You think you know which bot platform to pick until the first production pilot exposes brittle intent models, messy handoffs, and channel policy surprises. Working across different tech companies, we have seen teams waste months on issues that better tools solve out of the box. From our experience in the startup ecosystem, three technical choices separate quick wins from rework: a dialogue manager that handles interruptions, strong voice and telephony connectors for IVR handoffs, and an analytics loop that drives training data fixes. The market is moving fast, and adoption pressure is rising, which is why this guide focuses on proven platforms. A 2024 survey found that 85 percent of service leaders planned to explore or pilot customer-facing conversational GenAI in 2025, a signal that budgets are real and timelines are short, according to a Gartner press release.

The final five platforms below consistently delivered on orchestration, deployment flexibility, and measurable outcomes. For market context, the global conversational AI market was about 11.6 billion dollars in 2024 and is projected to reach 41.4 billion dollars by 2030, based on Grand View Research's 2025 report. In this guide, you will learn when to choose each platform, what it does well, where reviewers report friction, and how pricing is structured where public information exists.

Rasa Pro

Commercial, pro-code framework plus optional no-code UI for building production AI assistants with granular control and enterprise add-ons. Known for on-prem and private cloud deployments, with telemetry and observability options for regulated environments.

- Best for: Engineering-led teams that want full control, on-prem or private VPC deployments, and extensibility for custom pipelines.

- Key Features: Language-agnostic NLU, dialogue with transformer-based policy, multi-LLM management, OpenTelemetry-based observability, Kafka-backed data pipeline, role-based access, Helm charts for Kubernetes.

- Why we like it: You can own the entire stack and tune models and policies, which saves time later when you hit domain edge cases that black-box tools struggle with.

- Notable Limitations: Reviews cite a steeper learning curve and complexity for long-running or open-ended conversations, and requests for deeper LLM support in earlier versions, based on consolidated feedback on G2.

- Pricing: Rasa's G2 pricing indicates a free Developer edition and commercial plans with a Growth tier starting around 35,000 dollars annually, with Enterprise on quote, per G2's pricing page. Always confirm current terms with the vendor.

Kore.ai XO Platform

Enterprise agent platform for designing, deploying, and orchestrating AI agents across channels with no-code and pro-code tooling. Recognized by analysts for strong orchestration, voice, and security controls.

- Best for: Large or mid-market enterprises needing end-to-end customer and employee experiences, agent assist, and contact center integrations.

- Key Features: No-code dialog builder plus pro-code extensions, multi-agent orchestration, omnichannel and voice, knowledge search and answer management, analytics and governance controls.

- Why we like it: The orchestration layer plus contact-center and enterprise app integrations reduce glue work your team would otherwise build from scratch.

- Notable Limitations: Users report an initial learning curve, documentation gaps for advanced use cases, and occasional UI sluggishness with large flows, per recent G2 reviews.

- Pricing: Public list pricing is not disclosed. However, AWS Marketplace shows pre-negotiated catalog items such as a 12-month "AI for Service" SKU at 6,600 dollars and support or expert-services line items, which indicates contract-based pricing, per the AWS Marketplace listing. Forrester also evaluated Kore.ai as a Leader in a 2024 Wave for customer service, which many buyers use as a shortlisting signal, as reported by PR Newswire.

Yellow.ai

Omnichannel platform with multilingual AI agents, a visual builder, and real-time analytics. Offers both customer and employee experience use cases, including voice and email agents.

- Best for: Teams that want a packaged CX and EX stack with a no-code start and room to customize for scale.

- Key Features: Agentic builder for chat and voice, multilingual support, analytics and LLM telemetry, campaign and notification tools, prebuilt connectors.

- Why we like it: Good coverage across channels and strong operational analytics make it easier to track deflection and resolution quality without bolting on other tools.

- Notable Limitations: G2 reviewers note project communication gaps and extended timelines in some engagements, plus account team changes causing context resets, per aggregated G2 feedback.

- Pricing: G2 reports "pricing not provided," which typically signals quote-based enterprise deals, per G2's pricing page. For ballpark planning, AWS Marketplace lists annual offers such as a Basic plan at 10,000 dollars and a Standard plan at 25,000 dollars, per the AWS Marketplace listing.

Haptik

Indian enterprise conversational AI platform, now part of Jio Platforms, supporting free-text spoken or text assistants and WhatsApp-centric CX at scale.

- Best for: Brands prioritizing WhatsApp automation and multilingual CX across India and high-growth international markets, plus enterprises needing a partner with telecom scale via Jio.

- Key Features: Chat and voice AI, WhatsApp CRM and marketing through Interakt, omnichannel connectors, analytics, and enterprise deployment services.

- Why we like it: Strong execution on WhatsApp and India-first scenarios, with enterprise scale from parent Jio, which helps when volumes spike during campaigns.

- Notable Limitations: Reviewers mention limits when building very complex logic in the flow builder, a learning curve for deeper customization, and higher costs for new requirements, based on G2 reviews.

- Pricing: Enterprise pricing is not publicly available. For SMBs, Haptik's Interakt initiative has India pricing starting around Rs 10,000, as covered by the Times of India. Haptik has operated under Jio since a 2019 acquisition, which you should note for vendor due diligence, per TechCrunch's deal report.

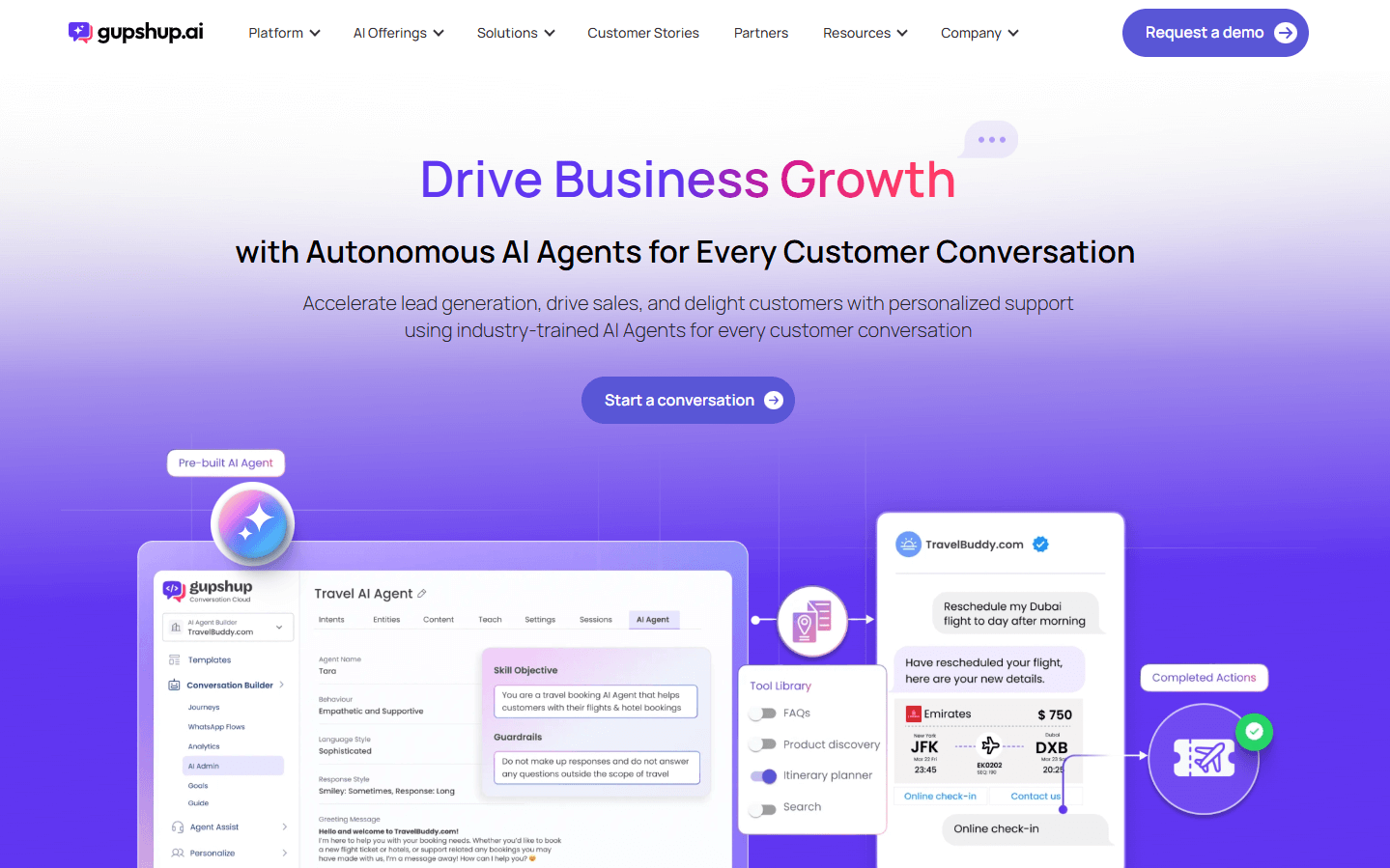

Gupshup

Conversational engagement and messaging platform with multichannel bot building and generative automation, widely used for WhatsApp, SMS, and marketing flows.

- Best for: Commerce and marketing teams that need to build, send, and measure message campaigns and automations across WhatsApp and SMS with chatbot add-ons.

- Key Features: WhatsApp, SMS, and other channel APIs, bot builder with LLM-assisted creation, analytics and campaign tools, and domain-specific ACE LLM options.

- Why we like it: Deep channel coverage plus recent LLM upgrades make it practical to consolidate messaging and conversational flows under one roof.

- Notable Limitations: Reviewers cite dashboard latency and limited reporting customization at times, as well as support responsiveness that could be more proactive, per G2 reviews.

- Pricing: Pricing varies by channel and country. WhatsApp moved from conversation-based to per-message template pricing on July 1, 2025, which affects all providers, per Twilio's changelog and Vonage's update. For SMS, AWS Marketplace lists a Gupshup plan at roughly 12.359 dollars per 10,000 messages in India, per the AWS Marketplace listing.

Conversational AI Development Platforms Comparison: Quick Overview

| Tool | Best For | Pricing Model | Highlights |

|---|---|---|---|

| Rasa Pro | Engineering-led, on-prem or private cloud builds | Annual subscription, quote based (Developer edition free) | Deep control, observability, pro-code plus optional no-code UI |

| Kore.ai XO Platform | Enterprise CX, EX, and agent assist | Contract based, marketplace line items exist (Trials available periodically) | Analyst-recognized orchestration and voice, strong governance |

| Yellow.ai | Omnichannel CX and EX with analytics | Contract based, marketplace tiers exist (Freemium or trials vary) | Multilingual agents, analytics, campaigns |

| Haptik | WhatsApp-centric CX at scale, India and global | Quote based, SMB Interakt pricing in INR | Jio-backed scale, voice and chat assistants |

| Gupshup | Messaging-led automation across WhatsApp and SMS | Usage plus subscription, channel dependent | Channel breadth, LLM-assisted bot building |

Conversational AI Development Platforms: Key Features at a Glance

| Tool | Orchestration | Voice/Telephony | Analytics |

|---|---|---|---|

| Rasa Pro | Policy-driven dialog with multi-LLM control | Connectors for IVR handoffs | OpenTelemetry signals and conversation views |

| Kore.ai XO Platform | Multi-agent orchestration | Voice bots and contact center ties | Real-time insights and answer management |

| Yellow.ai | Visual builder, agentic flows | Voice and email agents | Real-time dashboards and LLM analytics |

| Haptik | Flow builder and WhatsApp journeys | Voice and chat | Business dashboards |

| Gupshup | Bot builder plus campaign flows | Voice, WhatsApp, SMS | Campaign and bot analytics |

Analyst mentions for orchestration, voice, and trust criteria are highlighted in the 2024 Forrester evaluation for customer service platforms and in Gartner's Market Guide summary language about vendor capabilities, per Gartner.

Conversational AI Development Platforms: Deployment Options

| Tool | Cloud API | On-Premise | Integration Complexity |

|---|---|---|---|

| Rasa Pro | Yes | Yes | Varies by implementation scope |

| Kore.ai XO Platform | Yes | Yes | About 2 months median, per G2 |

| Yellow.ai | Yes | Limited public details | About 4 months median, per G2 |

| Haptik | Yes | Services-led enterprise rollouts | About 2 months median, per G2 |

| Gupshup | Yes | Not typical | About 1 month median, per G2 |

Conversational AI Development Platforms: Strategic Decision Framework

| Critical Question | Why It Matters | What to Evaluate |

|---|---|---|

| Do you need on-prem or private VPC? | Regulated data and vendor-risk constraints drive deployment choices | Self-managed installs, Kubernetes support, logging and telemetry controls |

| What is your primary channel mix? | Voice, WhatsApp, and web chat have different policy and cost models | Native telephony, WhatsApp BSP capabilities, web and app SDKs |

| How will you measure success? | Without analytics and answer management, model quality stalls | Intent analytics, containment, CSAT impact, labeling workflow |

| What happens when policies change? | WhatsApp pricing and platform rules shift, which affects ROI | Roadmap velocity, policy updates, alerting, and pricing transparency |

Conversational AI Development Platforms: Pricing and Buying Signals

| Organization Size | Recommended Setup | Pricing Availability |

|---|---|---|

| Startup to early growth | Rasa Pro developer tier for pilots, Gupshup for messaging, then graduate to enterprise plans | Mix of free tier and contract plans, public marketplace SKUs exist for some vendors |

| Mid-market | Kore.ai XO or Yellow.ai for CX, Rasa Pro for controlled workflows, Gupshup for WhatsApp at scale | Contract based, with sample annual prices on AWS Marketplace for Kore.ai and Yellow.ai |

| Enterprise | Mix of Kore.ai for contact center, Rasa Pro for on-prem or private VPC, Yellow.ai or Haptik for multilingual and WhatsApp heavy use cases | Mostly custom quotes, marketplace used for procurement and budgeting |

Problems & Solutions

-

Problem 1: Contact center leaders need rapid containment without brittle scripts.

- Why it matters: Customer teams have been under pressure to adopt conversational GenAI, with 85 percent planning to explore or pilot solutions based on a 2024 Gartner survey.

- How tools help: Kore.ai was evaluated as a Leader in Forrester's 2024 assessment, with strengths in orchestration, voice, and trust and privacy, which maps directly to faster time to value. Yellow.ai appears as a vendor in Gartner's enterprise conversational AI coverage, a signal that it addresses multi-channel automation for CX, per Gartner research listings.

-

Problem 2: Regulated industries need private deployments with observability.

- Why it matters: Without governance, you cannot push past pilots. Market guides emphasize security and trust as differentiators in platform selection, per Gartner's Market Guide summary.

- How tools help: Rasa Pro's self-managed patterns and observability are commonly selected by engineering-led teams that prefer on-prem or private VPC builds. Reviewers highlight Rasa's power and flexibility while noting its learning curve, which is useful context for scoping team effort.

-

Problem 3: WhatsApp costs and policy shifts threaten campaign ROI.

- Why it matters: Meta changed WhatsApp Business pricing to per-message templates on July 1, 2025, which impacts all BSPs and can increase spend for template-heavy campaigns.

- How tools help: Gupshup and Haptik both specialize in WhatsApp journeys. Reviewers describe Gupshup's strong WhatsApp integrations, with feedback on dashboard performance to watch. Haptik's Interakt targets SMB and mid-market WhatsApp automation with published India pricing that can simplify early planning.

The Bottom Line

Enterprise conversational AI is no longer a science project - budgets and adoption are moving, supported by a multi-billion dollar market trajectory through 2030. If you want maximum control and on-prem options, start with Rasa Pro. If you need an enterprise CX stack with orchestration and voice, short-list Kore.ai, with Yellow.ai as a strong omnichannel alternative. If WhatsApp and messaging are central to your growth, Gupshup and Haptik bring the channel depth you will need, with costs now shaped by Meta's per-message pricing policy that took effect July 1, 2025. Pick one that matches your deployment constraints, channel mix, and the metrics you must move this quarter.