA

Size: 51-200

Founders: Christine Tsai, Dave McClure

500 Startups is a USA VC firm that was founded in 2010 and is currently based in San Francisco, California. They focus on providing pre-seed funding and mentoring for early stage startups which can help them to grow into strong and high-growth startups. They have invested in businesses like Canva and Credit Karma.

Since being founded in 2010, the company has managed a significant number of investment funds, which has seen the business make a total of 2615 investments, despite its relatively short trading time. From these investments, the team has managed to successfully exit from 291 of these investments.

20. Forum Ventures

Year Founded: 2012

HQ: New York, USA

Size: 1-10

Founders: Karen Page, Michael Cardamone, Nick Mehta, Rowan Trollope

Forum Ventures is an American VC firm that was founded in 2012 and is currently based in New York, USA. The company predominantly focuses on making investments into SaaS startups in the B2B market. The funding they provide is in the pre-seed stage and a range of mentoring opportunities helps these businesses to grow even further.

Since it was founded, Forum Ventures has managed 5 investment funds, which has led to a total of 284 investments being made. From these investments, Forum Ventures has managed to exit from 17 investments.

21. Costanoa Ventures

Year Founded: 2012

HQ: Palo Alto, USA

Size: 11-50

Founders: Greg Sands

Costanoa Ventures is an American Venture Capital firm that was founded in 2012 and is currently based in Palo Alto, California. The company mainly invests in Seed and Series A rounds and focuses on startups in the B2B market.

Costanoa Ventures has managed seven investment funds since it was founded in 2012 and from these investment funds, the company has used them to make a series of 133 investments. As it stands, the VC firm has decided to exit from a total of 20 of these investments.

FAQs

How Many Startups Are There in the USA?

The United States is a world leader in terms of startups, with the country boasting an impressive figure of more than 63,000 startups across the whole country.

Which Industries Are Strongest In The USA?

The main industries that do well in the USA are the financial and insurance sectors, real estate, healthcare, manufacturing and there are many more that are worth a lot of money to the country.

How Much VC Funding Comes Through The USA?

The total venture funding conducted in the USA has swelled this year to reach a level of $210 Billion at the conclusion of Q3 of this year. This represents a 1.5x increase from the previous year and shows the strong position of the US VC ecosystem.