Have you ever split a bill with someone? You’ve just eaten an amazing meal at a restaurant with your friends. At the end of the meal, the bill arrives, and you all have to divide the amount among yourselves. It can get awkward if all of you all swipe your card or pull out cash. So one person pays the bill, and everybody else pays that person.

If this is a scenario you’re familiar with, congratulations, you have friends! More importantly, you’ve probably used a mobile payment tool to settle your bill. Good news: you're not alone, because the usage of mobile payment applications has risen dramatically in recent years.

According to a report by Statista, the worldwide mobile payment revenue in 2015 was 450 billion U.S. dollars and is expected to surpass 1 trillion U.S. dollars in 2019. This means that every reader of this article has used or will use a mobile payment application!

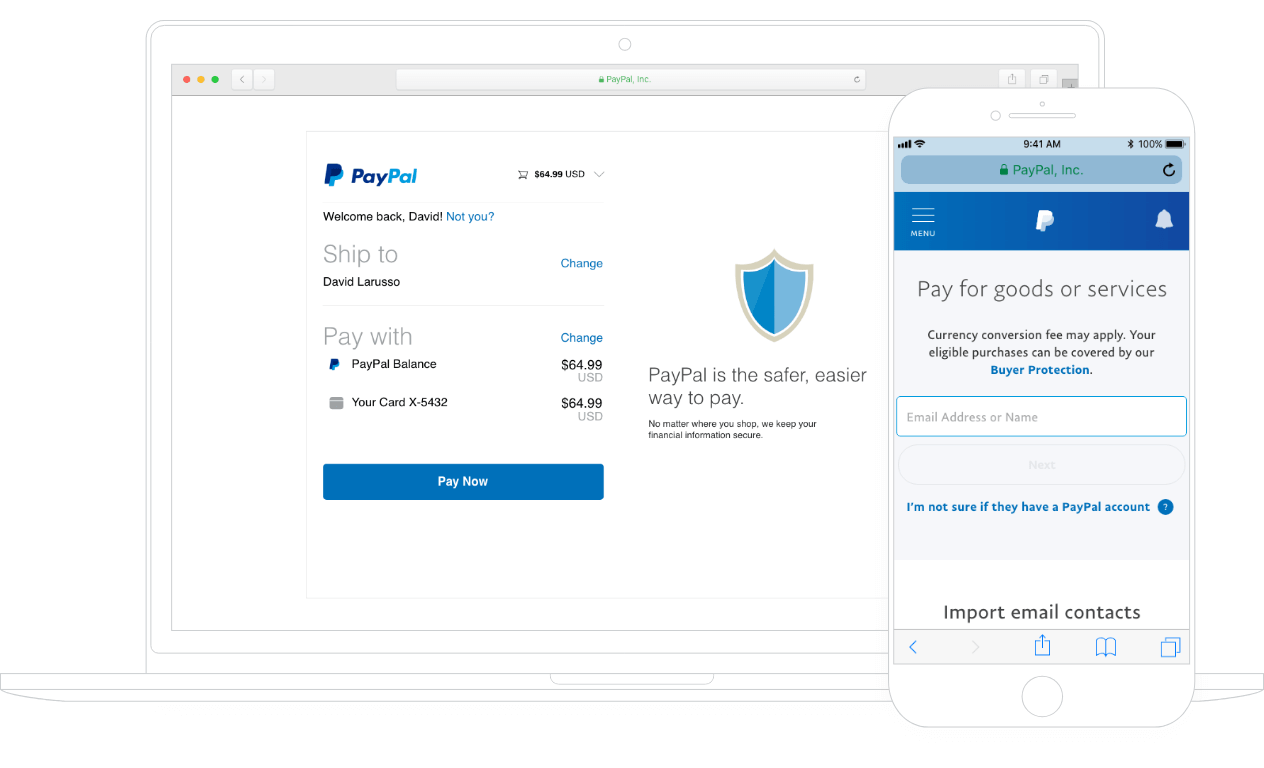

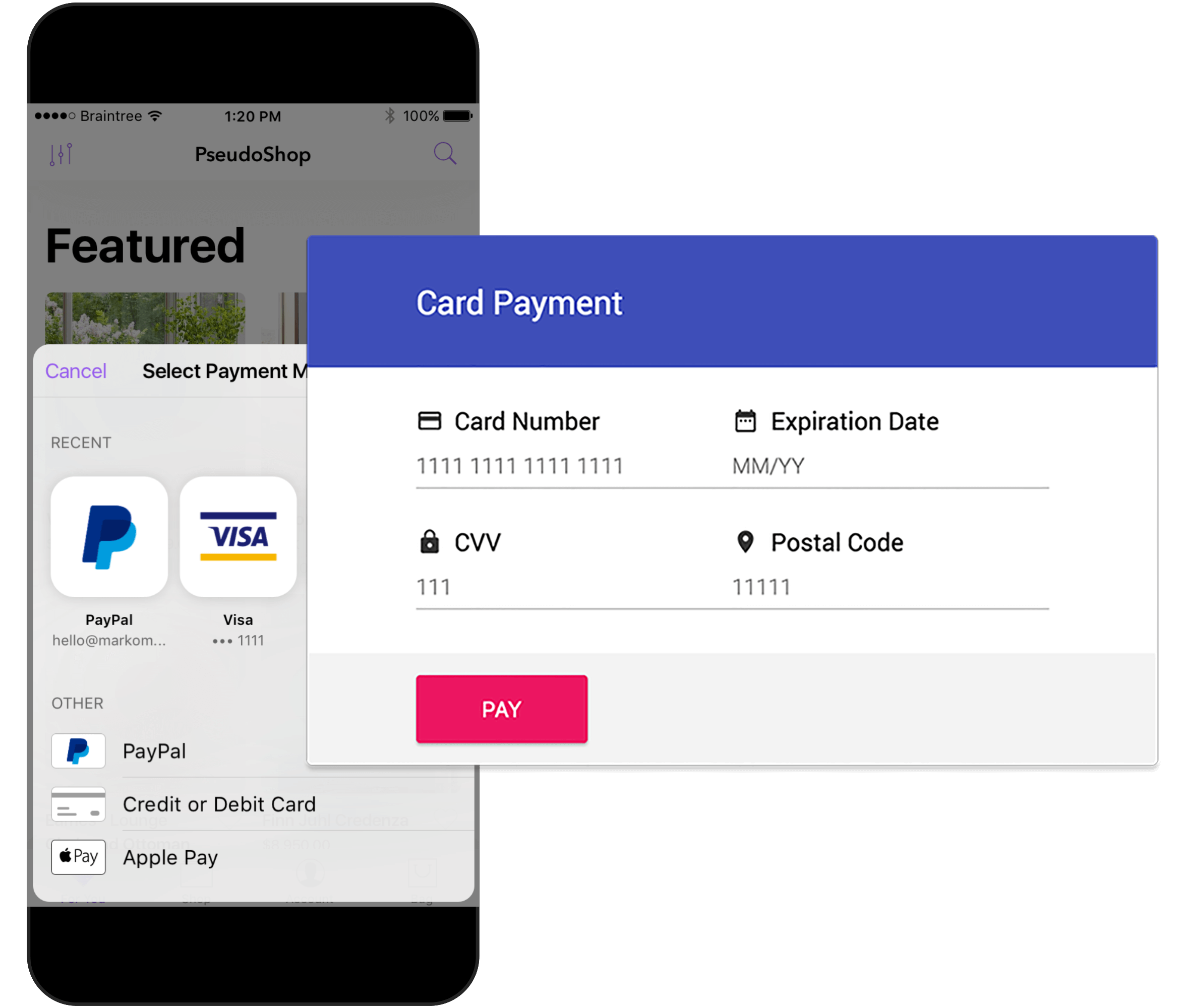

If you can't decide between payment tools, you should go through some pros and cons. This article will focus on alternatives to Venmo, a payment tool under the wing of PayPal, an industry giant.

One of the features that make this tool stand out is that it doubles up a social feed to chat with your friends. Another pro is that it is effortless to use because of its intuitive UI.

One of the main cons of Venmo is that hackers can sometimes use it to scam unwitting customers out of money. Another con is that Venmo charges high ATM Withdrawal fees when compared to other payment tools.

In case you want to look at some more options before making a decision, our team at Startup Stash has put together a list of Venmo alternatives that can help you make a more informed decision.