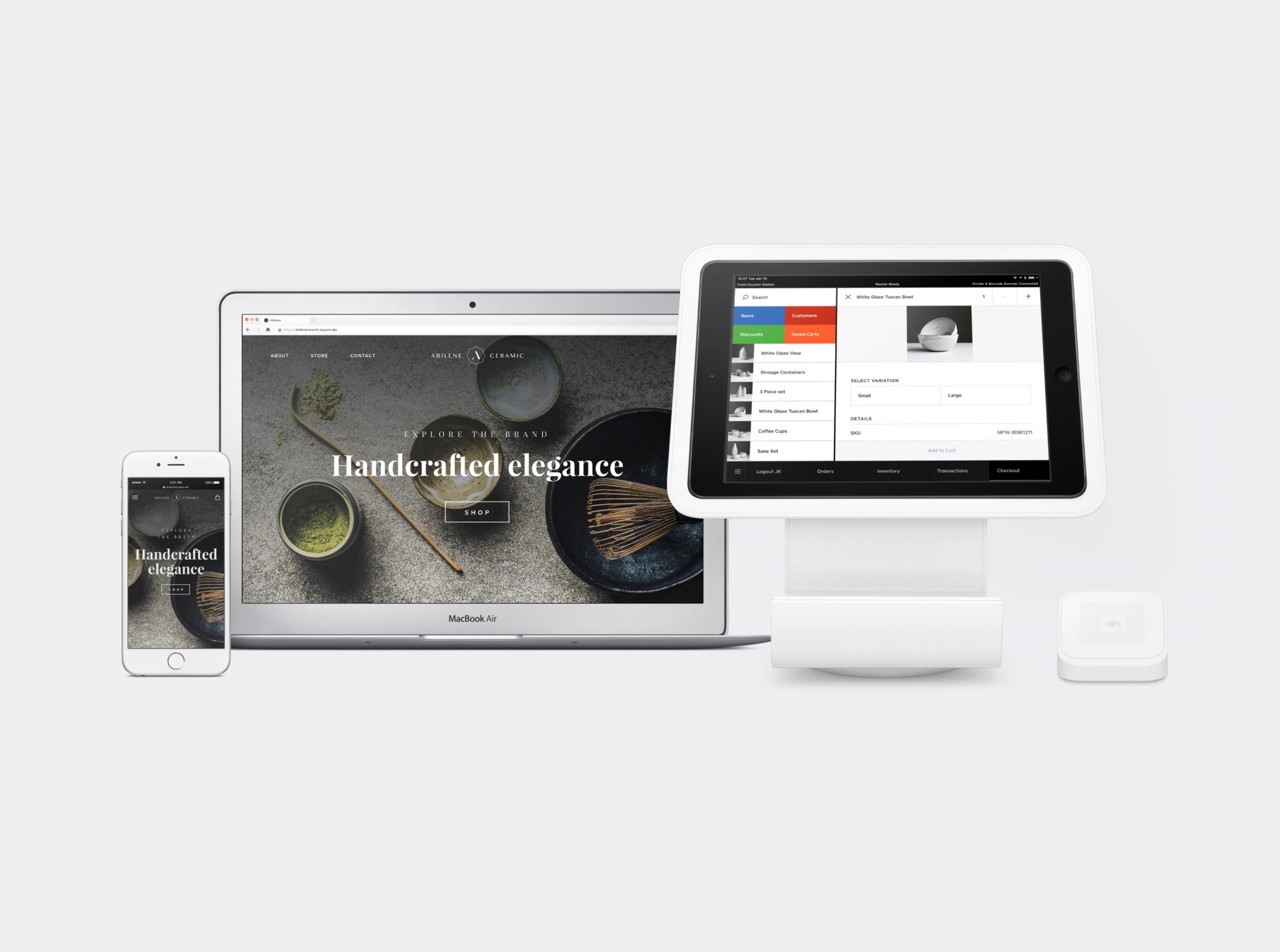

PayPal is quite a robust tool and does the job well, but its transaction fees can make it quite expensive for small businesses. In case you are someone looking for cheaper alternatives, read on. StartupStash has just the PayPal alternatives list for you.

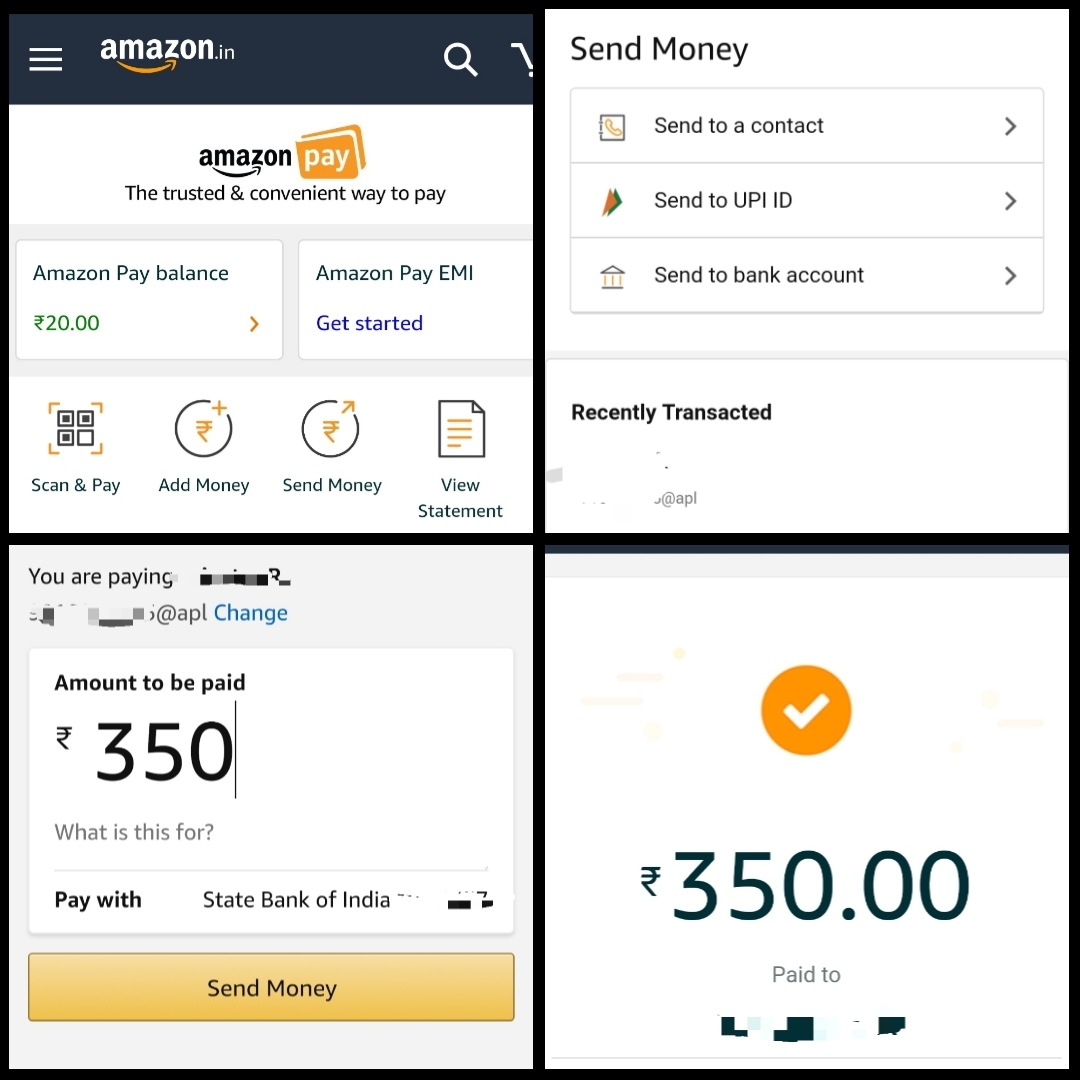

But before we get into the alternatives, let us first answer the most basic question- Are payment tools even necessary? The answer is that whether they are necessary or not, they are inevitable. In today’s digital age, online payments are omnipresent. As more and more businesses start operating across borders, online payment tools are the easiest way to conduct transactions.

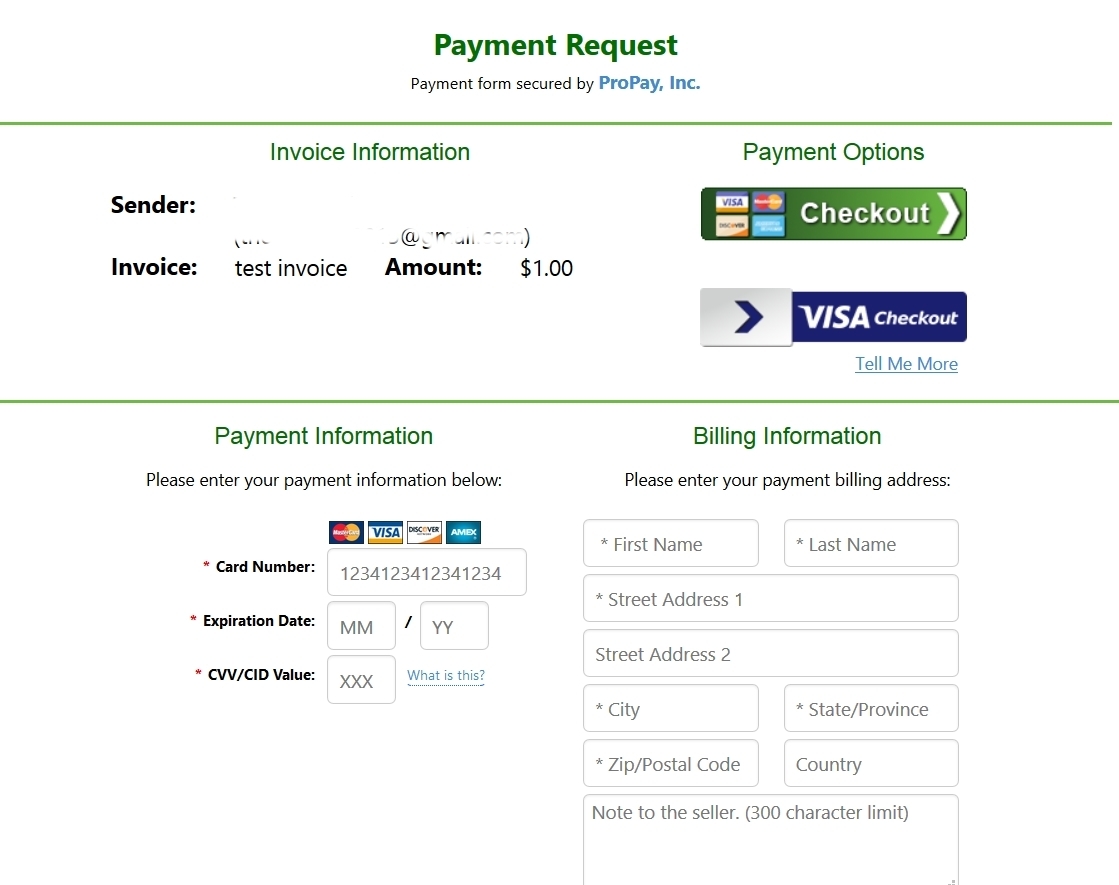

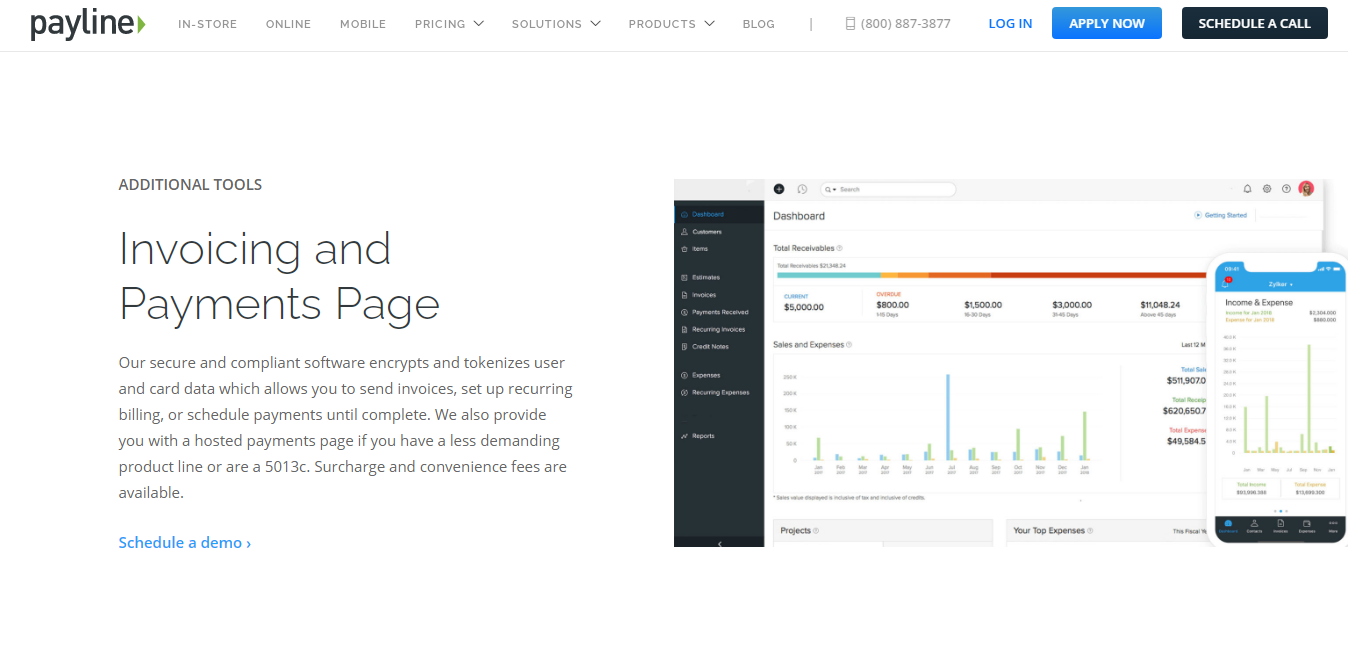

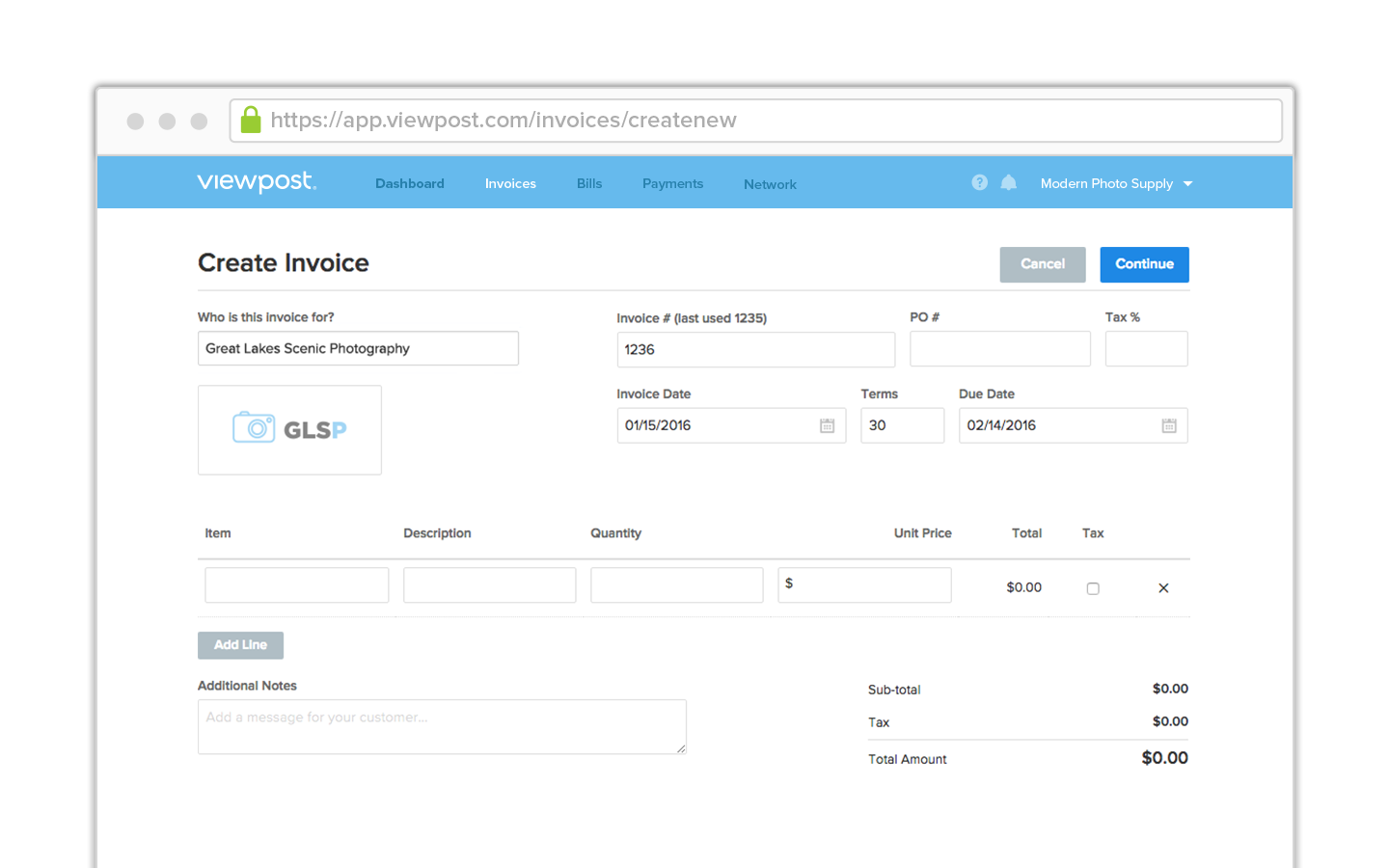

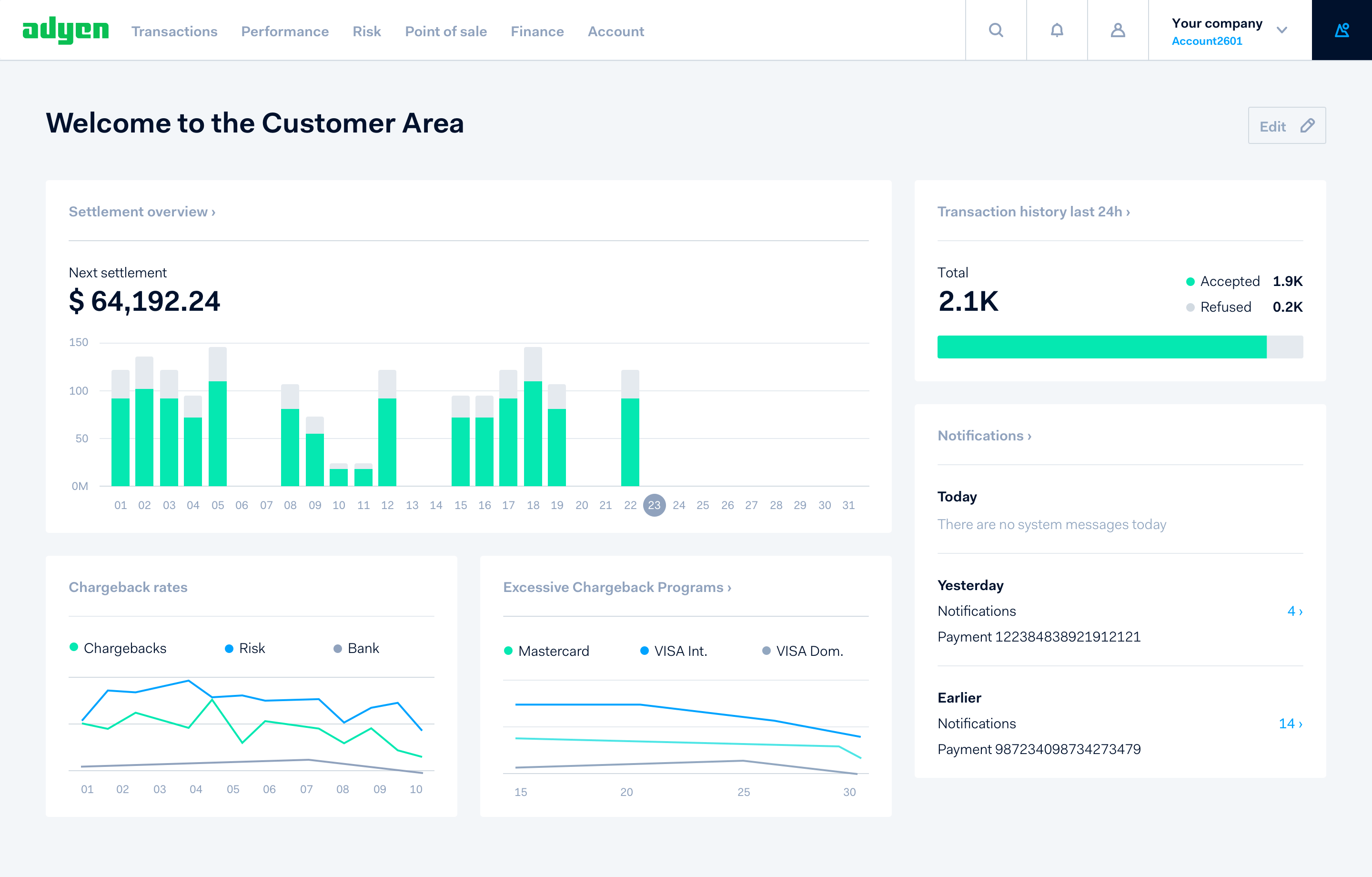

Payment tools are also handy because businesses can generate invoices and keep track of transactions. All in all, if you haven’t started using online payment tools yet, now would be a good time to start. You don’t want to be fumbling around at an ATM trying to draw money.

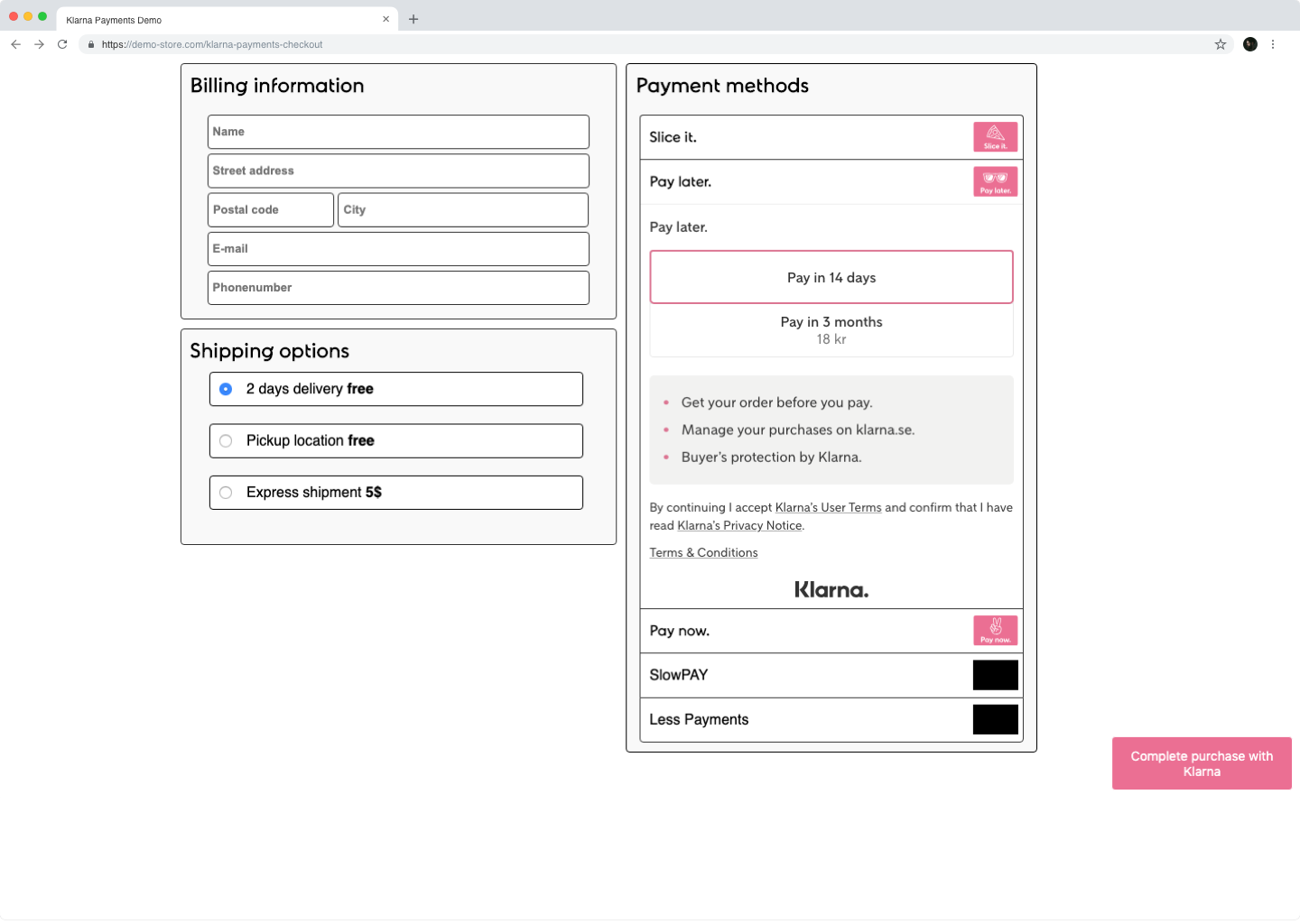

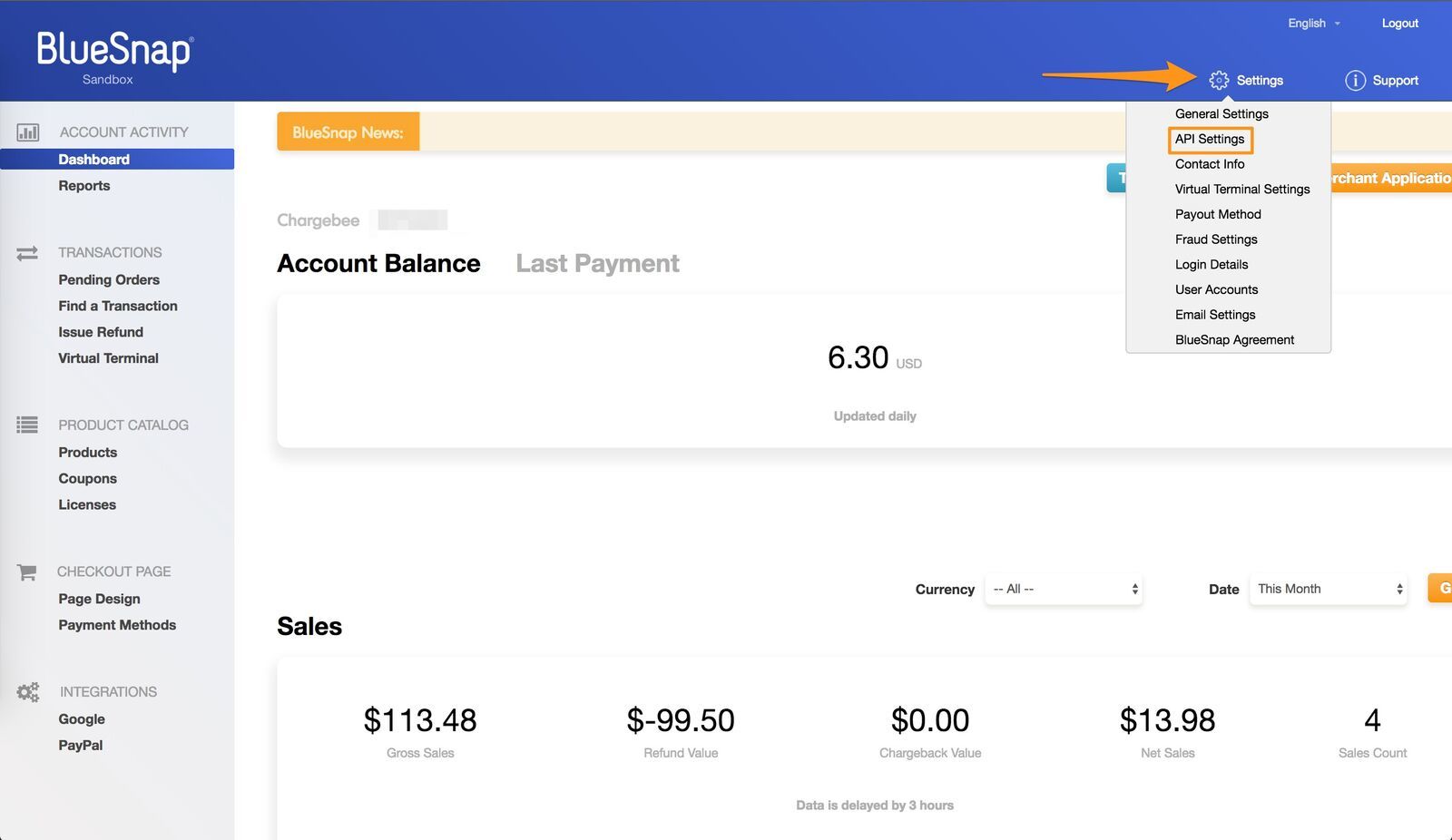

Before we forget, here are alternatives to PayPal we promised!