Most teams discover runaway cloud bills during month-end financial reviews, not from observability dashboards. Working across different tech companies, I have seen savings unlocked by three concrete moves: tuning anomaly detection to hourly signals, automating Savings Plans and Reserved Instance ladders, and right‑sizing Kubernetes nodes with bin‑packing rather than static headroom. In 2024 and 2025, cloud spend kept accelerating, and public cloud end‑user spending is forecast to reach $723.4 billion in 2025, according to Gartner's cloud spending forecast. From my experience in the startup ecosystem, you cut waste fastest when engineers get cost context in their workflow and commitments are automated.

The market is crowded, and buyers feel it. The broader context, the IaaS market grew 22.5 percent in 2024 to $171.8 billion per Gartner, and 94 percent of IT leaders say they struggle with cloud costs, per a Sapio Research survey covered by TechRadar. Below, you will learn when each tool makes sense, what to watch out for, and how to model ROI.

CloudZero

Cloud cost intelligence that maps spend to products, features, teams, and customers, then surfaces anomalies before they become headline‑level bills. The platform focuses on unit economics, shared cost allocation, and engineering workflows.

- Best for: Product‑led teams that need unit‑cost visibility across AWS, Azure, and Google Cloud with anomaly detection that engineers actually use.

- Key Features: Per CloudZero documentation and user reviews, unit economics and chargeback, AI‑assisted anomaly detection, multi‑cloud and SaaS spend aggregation, persona‑based dashboards for finance through engineering, and alerting in Slack and email. Verified in part by G2 reviews.

- Why we like it: It closes the gap between finance views and engineering action, which is where savings die if you cannot attribute costs by customer or feature.

- Notable Limitations: Reviewers note limited direct automation of fixes and a learning curve in parts of the UI, plus comments about price at renewal for some enterprises, based on G2 feedback and Gartner Peer Insights summaries.

- Pricing: Pricing not publicly available. Contact CloudZero for a custom quote. Recent funding and momentum reported by PR Newswire.

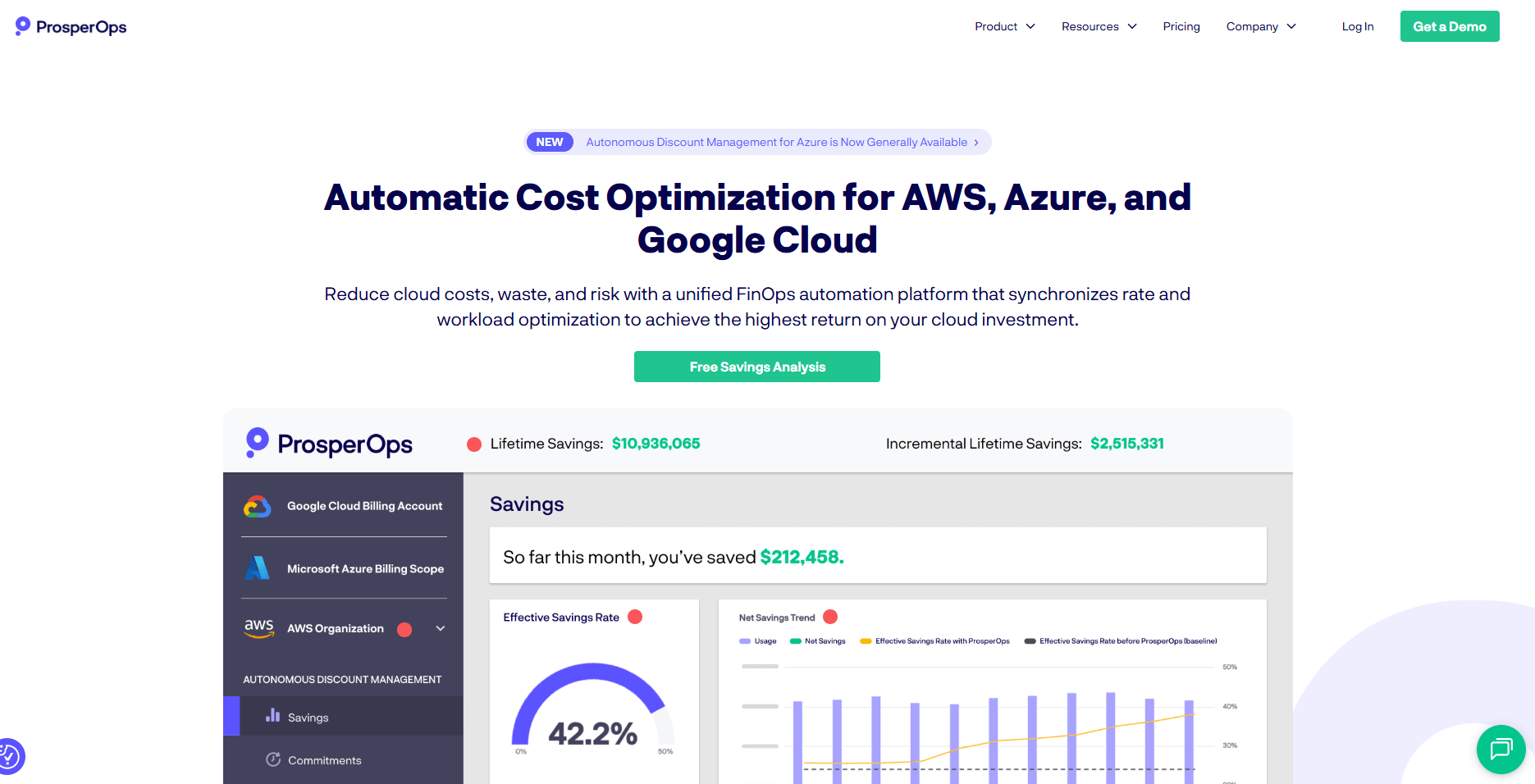

ProsperOps

Autonomous FinOps platform centered on commitment‑based discounts and, more recently, workload scheduling that aligns rate optimization with engineering changes. Now supports AWS, Azure, and Google Cloud discount programs.

- Best for: Teams that want set‑and‑forget management of Savings Plans, Reserved Instances, and committed‑use discounts across clouds, with outcome tracking.

- Key Features: Automated commitment management for AWS, Azure, and Google Cloud, ESR benchmarking, adaptive laddering for Savings Plans, and a new Scheduler that aligns workload schedules with discount actions. Verified via TechCrunch coverage, Newswire product announcement, and marketplace availability for Azure and Google Cloud noted by Accesswire and Accesswire.

- Why we like it: It handles the hardest part of FinOps to do well at scale, commitment math under changing usage, and reports savings in Effective Savings Rate terms finance teams understand.

- Notable Limitations: Narrower scope than full CMPs, focused on rate optimization and scheduling, so you may still need separate deep visibility and governance. Reviewers also mention pricing as a share of savings and the need for clear ROI baselines, reflected on G2 pricing notes and PeerSpot summaries.

- Pricing: "We only get paid when you save money," with a small percentage of savings model, per G2 pricing. No published list price. Contact ProsperOps for a custom quote. AWS Marketplace reviews highlight real‑world outcomes, see AWS Marketplace reviews.

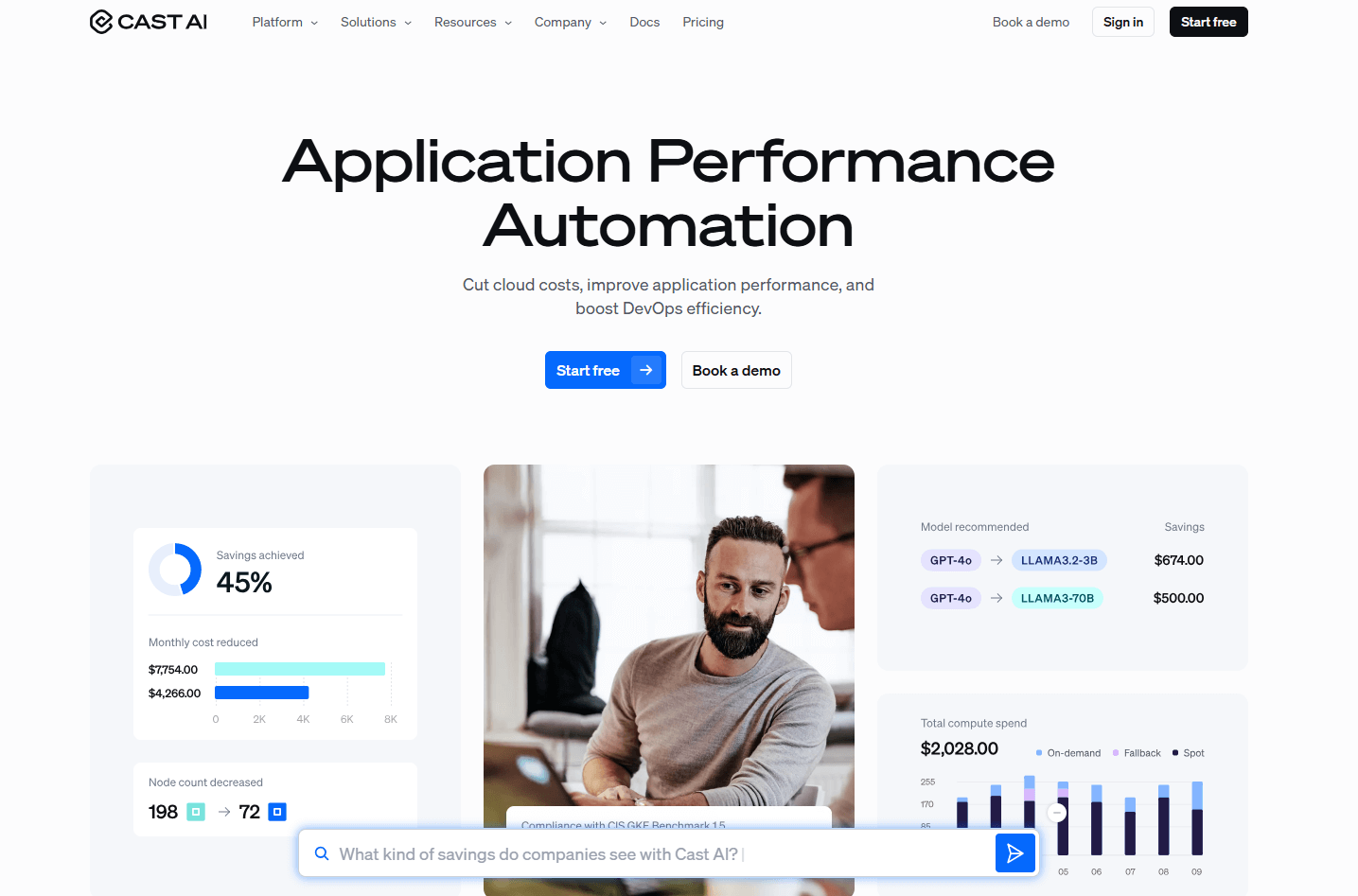

Cast AI

Kubernetes cost optimization platform that automates rightsizing, autoscaling, spot orchestration with fallback, and bin‑packing for CPUs and GPUs. The company expanded quickly as AI workloads spiked.

- Best for: Kubernetes‑heavy teams running dynamic, spiky, or GPU workloads across EKS, GKE, and AKS that want hands‑off optimization.

- Key Features: Automated workload and node rightsizing, spot automation with fallback, advanced autoscaling and scheduling, GPU and bin‑packing controls, and cost dashboards. Features and traction covered by Reuters and user feedback on G2.

- Why we like it: It delivers measurable savings without a long internal platform build, and reviews consistently call out time saved for SRE and platform teams.

- Notable Limitations: Reviewers report a learning curve on policy governance and advanced integrations, and some note costs that can be material at scale, per G2 reviews.

- Pricing: Free tier for Kubernetes cost monitoring, paid plans published with CPU‑based pricing on G2 pricing. Contact Cast AI for enterprise quotes.

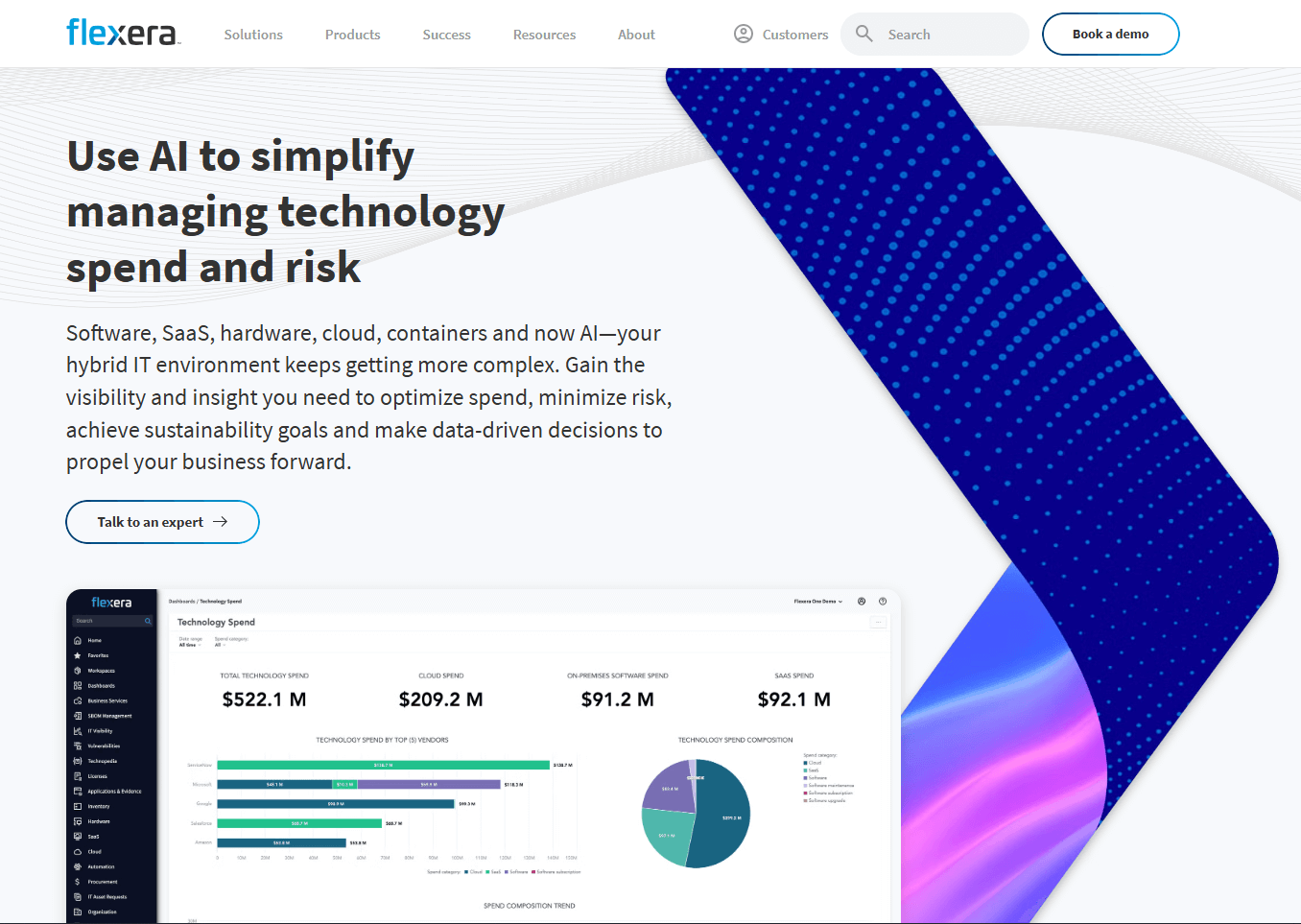

Flexera One

Unified FinOps and IT asset management platform for multi‑cloud, SaaS, and license optimization, with forecast modeling and commitment management inherited from the RightScale acquisition.

- Best for: Large enterprises that need one system of record for cloud, SaaS, and software licenses, plus chargeback, showback, and audit‑grade data.

- Key Features: Multi‑cloud cost optimization and forecasting, SaaS spend and license analytics, policy‑driven recommendations, and integrations with ITAM and CMDB. Verified in user feedback on G2 and the acquisition of RightScale covered by GlobeNewswire.

- Why we like it: It connects FinOps with ITAM and SaaS management, which is where many enterprises are headed as FinOps broadens to "Cloud plus."

- Notable Limitations: Reviews cite a steep learning curve, complex setup, and higher cost that can challenge smaller teams, based on G2 reviews.

- Pricing: Pricing not publicly available. Contact Flexera for a custom quote. Users mention enterprise‑grade pricing and long contracts on G2.

Cloud Cost Optimization Tools Comparison: Quick Overview

| Tool | Best For | Pricing Model | Highlights |

|---|---|---|---|

| CloudZero | Product teams needing unit economics and anomaly detection | Subscription, pricing not public | Unit‑cost visibility, strong anomaly workflows, per G2 |

| ProsperOps | Automated commitment management across clouds | Percentage of savings, per G2 pricing | ESR benchmarking, adaptive laddering, Azure and Google Cloud support via Accesswire |

| Cast AI | Kubernetes and AI workloads on EKS, GKE, AKS | CPU‑based paid plans, per G2 pricing | Rightsizing, spot automation, and GPU controls, growth covered by Reuters |

| Flexera One | Enterprises consolidating FinOps, ITAM, and SaaS | Enterprise subscription, custom quotes | Integrated cloud, SaaS, and license optimization, RightScale lineage via GlobeNewswire |

Cloud Cost Optimization Platform Comparison: Key Features at a Glance

| Tool | Feature 1 | Feature 2 | Feature 3 |

|---|---|---|---|

| CloudZero | Unit economics and chargeback | AI‑assisted anomaly detection | Multi‑cloud and SaaS aggregation, per G2 |

| ProsperOps | Autonomous Savings Plans and RI management | ESR benchmarking | Scheduler aligning workloads with discount actions, per Newswire |

| Cast AI | Automated rightsizing and autoscaling | Spot orchestration with fallback | Bin‑packing and GPU scheduling, traction reported by Reuters |

| Flexera One | Multi‑cloud optimization and forecasting | SaaS and license analytics | Policy engine and ITAM integrations, per G2 |

Cloud Cost Optimization Deployment Options

| Tool | Cloud API | Integration Complexity | Key Notes |

|---|---|---|---|

| CloudZero | Yes | Low to moderate, based on reviewer setup notes on G2 | No public on‑prem option |

| ProsperOps | Yes | Low, guided deployment and marketplace availability, per Accesswire | No public on‑prem option |

| Cast AI | Yes | Moderate, policy governance learning curve, per G2 | Agents for clusters, SaaS control plane |

| Flexera One | Yes | Higher, enterprise integrations and data normalization, per G2 | Primarily SaaS |

Cloud Cost Optimization Strategic Decision Framework

| Critical Question | Why It Matters | What to Evaluate | Red Flags |

|---|---|---|---|

| Do engineers get cost context tied to products, features, and customers? | Savings stall without unit economics in daily work | Dimensions, tagging coverage, anomaly signal to noise | Only aggregate finance reports, no engineering‑grade context |

| How are commitments managed under changing usage? | Mismanaged RIs and Savings Plans can erase savings | Automation scope across AWS, Azure, Google Cloud, ESR reporting | Manual spreadsheets, quarterly buys, no adaptive laddering |

| Are Kubernetes workloads right‑sized and bin‑packed? | Overprovisioned clusters waste CPU and memory | Real‑time autoscaling, spot with fallback, GPU policies | Static headroom, long scaling delays, no bin‑packing |

| Do you need SaaS and license analytics with FinOps? | FinOps is expanding to Cloud plus SaaS and ITAM | Breadth of data sources, license intelligence, SaaS discovery | Point tools without cross‑domain normalization |

Cloud Cost Optimization Solutions Comparison: Pricing & Capabilities Overview

| Organization Size | Recommended Setup | Monthly Cost | Annual Investment |

|---|---|---|---|

| Startup to Mid‑Market with heavy K8s | Cast AI Growth for automated optimization | From plan levels shown on G2 pricing | Estimate using CPU counts and plan tiers, confirm with vendor |

| Mid‑Market with commitments under‑managed | ProsperOps autonomous commitments | Percentage of savings, per G2 pricing | Modeled against current Savings Plans, RIs, and on‑demand mix |

| Product‑led SaaS needing unit economics | CloudZero for unit cost and anomalies | Pricing not public | Contact vendor for a quote |

| Large enterprise consolidating FinOps, ITAM, SaaS | Flexera One platform | Pricing not public | Contact vendor for a quote |

Problems & Solutions

-

Problem: "We keep getting surprise bill spikes."

What the data says: 44 percent of orgs report limited visibility and unexpected cost swings, per Sapio Research covered by TechRadar.

How tools help:

• CloudZero, anomaly detection tied to engineering context and Slack alerts, noted by users on G2.

• Flexera One, policy‑driven recommendations and forecasting surfaced in enterprise dashboards, per G2.

• Cast AI, cuts cost volatility by automatically right‑sizing and scaling clusters, per reviewer outcomes on G2. -

Problem: "Commitments are risky, we either over‑ or under‑buy."

What the data says: Managing commitment‑based discounts rose to a top priority in the 2024 State of FinOps, per the FinOps Foundation. AWS documentation also highlights RI inflexibility and why Savings Plans exist, see AWS prescriptive guidance.

How tools help:

• ProsperOps, autonomous management across Savings Plans and RIs, plus Scheduler to align engineering changes with discount actions, as covered on Newswire.

• Flexera One, enterprise commitment visibility with forecasting to reduce coverage gaps, based on G2.

• CloudZero, unit economics to set safe coverage targets driven by business metrics, confirmed by user feedback on G2. -

Problem: "Our Kubernetes and AI clusters are oversized for safety."

What the data says: Organizations commonly under‑utilize compute and memory in clusters. Cast AI's growth reflects demand for automated K8s optimization as AI spend rises, per Reuters.

How tools help:

• Cast AI, automated rightsizing, bin‑packing, and spot with fallback, repeatedly cited in G2 reviews.

• CloudZero, shows K8s cost by team and service so SREs can target oversized deployments, per G2.

• Flexera One, policy recommendations for cloud resources that include containerized workloads, per G2. -

Problem: "We need one view across cloud, SaaS, and licenses."

What the data says: FinOps is expanding to Cloud plus SaaS and ITAM in 2025, with waste reduction still top priority, summarized by multiple industry analyses referencing the FinOps Foundation's 2025 report such as USU's recap.

How tools help:

• Flexera One, unifies cloud costs with SaaS and license intelligence, validated by enterprise reviewers on G2.

• CloudZero, pulls SaaS and third‑party telemetry alongside cloud spend for full cost views, per G2.

• ProsperOps, focuses rate optimization while broader visibility can live in your CMP or ITAM stack, with outcomes language that finance teams can track, per G2 pricing.

The Bottom Line on Cloud Cost Optimization

By 2026, cloud cost optimization is no longer about dashboards. It is about whether engineering, finance, and platform teams can act on cost signals fast enough to prevent waste from compounding. With public cloud spending still climbing and IaaS growth remaining strong, manual processes and quarterly commitment reviews no longer scale.

If your priority is unit economics, anomaly response, and giving engineers cost context tied to products and customers, CloudZero is the strongest starting point. If commitment management is where money leaks, ProsperOps is purpose-built to automate Savings Plans and Reserved Instances across AWS, Azure, and Google Cloud. Its momentum and category focus are reinforced by product and funding coverage in TechCrunch.

If Kubernetes and GPU workloads are driving your bill, Cast AI delivers the fastest hands-off savings through rightsizing, bin-packing, and spot automation, with growth and adoption reported by Reuters.

If you need one system across cloud, SaaS, and licenses, Flexera One fits enterprises moving toward FinOps plus ITAM, rooted in the RightScale acquisition covered by GlobeNewswire.

The common failure in 2026 is trying to solve everything at once. Start with your most painful cost failure, surprise spikes, mismanaged commitments, or oversized clusters. Pick the platform that directly fixes that problem, measure savings within the first ninety days, and expand only after the process proves repeatable. Cloud cost optimization now rewards focus, automation, and engineer adoption, not tool sprawl.