For your transaction history, ZenLedger will automatically determine cost basis, fair market value, and gains or losses.

The tax-loss harvesting function in ZenLedger analyses your transaction history and generates a list of tax-saving possibilities to take advantage of before the end of the year. ZenLedger is based on a basic concept. It makes it simple to calculate your bitcoin taxes by offering a digital workflow that simplifies, optimizes, and automates the entire process.

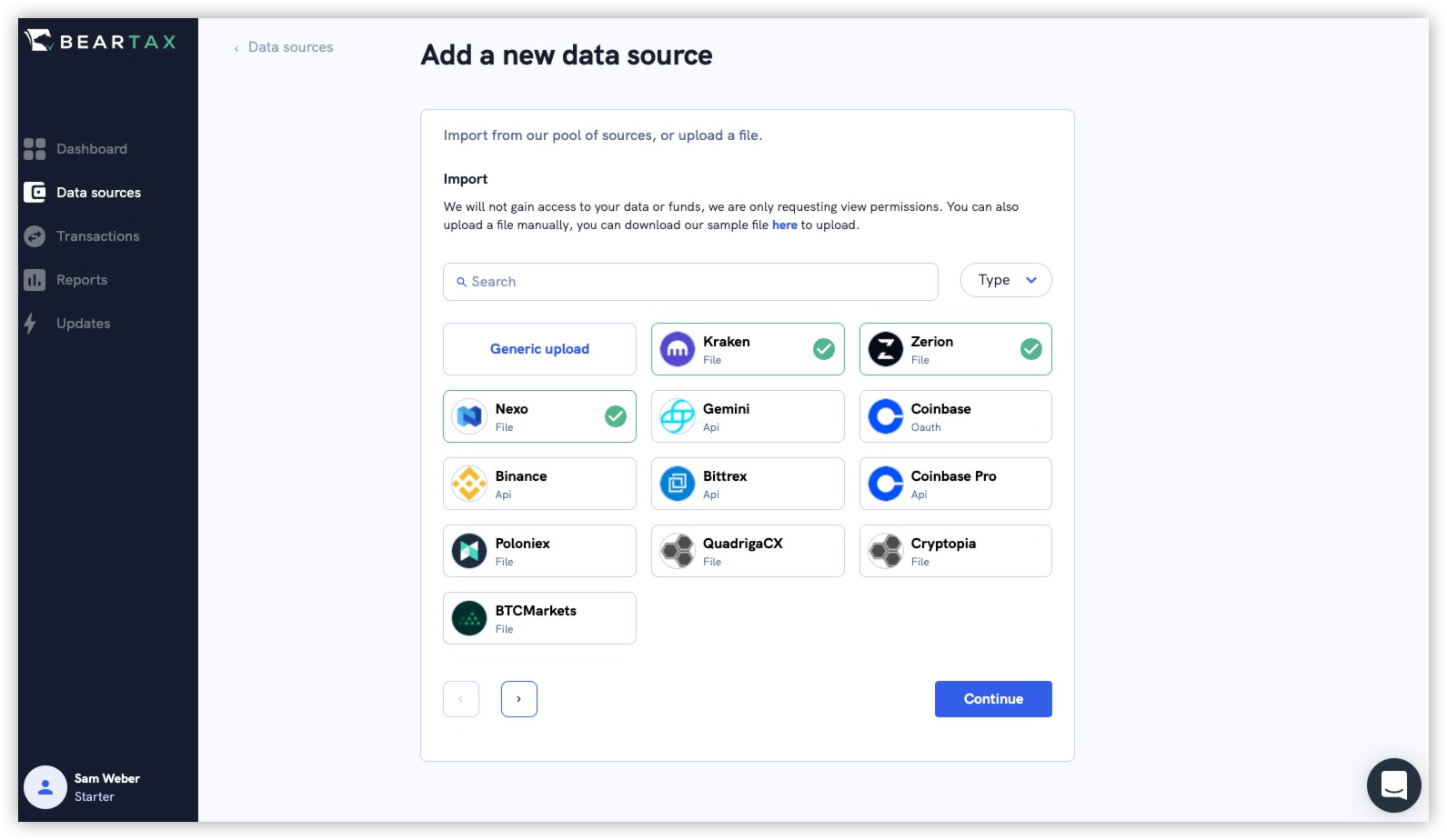

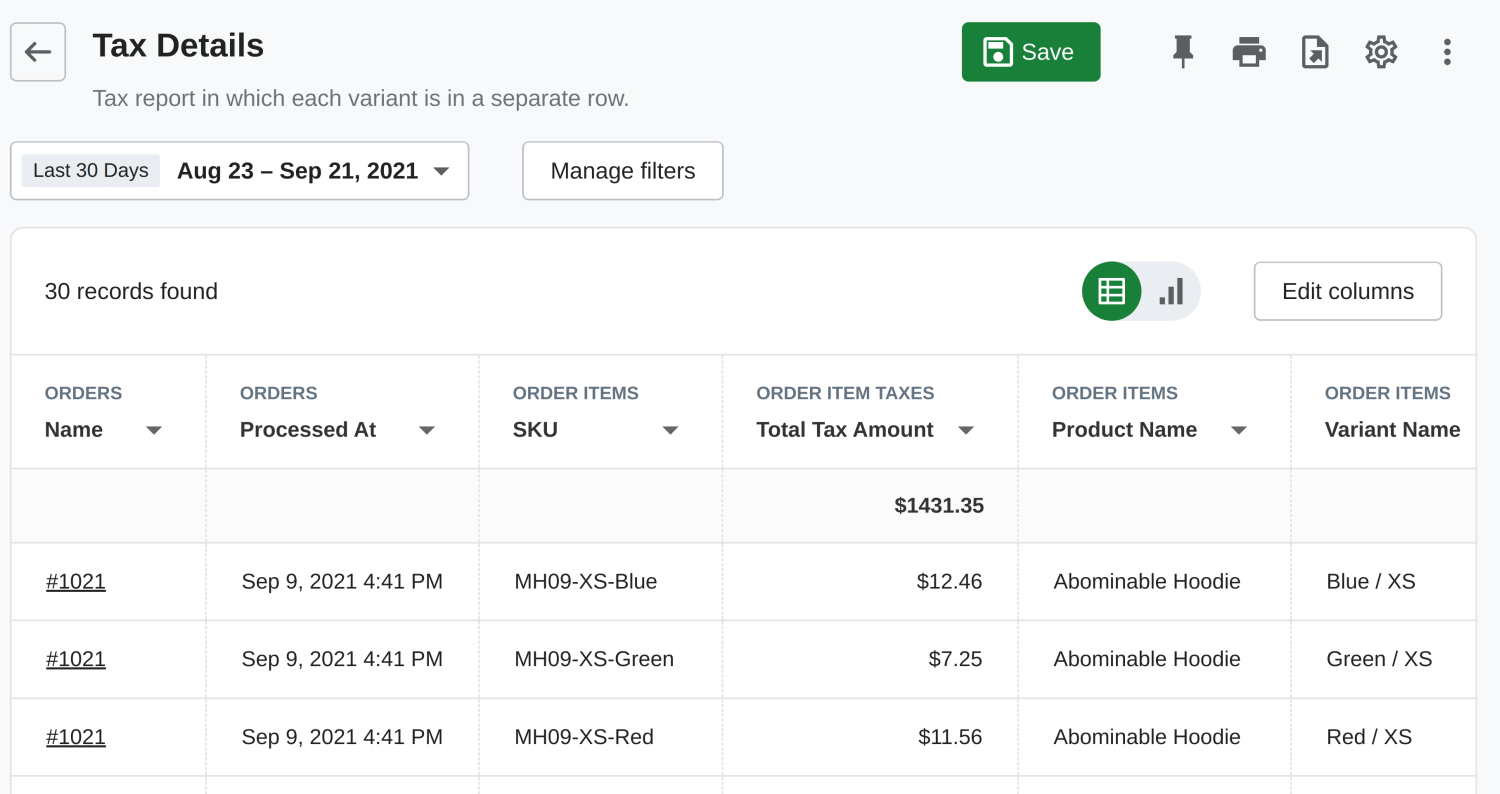

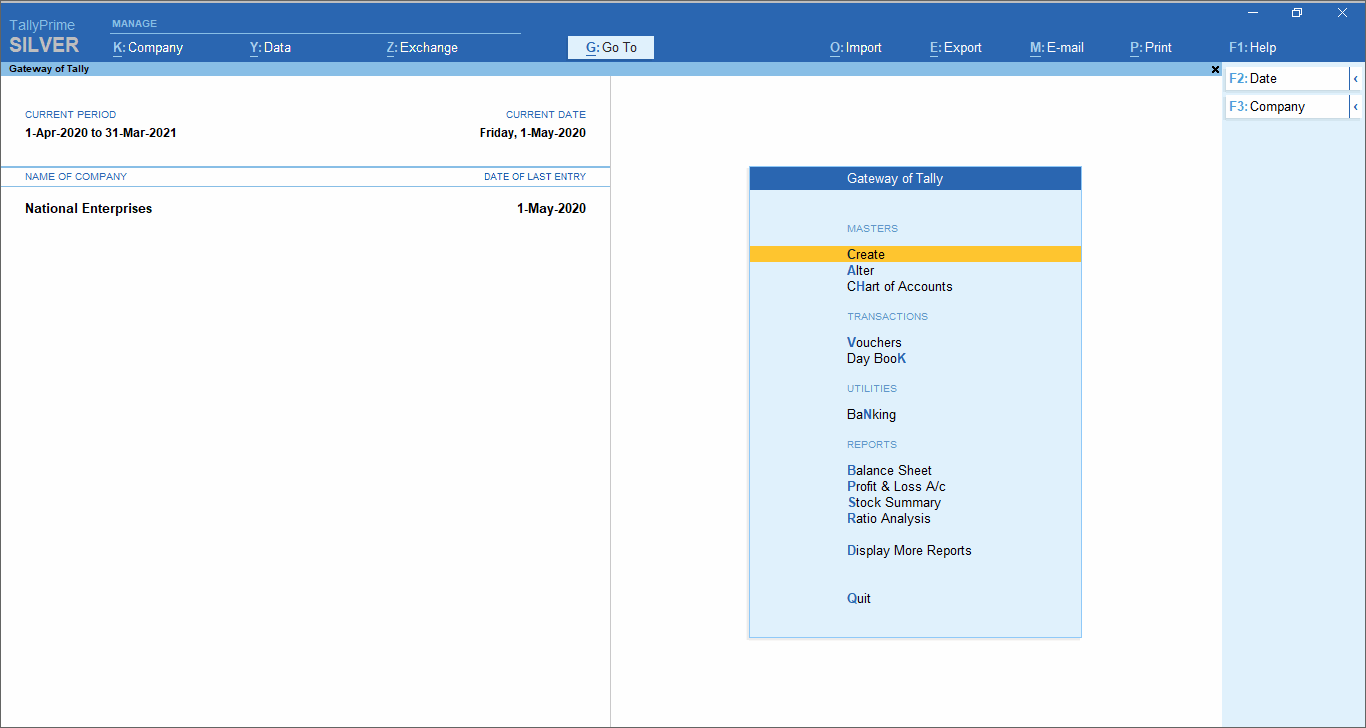

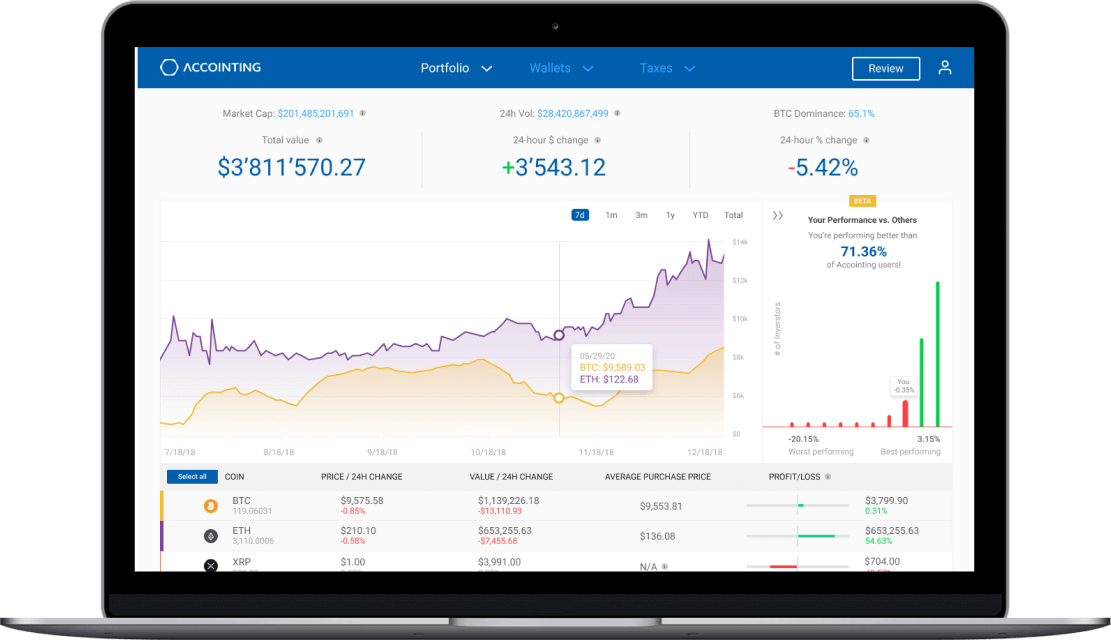

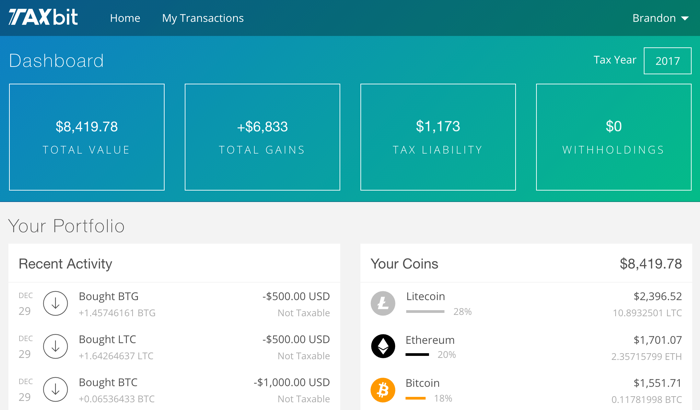

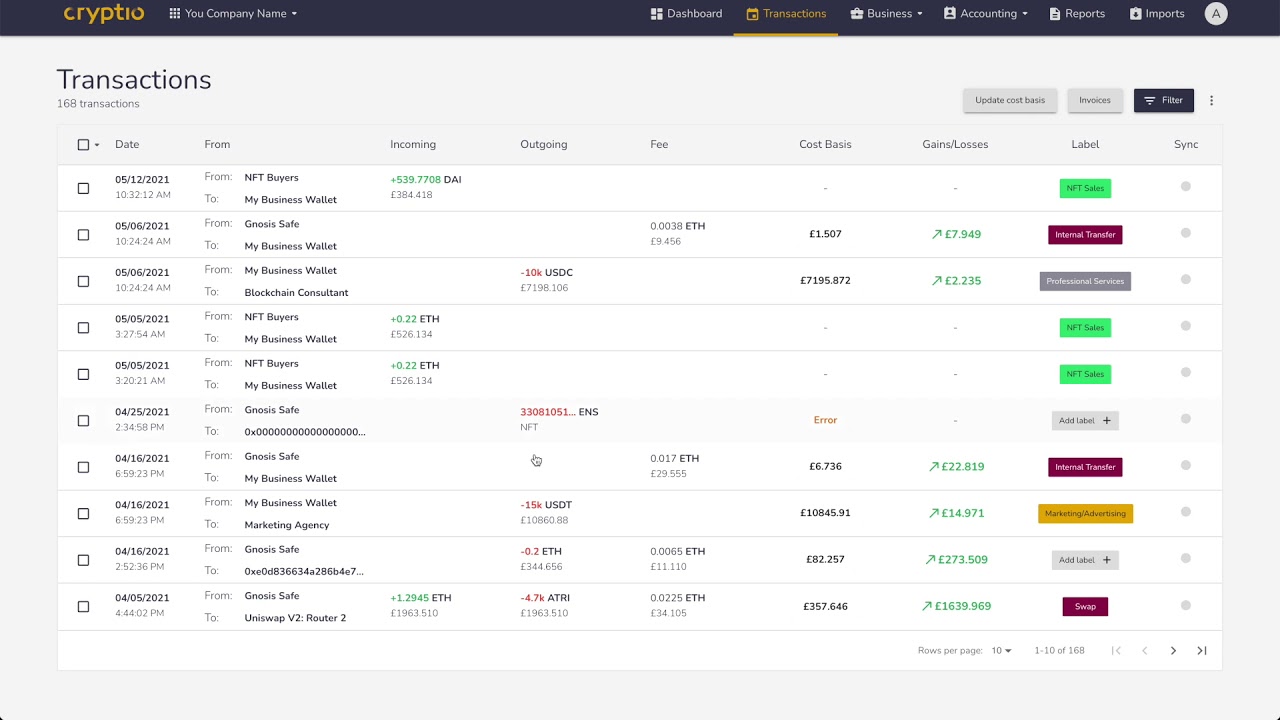

But did you know that there are some great alternatives to ZenLedger that you can consider? So, let’s take a look at some of the best ZenLedger alternatives. By the end of this article, we’re sure that you’ll have in-depth information about the various options, their features, and the pricing structure.