Republic is a private investment site for those looking for a high rate of return. Republic selects high-growth potential investment opportunities.

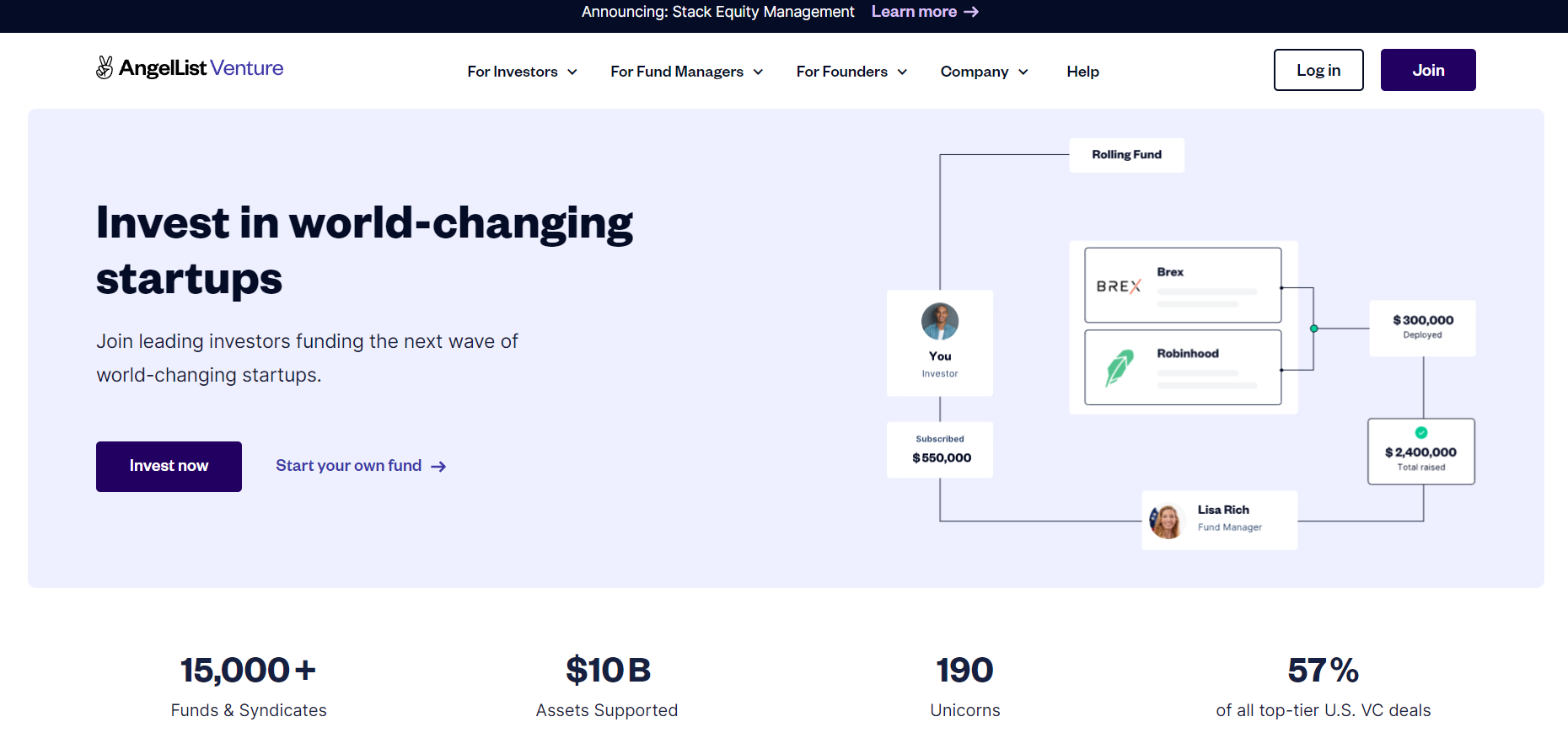

Republic acquired funding from AngelList in order to connect excellent entrepreneurs with retail investors of all income levels and offer them the opportunity to share in the potential rewards of venture investments. With modest entrance criteria of just $10, the website offers a carefully curated, sizable range of equity- and cryptocurrency-focused options.

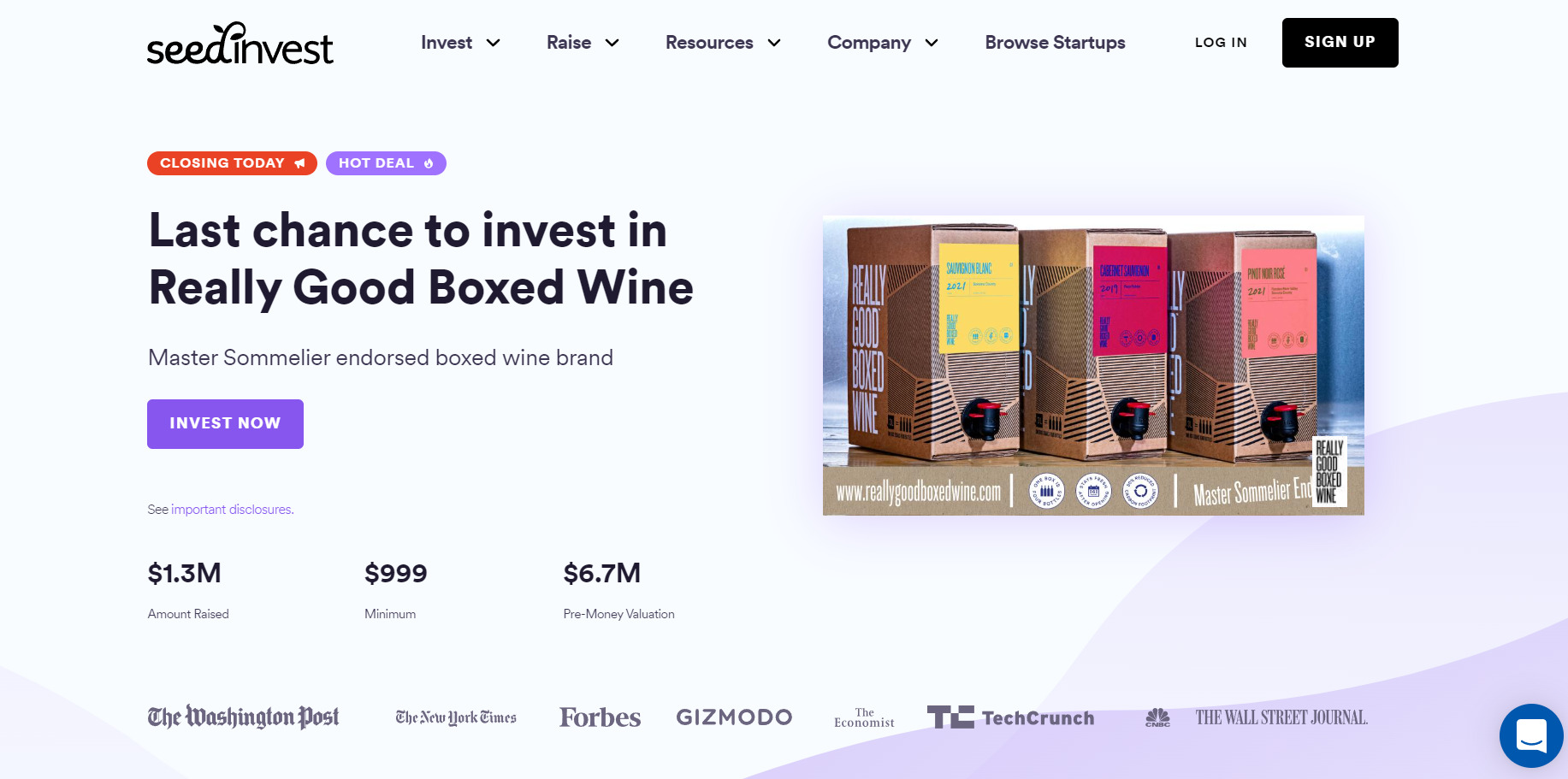

There are a bunch of decent tools out there that offer the same array of services as Republic And it can sure get confusing to choose the best from the lot. Luckily, we've got you covered with our curated lists of alternative tools to suit your unique work needs, complete with features and pricing.