What do a small scale entrepreneur and a Fortune 500 company have in common? I’m sure many of you thought of something like “drive for success” or “customers.” Think some more. Think about the challenges facing both types of entities. Managing payments definitely figures at the top of the list of challenges.

Managing payments can be a huge challenge, no matter the scale of the business. In the old days, you could have an army of accountants armed with registers and calculators taking care of payments, but in the digital age, such challenges can be dealt with using a range of tools available in the market.

You might already have chosen the perfect tool that meets your requirements. In case you have found “the one,” stop reading now. In case you are looking for a payment tool and are overwhelmed by the number of choices available, the pros and cons list might help make your decision easier.

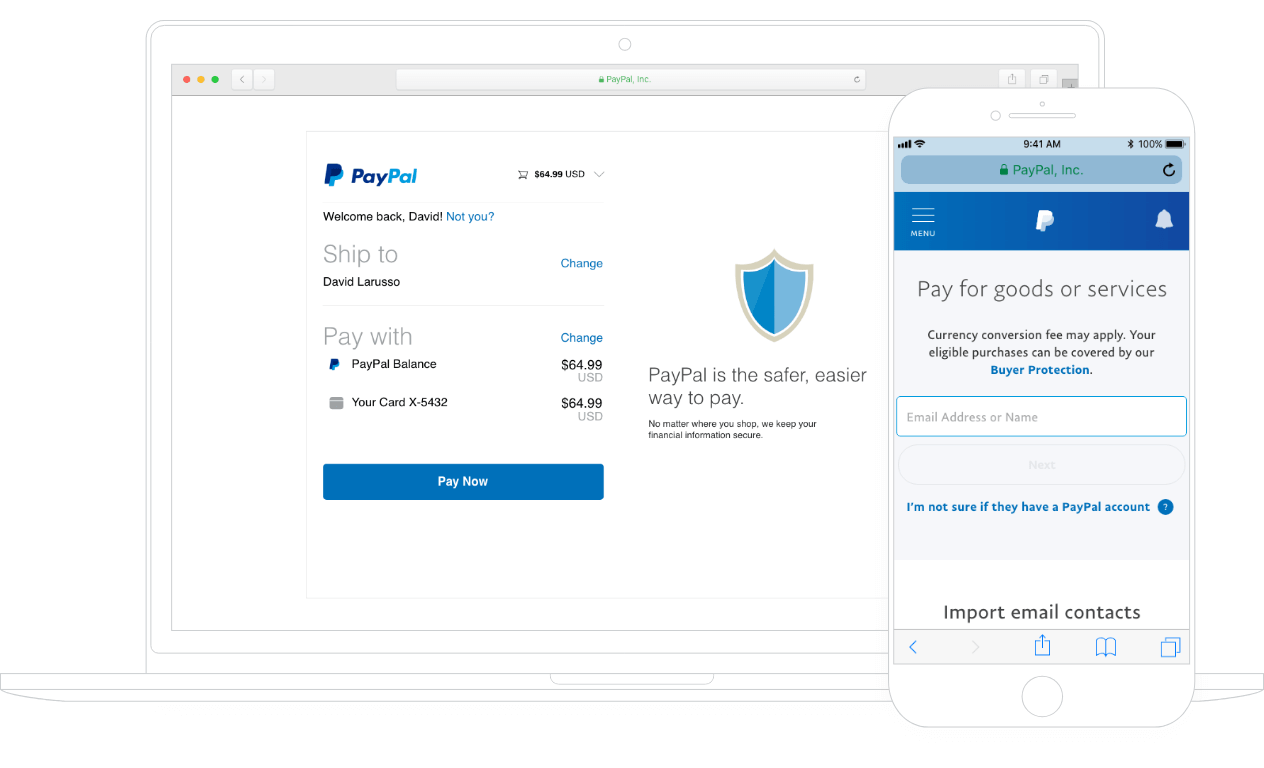

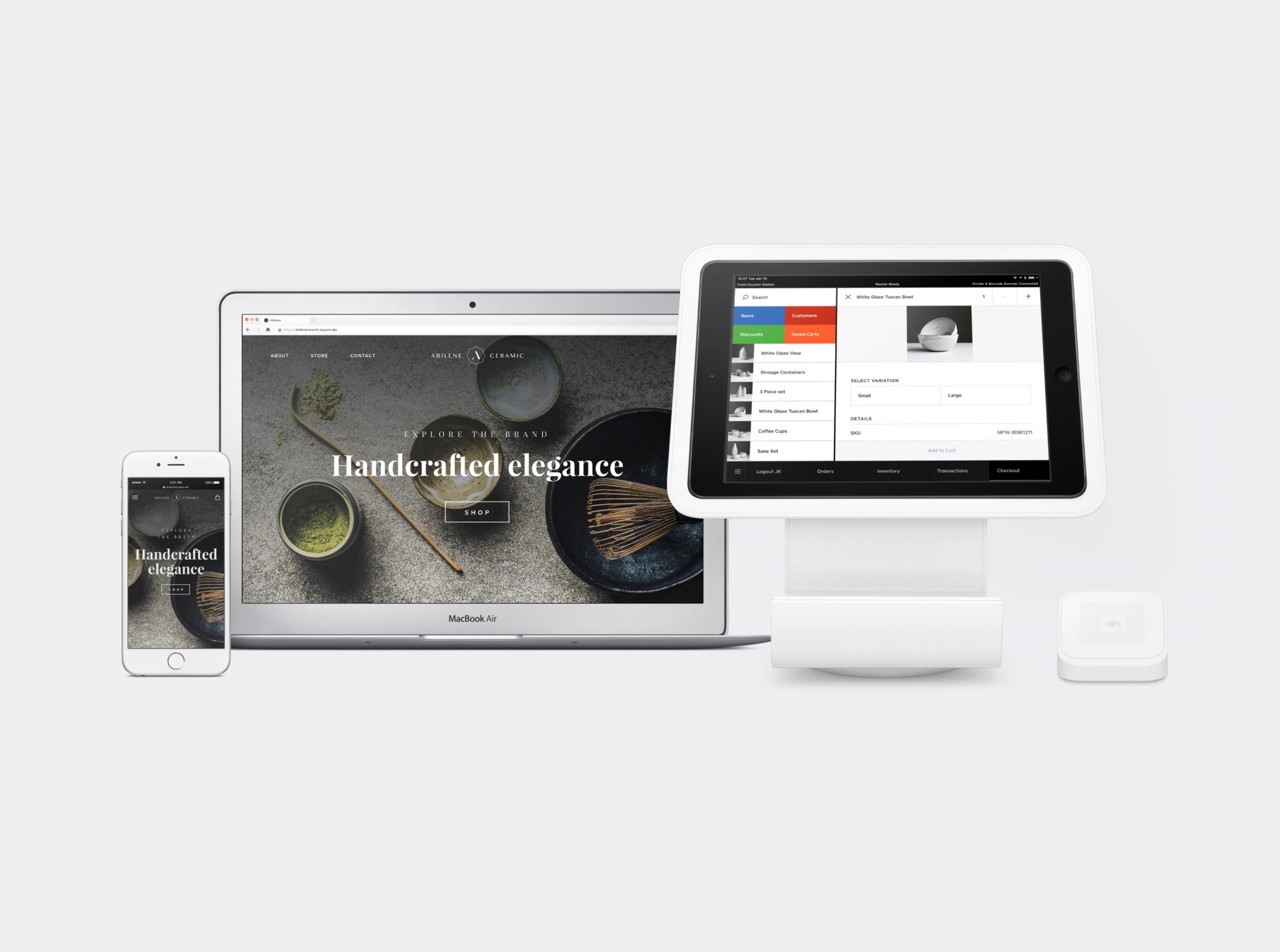

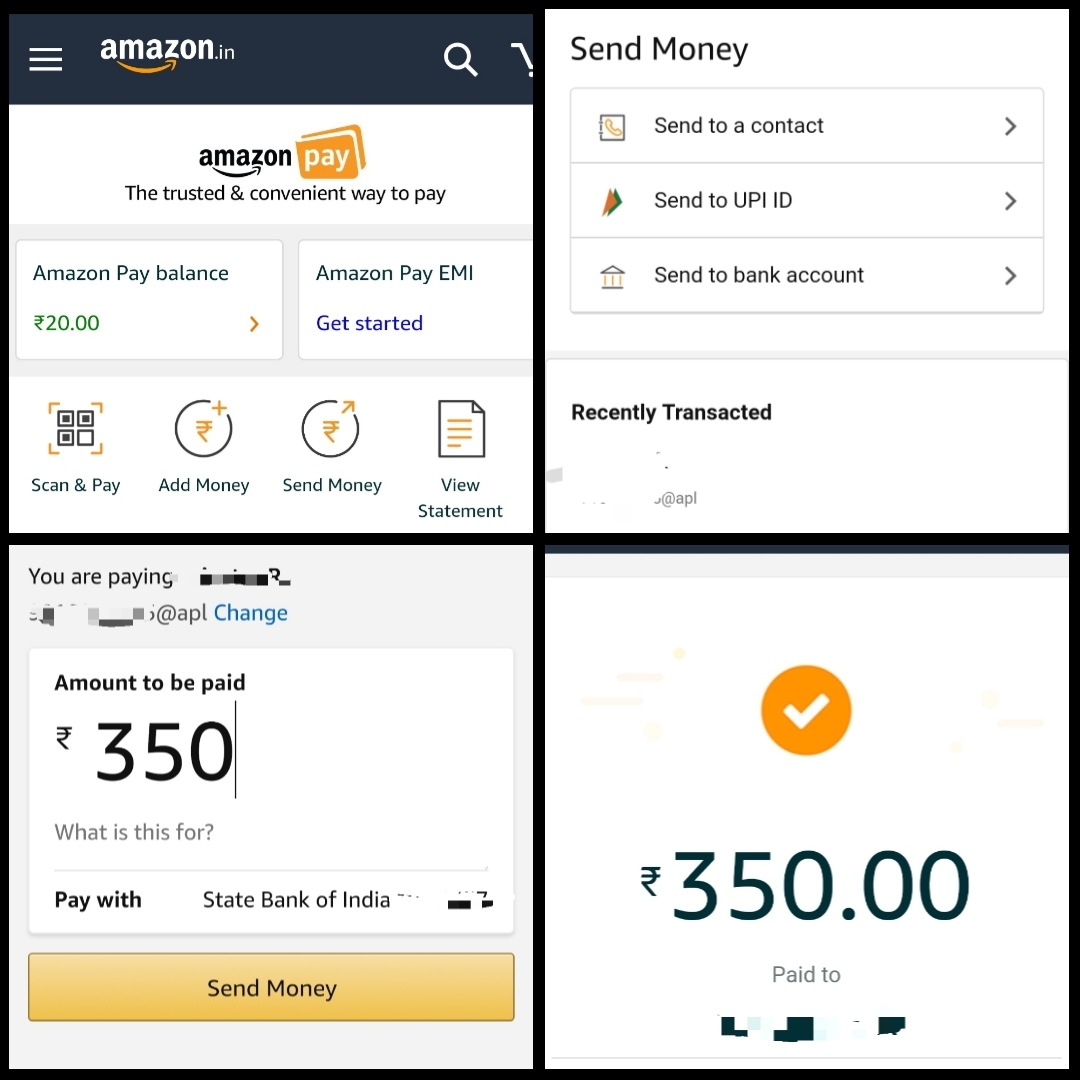

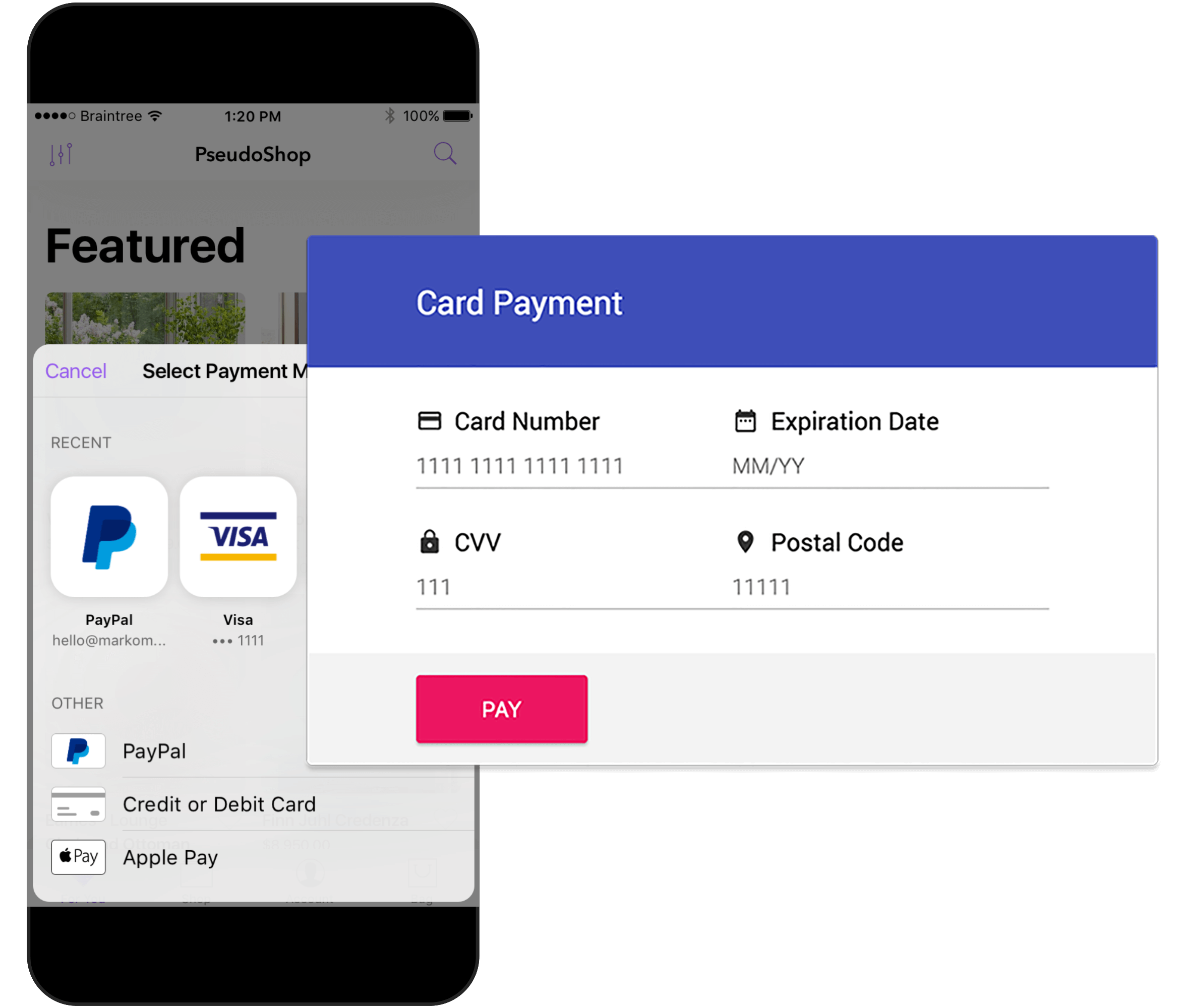

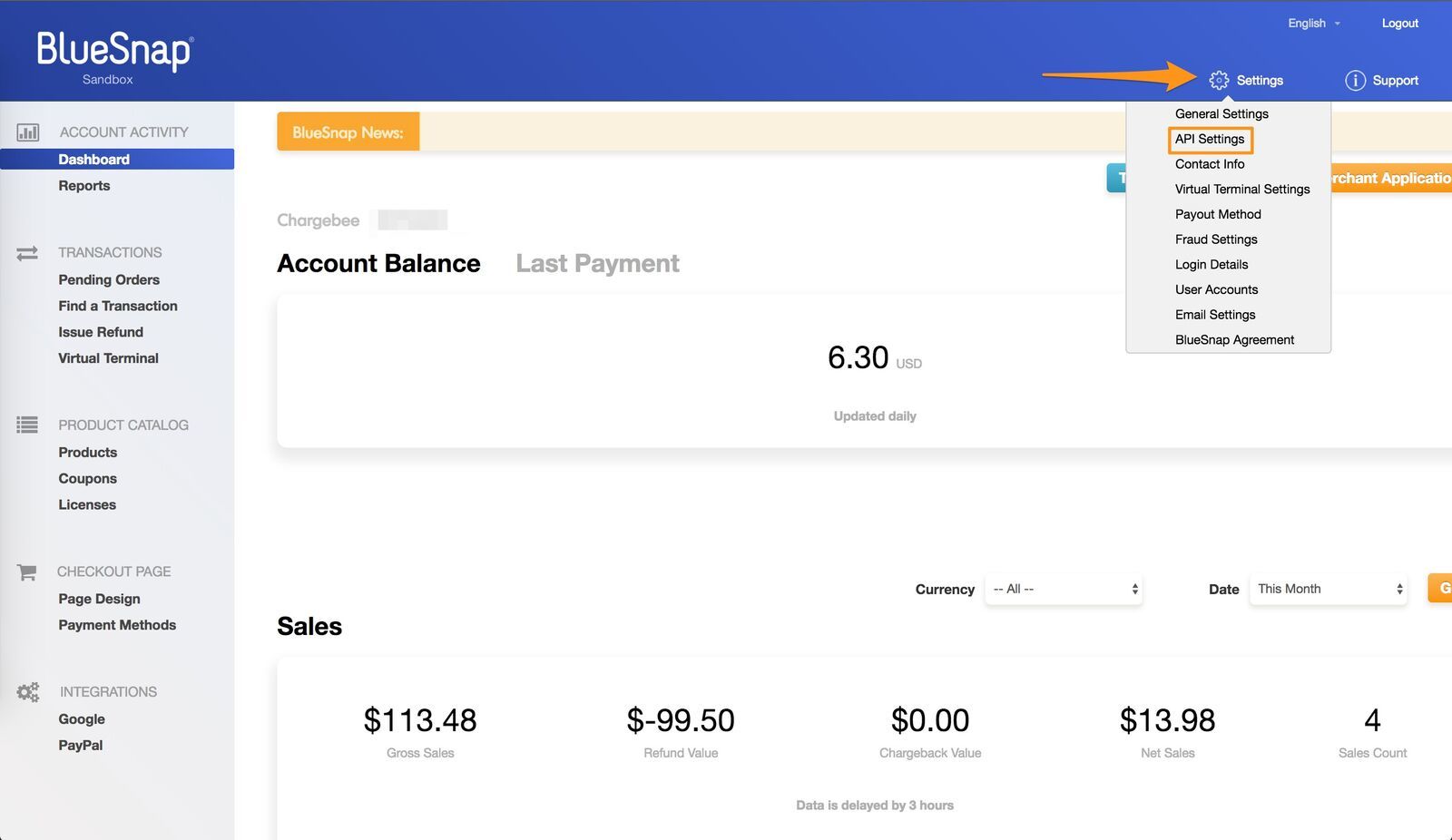

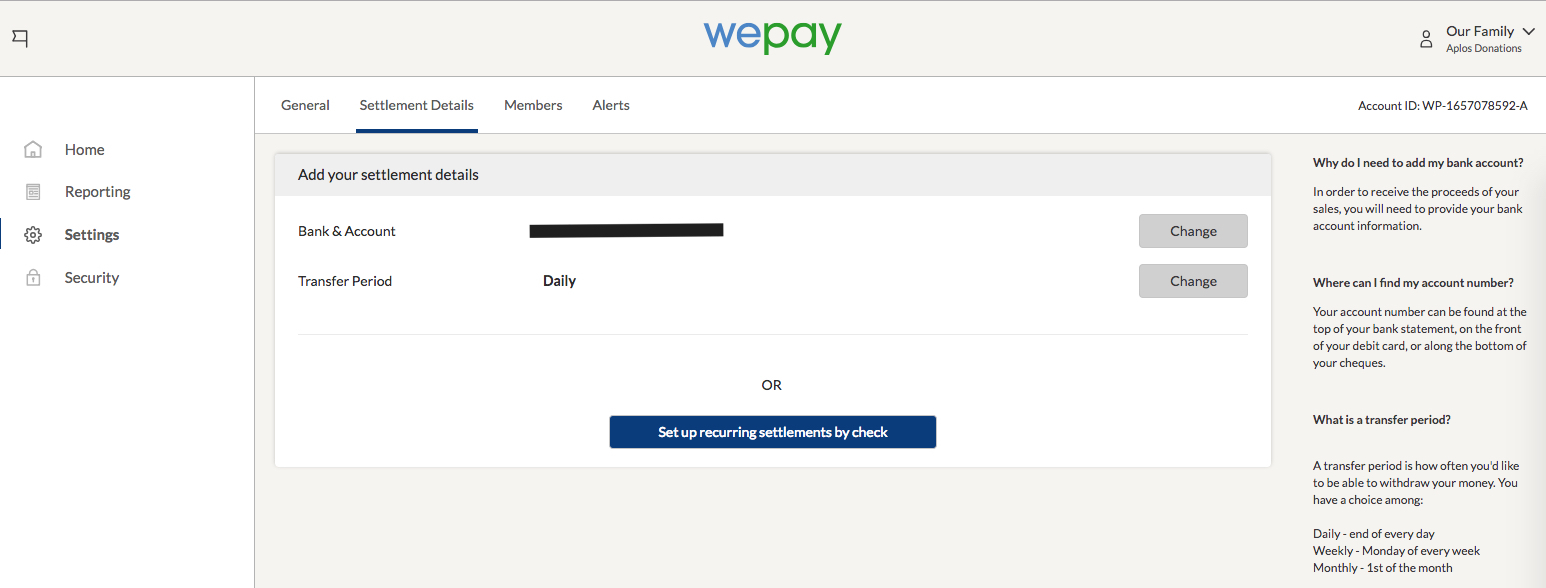

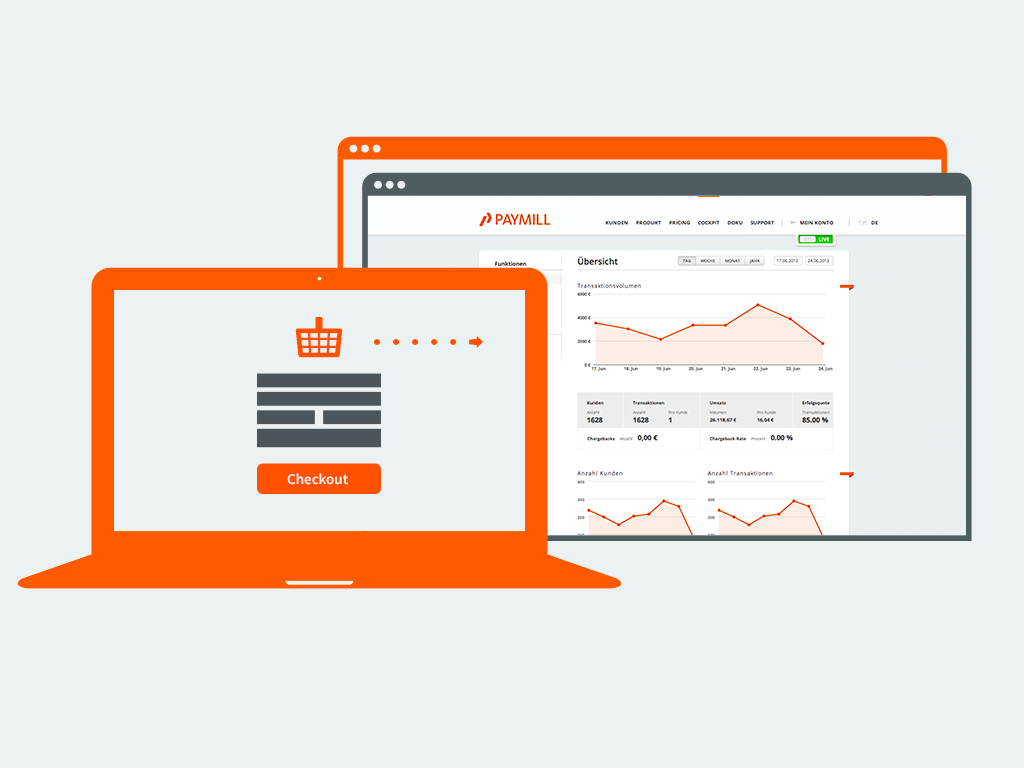

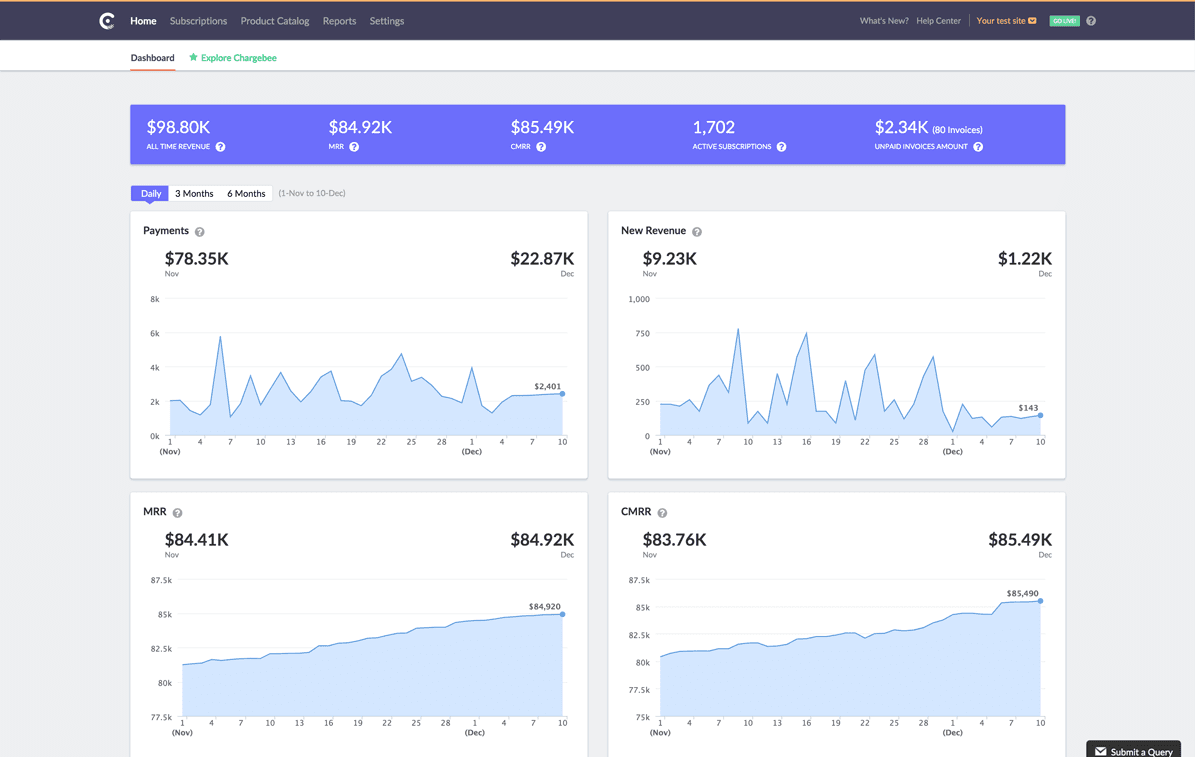

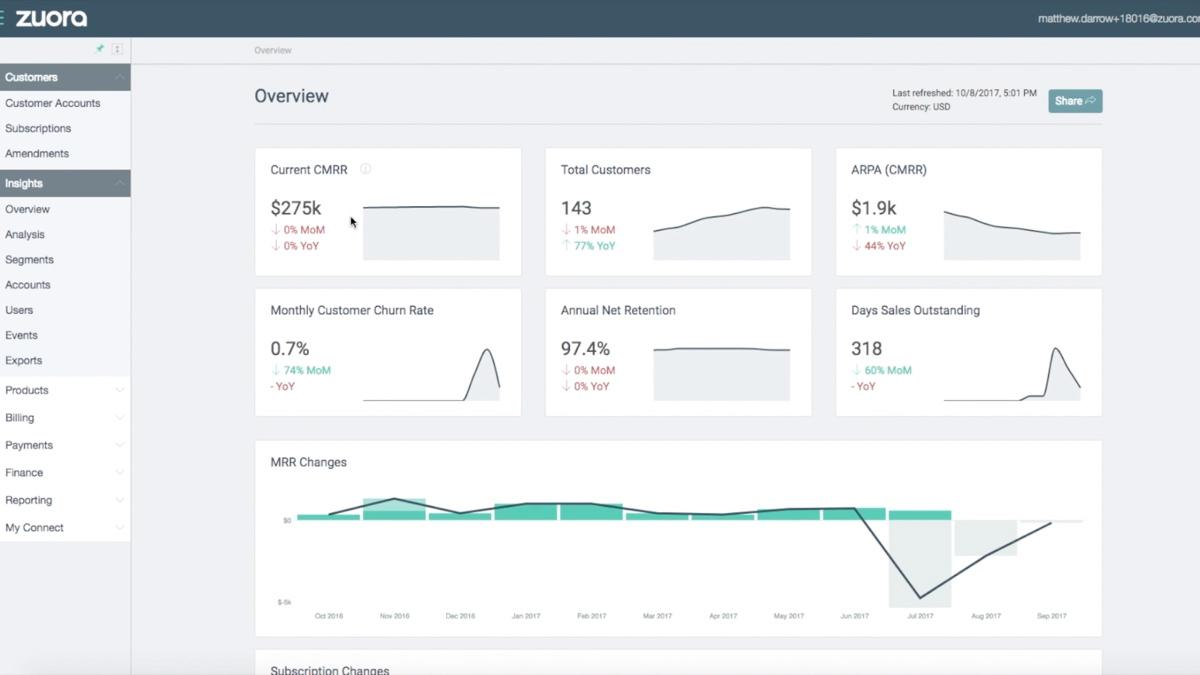

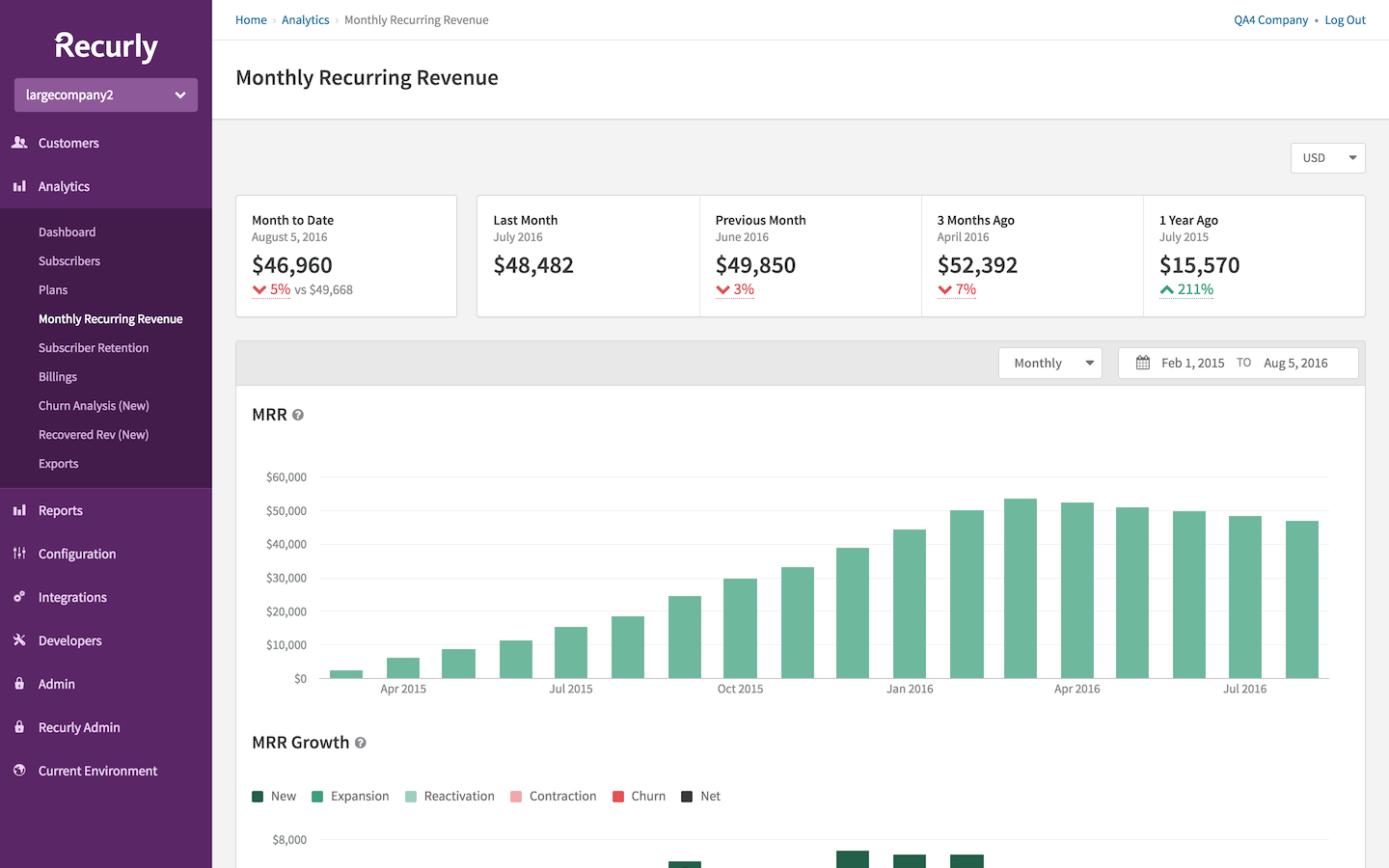

This article will focus on alternatives to Stripe, a tool that offers serious competition to PayPal. One of the main pros of this tool is that it allows for smooth and accurate payment automation. This ensures that your payments reach the concerned party on time. The detailed dashboard and analytics also make this tool a great option.

Every tool has its cons, and Stripe is not immune to this law either. Many users have complained that Stripe is difficult to use and takes some time to ease into. Some users have also complained that the payment structure is difficult to understand as they charge different fees.

In case these cons are making you think twice about using Stripe, you can go through a list of alternatives to Stripe put together by the Startup Stash team to see if anything else suits your needs.