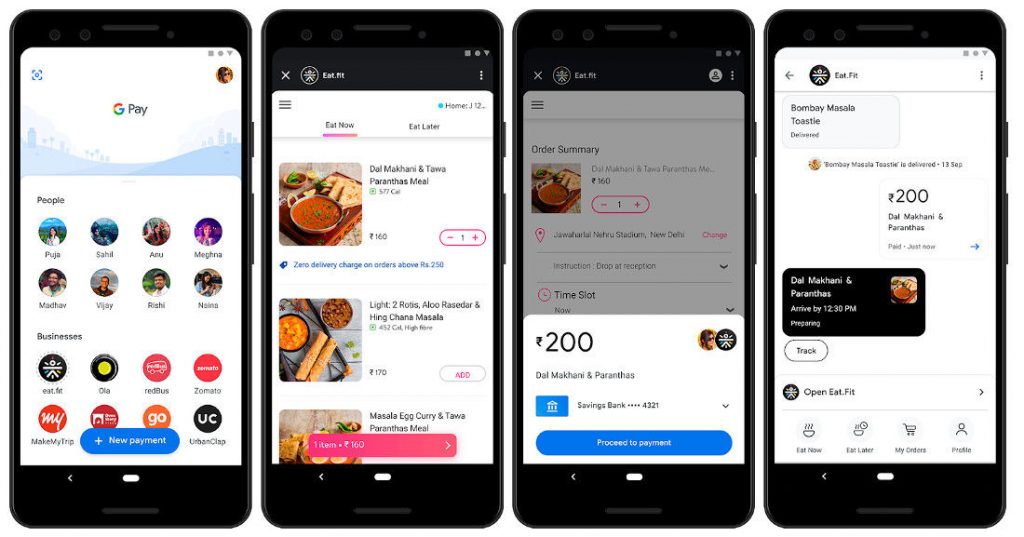

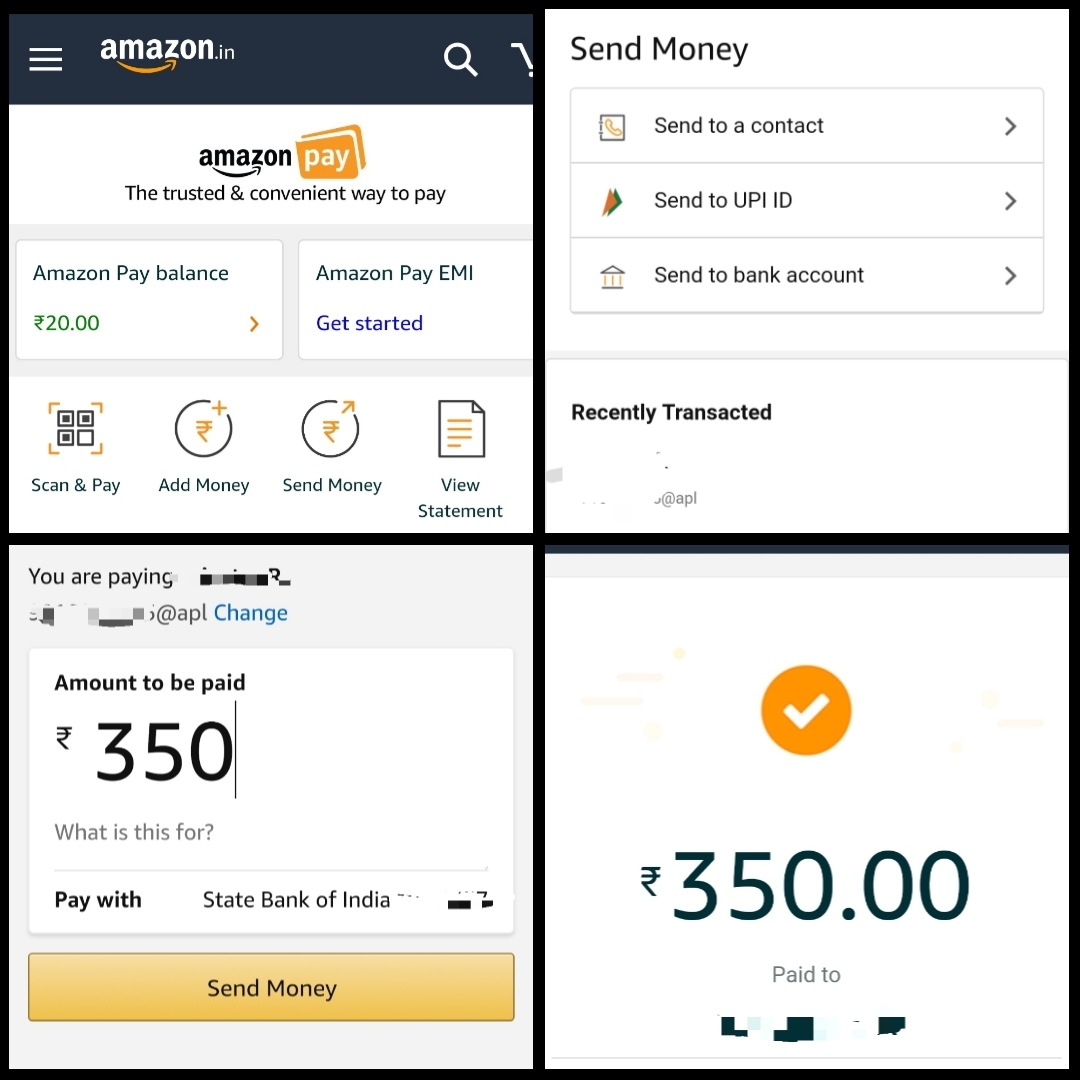

Whether you’re an entrepreneur, a freelancer, an employee, or a business owner, you will be familiar with using online payment applications. The usage of online payment applications has seen an unprecedented uptick over the past few years. The use of online payment applications has skyrocketed with the increasing reach of smartphones.

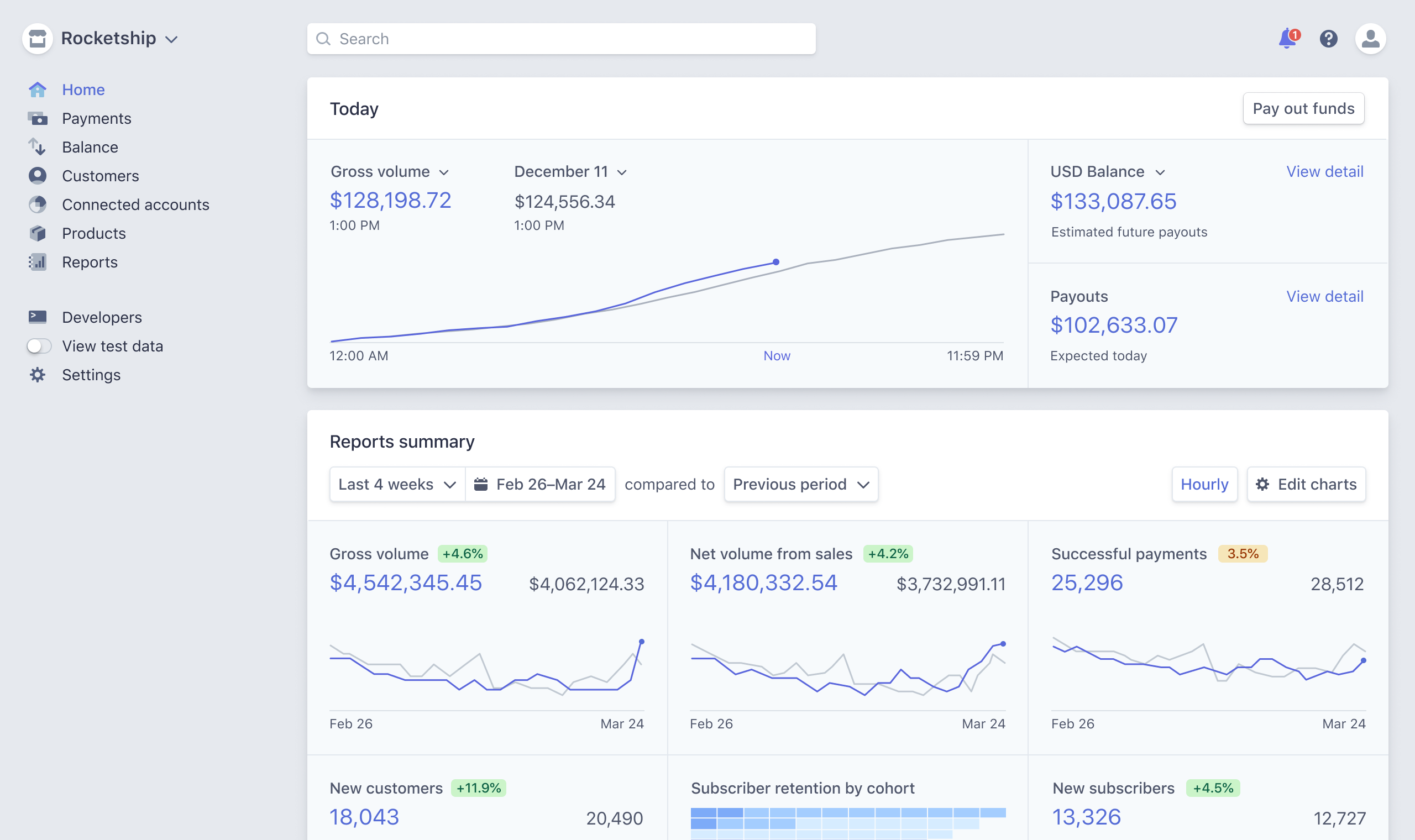

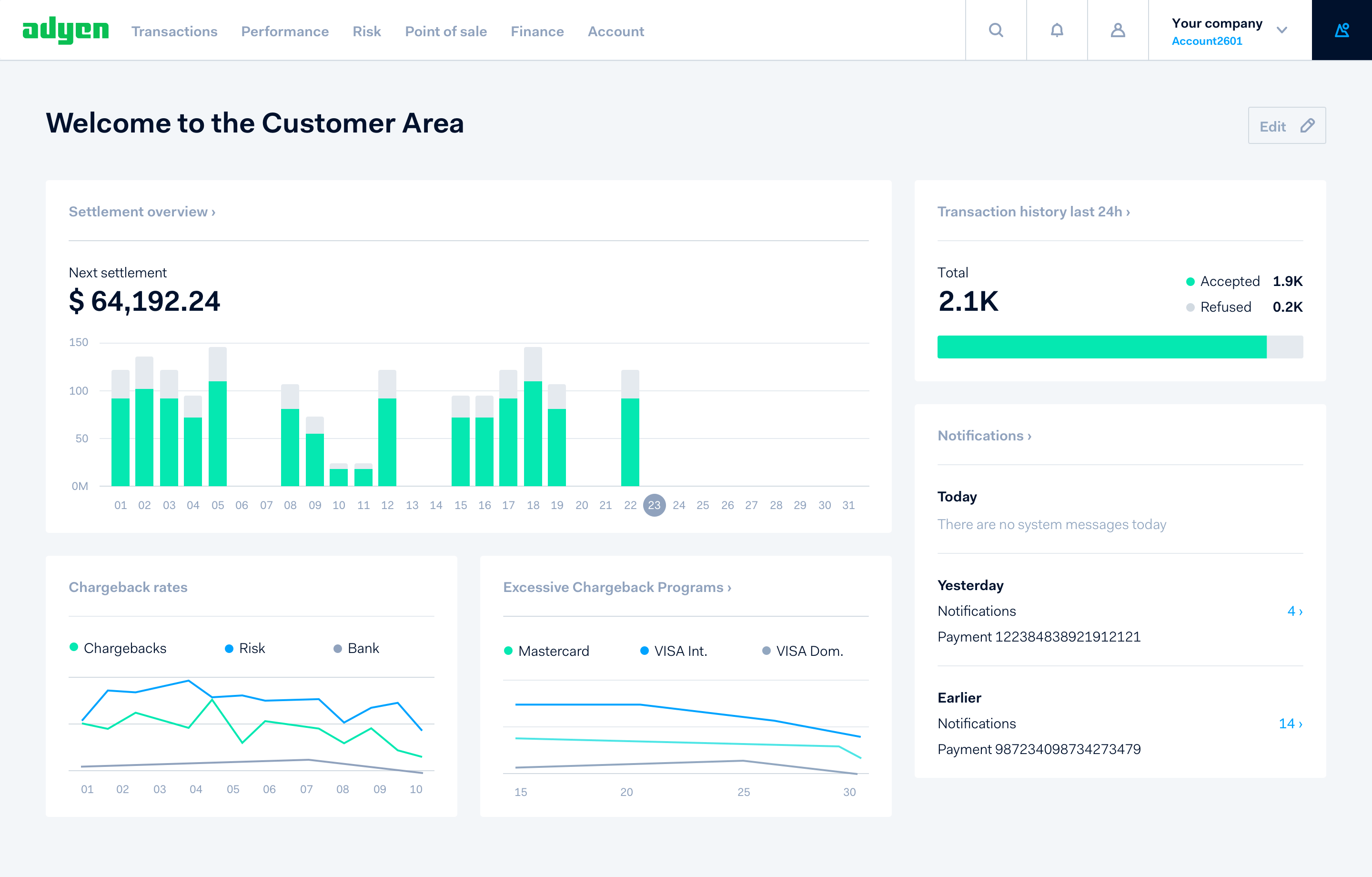

According to a report by Statista, the worldwide online payment revenue in 2015 was 450 billion U.S. dollars and is expected to surpass 1 trillion U.S. dollars in 2019.

Source: Statista

These numbers show a high likelihood that all readers of this article will use or have used an online payment application at some point. This definitely merits a further examination of these tools.

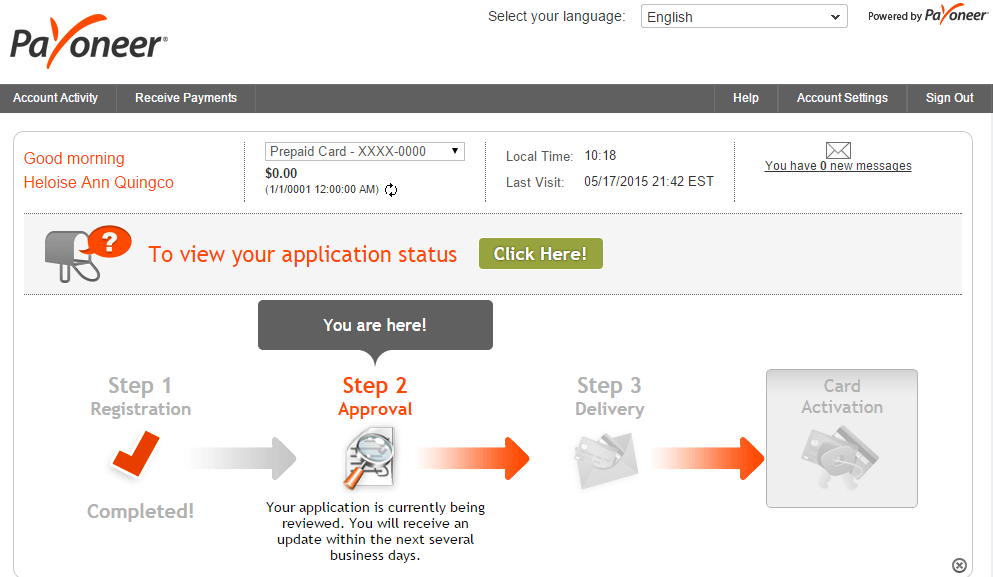

Skrill is a payment tool centered around low-cost international transfers. One of the main pros of Skrill is that it is elementary to use. Compared to Skrill's alternatives, it provides high levels of safety and transparency. Also, its freemium model with low prices is also a draw for users.

Though Skrill has been around since 2001, the developers need to iron out some issues. One of the main cons is that inactive users need to pay a monthly fee. This deters users who are not conducting transactions regularly. Another con is that the currency exchange fees for “Skrill to Skrill” international transfers are quite high.

In case you want to look at some more options before making a decision, we have put together a list of Skrill alternatives that can help you gain some more insight into the online payment space.